-

US indices finished yesterday's trading slightly lower. S&P 500 dropped 0.34%, Dow Jones moved 0.26% lower and Nasdaq declined 0.30%. Russell 2000 gained 0.33%

-

Indices from Asia-Pacific traded higher today. Nikkei rallied 1.9%, Kospi jumped 1.6% and S&P/ASX 200 added 0.4%. Indices from China traded higher as well

-

DAX futures point to a flat opening of the European cash session today

-

US President Biden called attrocities committed by Russia a genocide for the first time

-

United States is readying another $750 million weapons package for Ukraine, including advanced weapons

-

Reserve Bank of New Zealand increased the official cash rate by 50 basis points today, more than expected 25 bp. Bank noted that current interest rate level is still stimulatory but more tightening will come in the future

-

Fed Barkin said that US rate should be rapidly increased to neutral levels. However, Fed Bullard said that it is fantasy to think that neutral rate will be enough to halt price growth

-

Vitol, a major commodity trading company, plans to stop trading Russian oil and oil derivatives by the end of 2022

-

Chinese exports increased 13.4% YoY in Q1 2022 (yuan terms) while imports were 7.5% YoY higher

-

Japanese core machinery orders dropped 9.8% MoM in February (exp. -1.6% MoM)

-

API report pointed to a 7.76 million barrel build in US oil inventories (exp. +1.2 mb)

-

Cryptocurrencies trade higher. Bitcoin gains 1% and trades slightly above $40,000 mark

-

Brent is trading little changed in the $105 area

-

Precious metals gain with platinum (+1.2%) and palladium (+2.7%) being top performers

-

CAD and EUR are the best performing major currencies while NZD and JPY lag the most

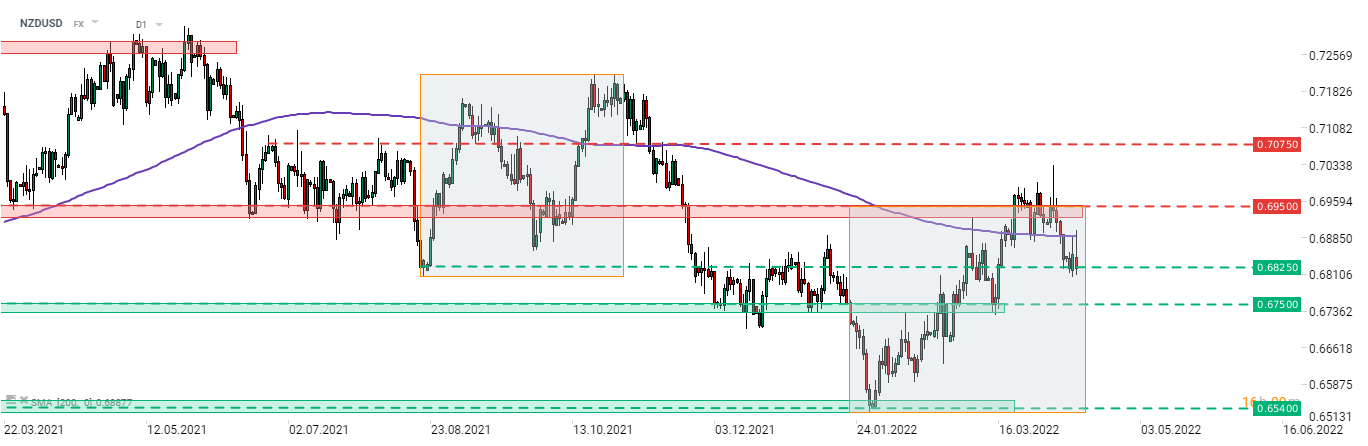

NZDUSD gained following a bigger-than-expected rate hike from RBNZ today. However, gains were already erased and now the pair is testing the 0.6825 support zone again. Note that today's advance was halted by the 200-session moving average (purple line), just as it was the case yesterday. Source: xStation5

NZDUSD gained following a bigger-than-expected rate hike from RBNZ today. However, gains were already erased and now the pair is testing the 0.6825 support zone again. Note that today's advance was halted by the 200-session moving average (purple line), just as it was the case yesterday. Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone