-

Stocks in Asia are trading higher at the beginning of a new week. Nikkei gains over 2%, S&P/ASX 200 trades 0.7% higher while Kospi adds 1%. Indices from China also trade higher

-

DAX futures point to a lower opening of the European session

-

ECB President Lagarde said that markets should not be allowed to build expectations that monetary stimulus is coming to an end. She also said that ECB will review its forward guidance in July

-

China claims that US military ship has unlawfully entered Paracel Islands in South China Sea

-

Chinese state media (China Securities Journal) reports that Chinese authorities may decide on even more monetary policy support

-

Australian banking regulator asked domestic lenders to have a plan how to operate in negative rate environment

-

Japanese core machinery orders increased 7.8% MoM in May (exp. 2% MoM)

-

South Korean exports increased 21.2% YoY during the first 10 days of July. Imports were 33.3% YoY higher. Semiconductor exports were 15.6% YoY higher

-

Bitcoin is trading slightly above $34,000 mark

-

Precious metals and oil trade lower, industrial metals trade mixed while agricultural goods advance

-

USD and CHF are the best performing major currencies while NZD and AUD lag the most

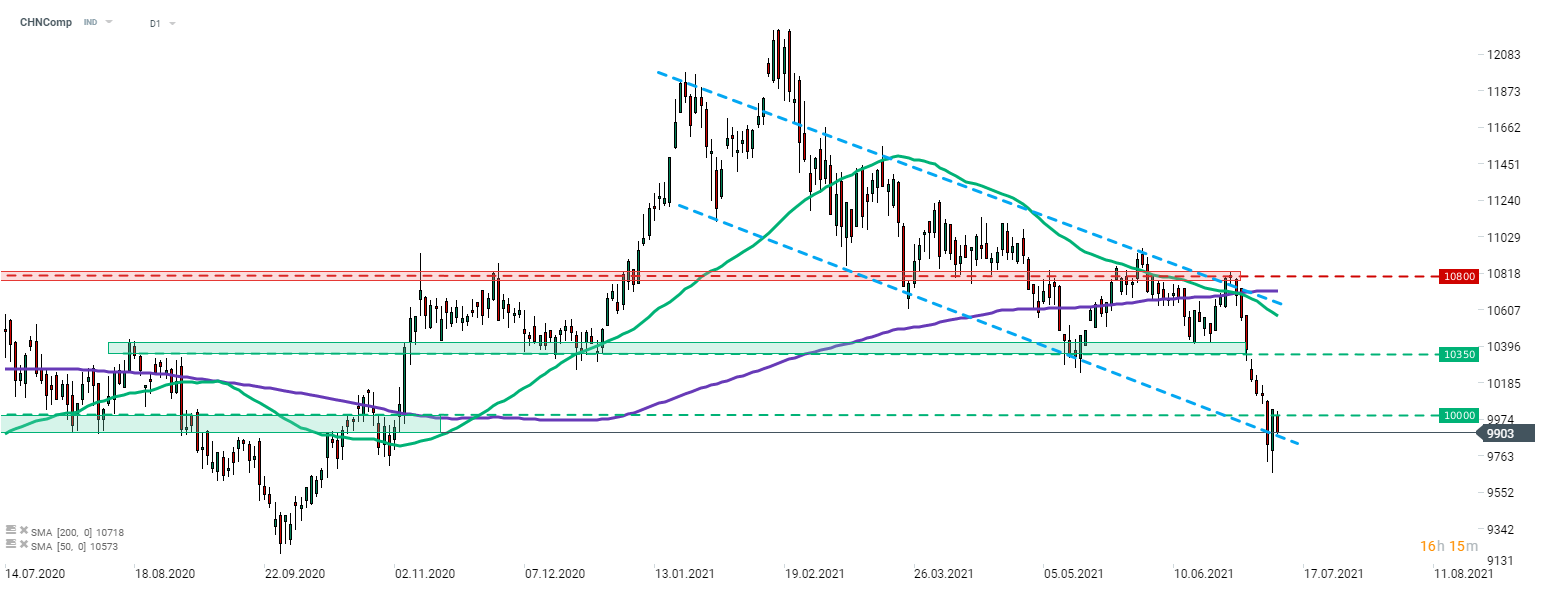

CHNComp is one of the few Chinese indices that fails to benefit from upbeat moods and lags today. Nevertheless, the index continues to trade above the lower limit of the downward channel following an unsuccessful break attempt at the end of the previous week. Source: xStation5

CHNComp is one of the few Chinese indices that fails to benefit from upbeat moods and lags today. Nevertheless, the index continues to trade above the lower limit of the downward channel following an unsuccessful break attempt at the end of the previous week. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report