-

US indices finished yesterday's trading higher. S&P 500 gained 0.35%, Dow Jones moved 0.36% higher while Nasdaq added 0.21%. Russell 2000 gained 0.08%

-

Stocks in Asia traded higher as well. Nikkei gained 0.5%, S&P/ASX 200 moved 0.2% higher and Kospi jumped 0.6%. Indices from China traded mixed

-

DAX futures point to a slightly lower opening of the European session

-

According to Wall Street Journal, France plans to restrict access to bars, restaurants and malls only to people who were vaccinated or tested negative for Covid-19

-

There is growing speculation that a more strict lockdown will be imposed in Sydney for 4-6 weeks. Australian government also plans to propose a support package for Sydney and New South Wales region later today

-

OPEC+ members do not expect group members to meet and discuss oil output until next month at earliest

-

Chinese exports increased 32.2% YoY in June (exp. 23% YoY) while imports were 36.7% YoY higher (exp. 30% YoY). Trade surplus for June stood at $51.53 billion (exp. $44.20 billion)

-

US Federal Aviation Administration said it found issues with some yet undelivered Boeing 787 Dreamliners. Boeing was order to fix the issue in both undelivered planes as well as in those that are already in use

-

Bitcoin dropped below $33,000 mark

-

Precious metals and oil trade higher. Industrial metals and agricultural goods trade mixed

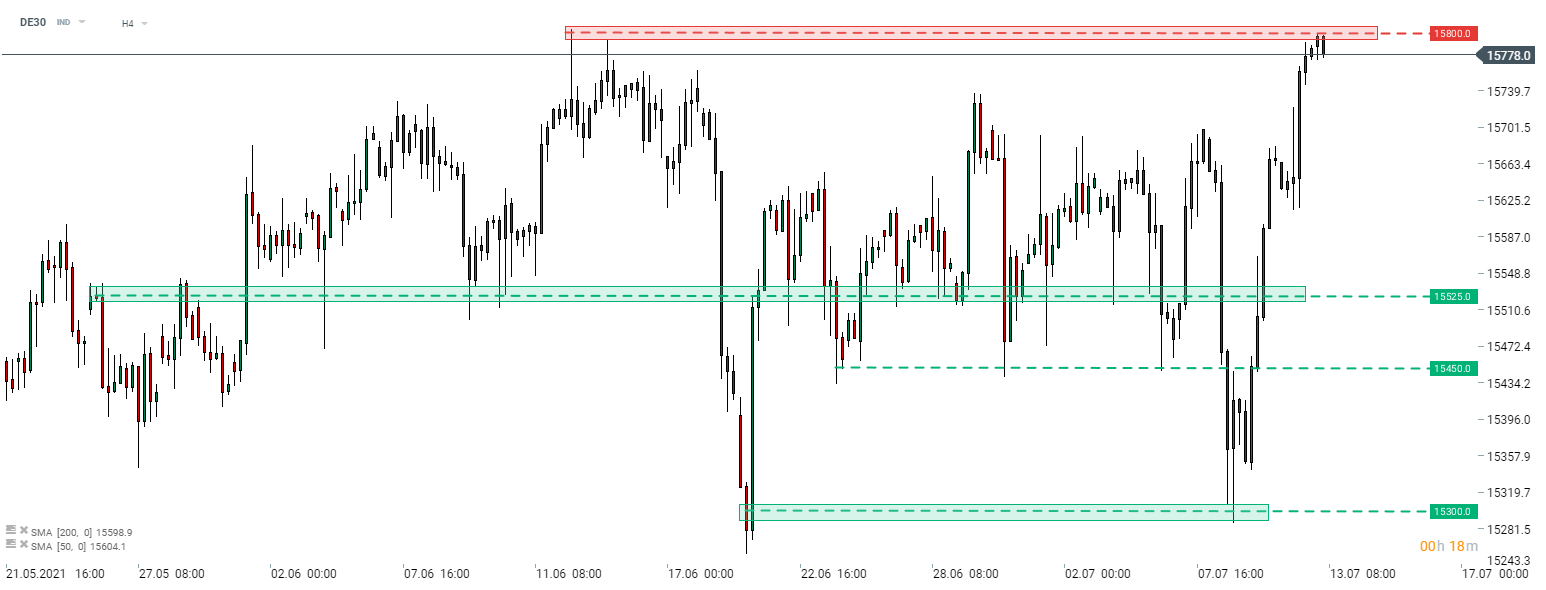

DE30 extended upward move and tested all-time highs in the 15,800 pts area. The index was unable to break above this zone but continues to trade nearby. Source: xStation5

DE30 extended upward move and tested all-time highs in the 15,800 pts area. The index was unable to break above this zone but continues to trade nearby. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report