-

US indices finished yesterday's trading mostly higher. S&P 500 gained 0.10%, Dow Jones moved 0.3% higher and Russell 2000 rallied 1%. Nasdaq was a laggard and finished flat

-

Indices in Asia-Pacific traded mostly higher today - Nikkei and S&P/ASX 200 gained around 1.2% each, Kospi rallied 1.4% and Nifty 50 traded 0.6% higher

-

Indices from China traded 0.1-0.5% lower

-

DAX futures point to a higher opening of the European cash session today

-

New Bank of Japan Governor Ueda said that a small rate hike would not be a problem for the Japanese financial system. Ueda also said that he agreed with PM Kishida that there is no need to revise government-BoJ joint statement

-

AUD gains after Australia and China reached agreement on barley exports and Australia suspended WTO dispute against China

-

Fed Williams said he expects inflation to get back under 2% by 2025

-

Citigroup expects oil to drop below $70 per barrel amid slower-than-expected demand recovery in China and significant production potential in Iraq and Venezuela

-

Chinese CPI inflation decelerated from 1.0 to 0.7% YoY in March (exp. 1.0% YoY). PPI inflation came in at -2.5% YoY as expected (-1.4% YoY previously)

-

Bitcoin jumps 3% and trades above $30,000 mark for the first time since June 2022

-

Energy commodities trade mixed - oil gains 0.5% while US natural gas prices drop 0.3%

-

Precious metals benefit from USD weakness - gold gains 0.5%, silver trades 0.6% higher and platinum adds 0.4%

-

AUD and EUR are the best performing major currencies while USD and NZD lag the most

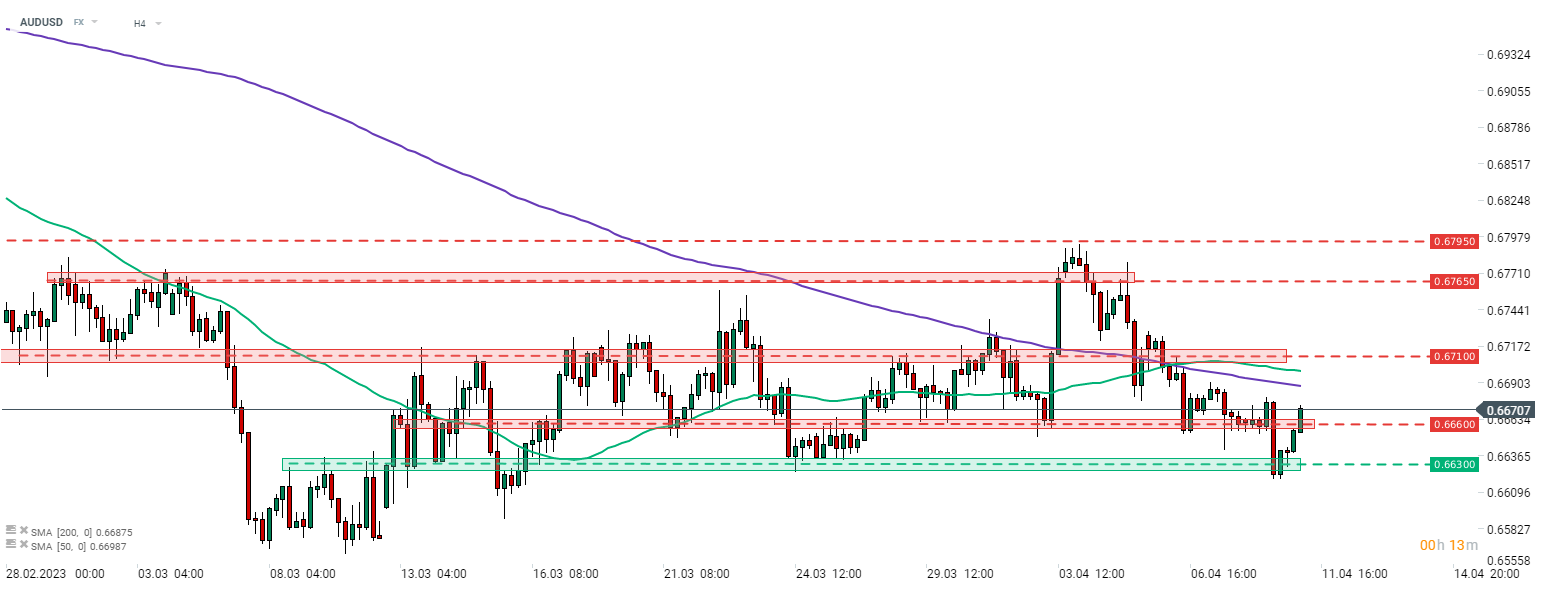

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

AUDUSD bounced off the 0.6630 support zone and climbed back above the 0.6660 area. Improvement in Australia-China trade relations is driving today's upward move on the pair. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️