-

US indices finished yesterday's trading lower. S&P 500 dropped 0.35%, Dow Jones moved 0.31% lower and Nasdaq declined 0.38%. Russell 2000 plunged 1.88%

-

Stocks in Asia are trading lower as well. Nikkei and Kospi drop 0.4% each while indices from China decline over 0.7%. S&P/ASX 200 gains 0.2%

-

DAX futures point to a lower opening of the European cash session

-

RBNZ left interest rates unchanged during a meeting today. However, New Zealand central bank said that the level of stimulus will be reduced. Interest rate derivative market now prices in 70% possibility of a RBNZ rate hike in August

-

Fitch affirmed United States rating at AAA with negative outlook

-

US and UK trade ministers agreed to combat China's anti-competitive practices

-

Lockdown in Sydney was extended by 2 weeks

-

Singapore GDP declined 2% QoQ in Q2 2021 (exp. -1.8% QoQ)

-

Japanese industrial production increased 21.1% YoY in May (exp. 22% YoY)

-

API report pointed to a 4.08 million barrel drop in oil inventories (exp. -4 mb)

-

Bitcoin dropped below $32,000 mark

-

Precious metals trade higher. Oil and industrial metals pull back. Agricultural goods trade mixed

-

NZD is an outperformer today, gaining around 1% against most other major currencies. CHF and USD are top laggards

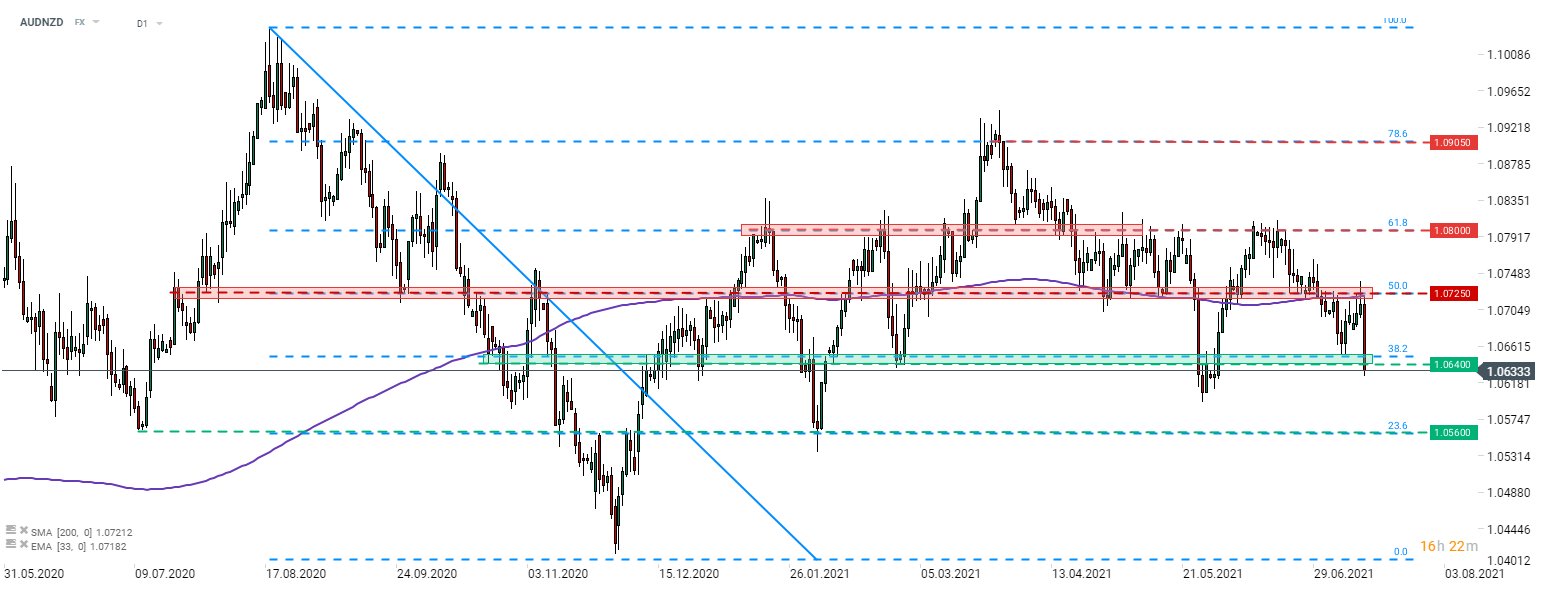

AUDNZD slumped today following a more hawkish than expected message from the Reserve Bank of New Zealand. The pair is testing support zone ranging below 38.2% retracement of the downward move launched August 2020. In case bears manage to deepen declines, the next level to watch can be found at 23.6% retracement (1.0560). Source: xStation5

AUDNZD slumped today following a more hawkish than expected message from the Reserve Bank of New Zealand. The pair is testing support zone ranging below 38.2% retracement of the downward move launched August 2020. In case bears manage to deepen declines, the next level to watch can be found at 23.6% retracement (1.0560). Source: xStation5

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)