- Asian stock markets started the week on a positive note: Hang Seng +1.25%, Shanghai Composite +0.75%, ASX 200 +0.41%. Markets in Japan are closed due to a bank holiday. Optimism was fuelled by improved sentiment following Chinese trade data and the PBOC fixing.

- On Wall Street, futures contracts point to declines following the outbreak of tension surrounding the Fed's independence; investors are shifting into defensive mode ahead of the CPI release and earnings season. The retreat from "risk" is also spreading to Europe, where futures are losing ground.

- Exxon found itself at the centre of a political storm after Trump threatened to block investment in Venezuela following criticism of its "uninvestable" market by the company's CEO.

- Jerome Powell disclosed that he had received subpoenas from the Department of Justice, heightening concerns about the Trump administration's interference in monetary policy.

- Federal prosecutors have launched an investigation into Federal Reserve Chairman Jerome Powell. Criticism centres on the costly renovation of the central bank's headquarters in Washington and the White House's general frustration with the pace of interest rate cuts.

- Senator Thom Tillis announced that he would block Fed nominations until the investigation is complete, increasing institutional uncertainty in the US.

- Geopolitical tensions are rising: the US is planning possible action in Iran, and Europe is strengthening NATO's presence in the Arctic following Trump's verbal threats against Greenland.

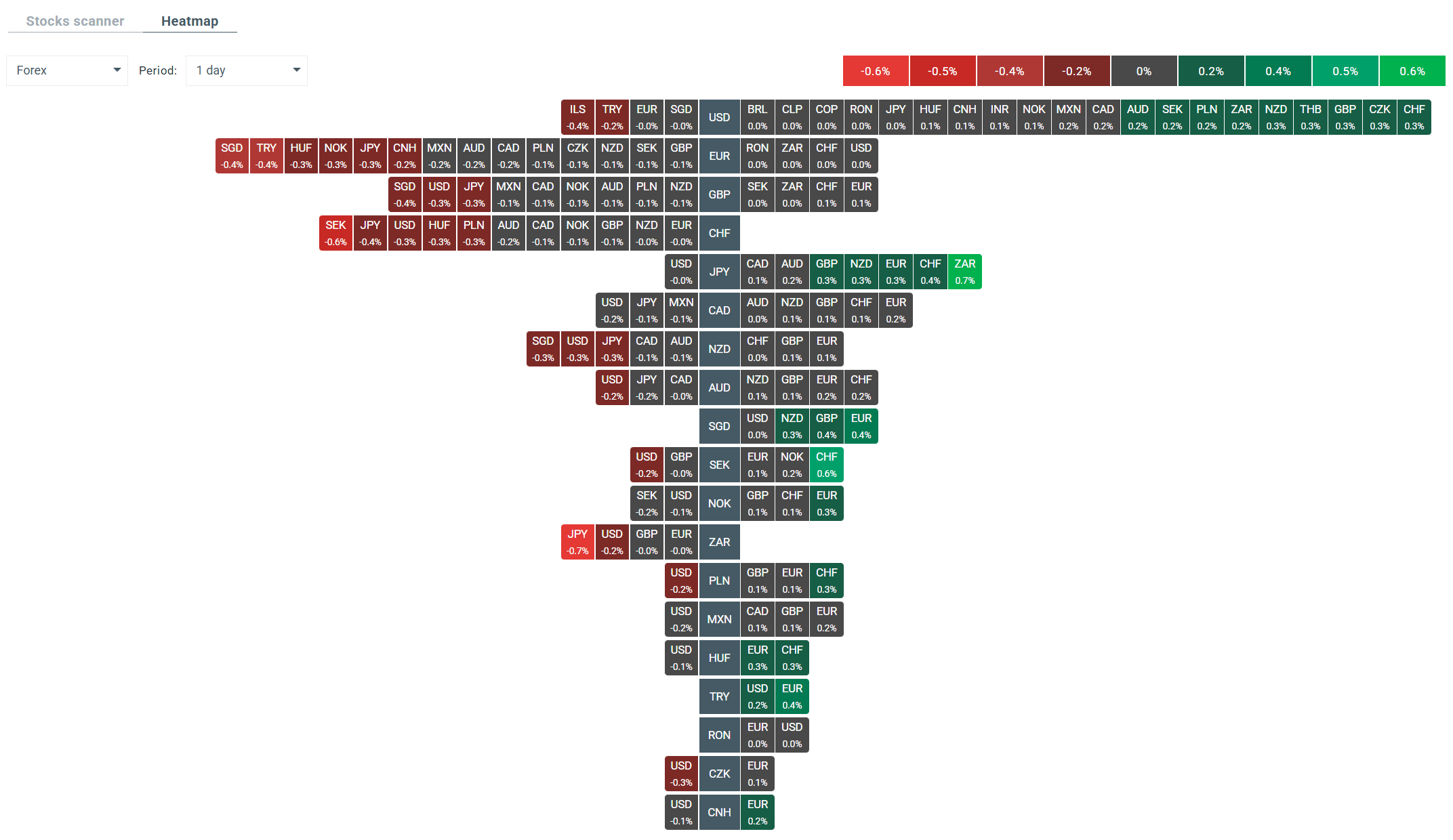

- The US dollar weakened significantly following controversy surrounding the Fed; the USDIDX index fell by approximately 0.2%, and investors increased their positions in gold (+1.4%), silver (+5.6%) and the Swiss franc (USDCHF -0.35%), which are rising sharply today.

- The PBOC set the USD/CNY fixing at 7.0108 against a forecast of 6.9849, signalling a desire to limit the appreciation of the yuan in the face of weak growth and deflation.

- Brent crude oil (OIL) rose in response to unrest in Iran, which could threaten exports of up to 1.9 million barrels per day.

- Silver is leading the gains in precious metals thanks to rising dollar volatility and speculative demand.

- The mood on the crypto market is positive. Bitcoin is currently gaining nearly 1.65% intraday and is trading at close to £92,000, while Ethereum is up 1.59% to £3,158.

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks