-

US indices finished yesterday's trading higher. S&P 500 gained 0.18%, Dow Jones moved 0.26% higher and Nasdaq jumped 0.63%. Russell 2000 rallied 2.65%

-

Moods weakened during the Asian session, especially in China, after Chinese authorities decided to halt classes at more than a dozen of schools in Beijing. Covid-19 outbreaks are the reasons

-

Nikkei dropped 0.4%, S&P/ASX 200 declined 0.6% and indices from China traded over 1% lower. Kospi outperformed, gaining 1.2%

-

DAX futures point to a slightly lower opening of today's European session

-

Reserve Bank of Australia left interest rates unchanged at the meeting today and purchases of government bonds are set to continue at A$4 billion per week. However, RBA decided to drop a 0.10% target on 10-year 2024 government bond yield

-

RBA Governor Lowe said that he thinks the market overreacted to the latest inflation data. He said that it is extremely unlikely for inflation to jump beyond projections

-

South Korean CPI inflation accelerated from 2.6 to 3.2% YoY - the highest level since January 2012

-

New Zealand building permits dropped 1.9% MoM in September

-

Precious metals are trading mixed - gold and palladium gain while platinum and silver drop

-

Bitcoin, Ethereum and Dogecoin climb. Chainlink, Litecoin and Tezos pull back slightly

-

USD and JPY the best performing major currencies while AUD underperforms the most

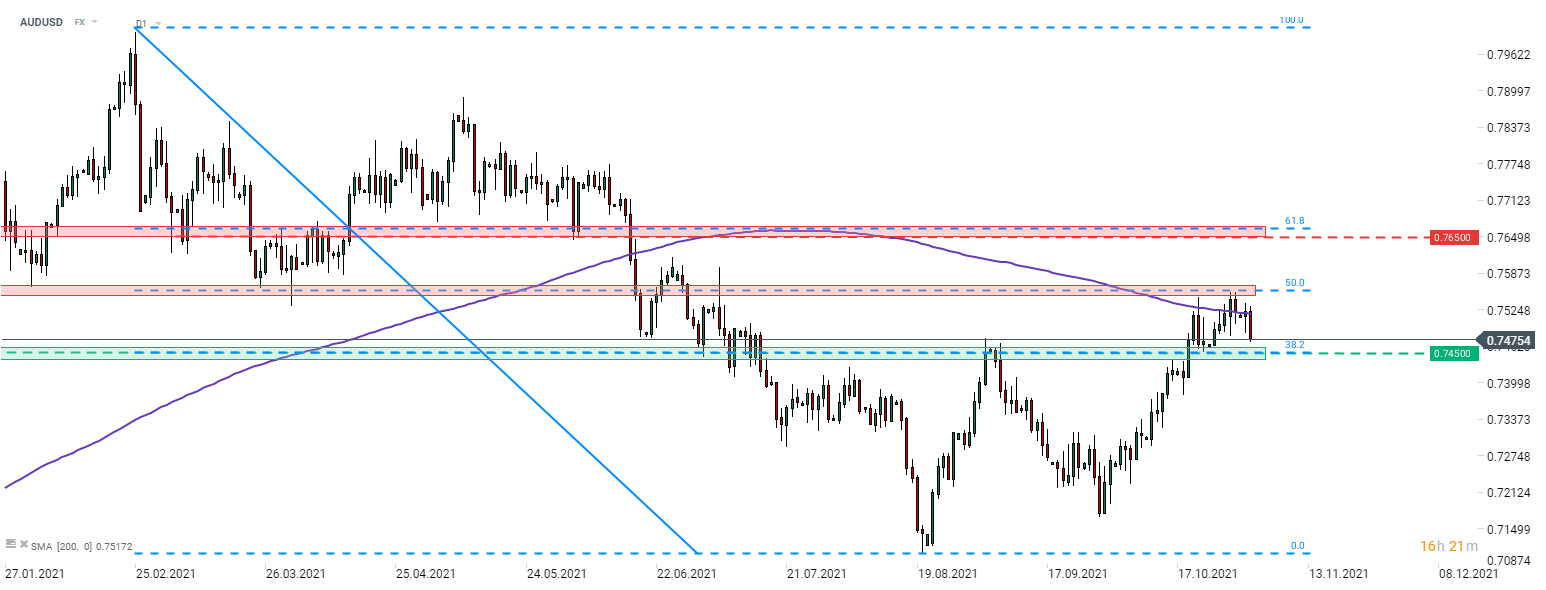

AUDUSD is plunging today following RBA's decision to drop a target bond yield. While the Bank sees a possibility of bringing the first rate hike forward from 2024 to 2023, Governor Lowe hinted that rate hike in 2022 is extremely unlikely. AUDUSD pulled back from the 200-session moving average (purple line) and dropped below the 0.75 handle. Source: xStation5

AUDUSD is plunging today following RBA's decision to drop a target bond yield. While the Bank sees a possibility of bringing the first rate hike forward from 2024 to 2023, Governor Lowe hinted that rate hike in 2022 is extremely unlikely. AUDUSD pulled back from the 200-session moving average (purple line) and dropped below the 0.75 handle. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️