-

US indices moved higher during the first Wall Street session of 2022. S&P 500 gained 0.64%, Dow Jones added 0.68%, Nasdaq jumped 1.20% and Russell 2000 rallied 1.21%

-

Moods during the Asian session were mixed. Nikkei gained 1.8%, S&P/ASX 200 jumped almost 2%, Kospi traded flat and indices from China dropped

-

DAX futures point to slightly higher opening of today's European cash session

-

China will require data security checks at companies that plan to list overseas

-

According to China Securities Journal, Chinese banks may boost credit action in the first quarter of 2022 even if economy slows

-

Over 1 million new coronavirus cases were reported yesterday in the United States

-

According to Axios report, Joe Biden is most likely to nominate Sarah Bloom Raskin as Fed Vice Chair for Supervision

-

Apple's market capitalization exceeded $3 trillion for a moment during yesterday's session

-

Precious metals trade mixed - gold and palladium gain while silver and platinum drop

-

Oil is trading flat while industrial metals advance

-

Bitcoin is trying to recover from a drop to $46,000 area

-

AUD, NZD and CAD are the best performing major currencies while JPY and GBP lag the most

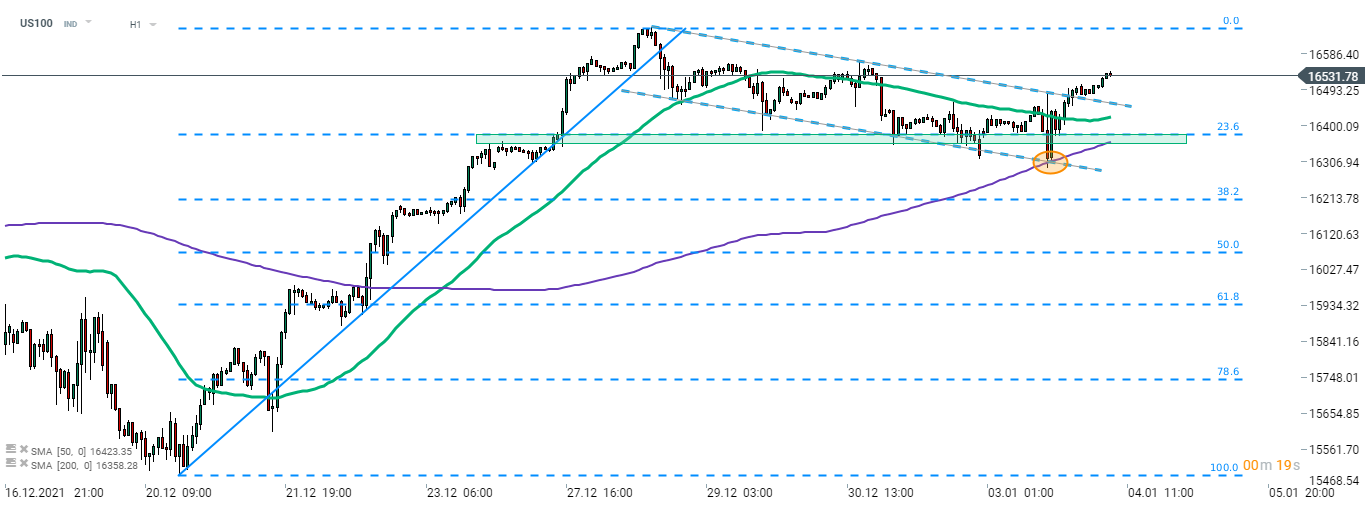

Nasdaq-100 (US100) tested the 200-hour moving average at the beginning of yesterday's Wall Street session. Bulls managed to defend the area and a strong upward impulse was launched. Index broke above the upper limit of the downward channel and is now trading above 16,500 pts. Source: xStation5

Nasdaq-100 (US100) tested the 200-hour moving average at the beginning of yesterday's Wall Street session. Bulls managed to defend the area and a strong upward impulse was launched. Index broke above the upper limit of the downward channel and is now trading above 16,500 pts. Source: xStation5

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

US OPEN: Wall Street buoyed by robust data and shifting sentiment

Strong Service ISM Reading as activity expanded most since 2022