- Wall Street is trading near record highs, but with a note of caution toward the technology sector, where Broadcom (AVGO.US) shares fell nearly 5% yesterday despite very solid earnings report. S&P 500 futures are trading largely unchanged on Friday, while Nasdaq 100 futures are down 0.5%. Following the earnings release, shares of wholesale retail giant Costco Wholesale are also retreating by nearly 1%. Meanwhile, Lululemon Athletica is posting a gain of more than 10% after a surprisingly strong earnings report.

-

Broadcom beat revenue expectations ($18.02 billion vs. the forecasted $17.49 billion) and earnings per share ($1.95 vs. the projected $1.87), and issued guidance for the current fiscal first quarter at $19.1 billion in sales, compared with the $18.3 billion expected by LSEG analysts. The company said that margins would fall due to a higher mix of AI revenue.

- Total revenue grew 28% during the quarter, largely due to a 74% increase in AI chip sales. The company solutions business came in at $11.07 billion in sales, up 22% YoY vs $10.77 billion expected. Broadcom’s other major segment, infrastructure software, reported 26% growth to $6.94 billion in sales, topping Wall Street’s expectations.

-

CEO Hock Tan said in a statement that Broadcom expects AI chip sales this quarter to double from a year earlier to $8.2 billion (custom AI chips and semiconductors for AI networking. Net income climbed 97% to $8.51 billion, or $1.74 per share, from $4.32 billion, or 90 cents per share, in the year-ago period. The company revealed that it doesn't expect more revenue from the $10 billion custom chips partnership with Anthropic.

-

Broadcom has a $73 billion backlog for custom chips, switches, and other data center parts for AI over the next 18 months, Tan said. The stock is up more than 70% this year. The company will issue a per-share dividend of 0.65 USD, payable this month, up from 0.59 USD.

- In yesterday’s cash session, the S&P 500 rose by 0.2% and set a new all-time high, although part of the market began reducing exposure to AI-related stocks following Oracle’s results. After the session, Broadcom reported earnings, and while the report itself was record-breaking, the company disappointed with its sales outlook for the AI segment.

-

With a relatively light macroeconomic calendar today, market attention will focus on speeches by Fed members (Paulson, Hammack, Goolsbee), as well as secondary data from Europe, including CPI readings from Germany and France, and GDP data from the UK.

- In yesterday’s cash session, the S&P 500 rose by 0.2% and set a new all-time high, although part of the market began reducing exposure to AI-related stocks following Oracle’s results. After the session, Broadcom reported earnings, and while the report itself was record-breaking, the company disappointed with its sales outlook for the AI segment.

- Asian equity markets are extending their gains, supported by record highs on Wall Street and global stock markets. Investor sentiment is being bolstered by expectations of rate cuts by the Fed this year, as well as a positive assessment of the condition of the U.S. economy. The MSCI Asia Pacific index gained 0.9%, heading toward its highest close since mid-November.

- The strongest performance was seen in Japan, where the Topix index approached a record high. Gains were driven by the financial sector, supported by speculation that the Bank of Japan could raise interest rates as early as next week—something the market has been waiting for months.

- A contrasting picture emerged in China, where the main indices declined. The government announced further support for the economy, but without additional fiscal stimulus in 2025, which cooled investor sentiment and triggered profit-taking.

- Global equity markets continue to show strong momentum. The MSCI All Country World Index rose another 0.1% after closing at a record level yesterday. The benchmark is on track for a gain of around 21% in 2025, which would be its best result in six years. Its Asian counterpart is trading less than 2% below its all-time high.

In commodity markets:

- Copper is stable after a recent record breakout.

- Most industrial metals are rising, responding to a more dovish Fed narrative.

- Gold is correcting after three days of gains, although the market continues to expect further monetary easing.

- Silver remains near record levels.

- Oil has rebounded from nearly two-month lows.

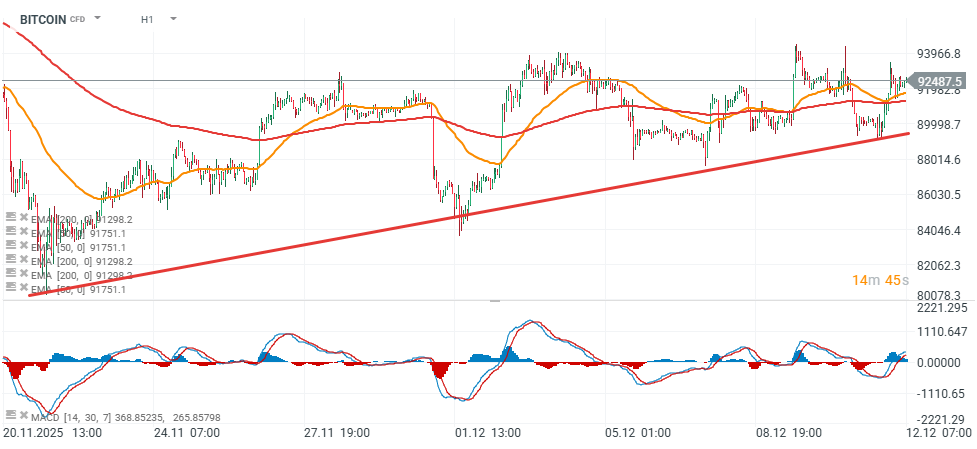

Bitcoin remains in a narrow range around USD 92,500, signaling an ongoing struggle between demand and supply in a key zone. Despite record highs in U.S. equities, Bitcoin has failed to sustainably break above the USD 94,000 area.

(Morning briefing in progress)

Source: xStation5

DE40 dips 3% and falls to 2026 lows 🚨📉

Economic calendar: Eurozone CPI and central bankers speeches in focus

Morning wrap (03.03.2026)

Daily summary: Markets aren’t afraid of the conflict, valuations are normalizing