-

US indices managed to recover most of the post-CPI losses but still finished yesterday's trading lower. S&P 500 dropped 0.45%, Dow Jones moved 0.67% lower while Nasdaq dipped 0.15%. Russell 2000 moved 0.12% lower

-

Mixed moods could be spotted during the Asian trading hours today. Nikkei gained 0.7%, S&P/ASX 200 moved 0.4% higher, Kospi dipped 0.1% and indices from China traded mixed

-

DAX futures point to a more or less flat opening of the European cash session today

-

After a higher-than-expected CPI reading, Fed funds futures price in an over-80% chance of a 100 basis point rate hike at the next FOMC meeting (July 27, 2022)

-

Fed's Daly said that a 75 basis point rate hike is her preferred option for the July meeting but a 100 bp move cannot be ruled out. Fed's Mester said that she does not see any evidence that inflation has peaked already

-

Turkey said that basic, technical agreement was reached between Ukraine and Russia to resume exports of grain from Ukraine

-

According to Bloomberg report, Chinese authorities asked domestic regulators to review offshore investment projects cautiously as Beijing fears that higher US interest rates may spur capital outflows

-

Australian employment increased by 88.4k in June (exp. +30k). Unemployment rate dropped from 3.9 to 3.5% (exp. 3.8%). This was another solid jobs report from Australia and it has boosted odds for an over-50 basis point rate hike at next RBA meeting

-

Japanese industrial production dropped 7.5% MoM in May (exp. -7.2% MoM)

-

USDJPY jumped above 138.00 during the Asian trading session - the highest level since 1998

-

Cryptocurrencies are trading higher today. Bitcoin gains 1.2% while Ethereum trades 1.8% higher. Polygon is outperformer with an over-10% gain

-

Oil is trading slightly lower this morning. Precious metals also pull back, with gold trading 0.5% lower on the day

-

USD and AUD are the best performing major currencies while JPY and EUR lag the most

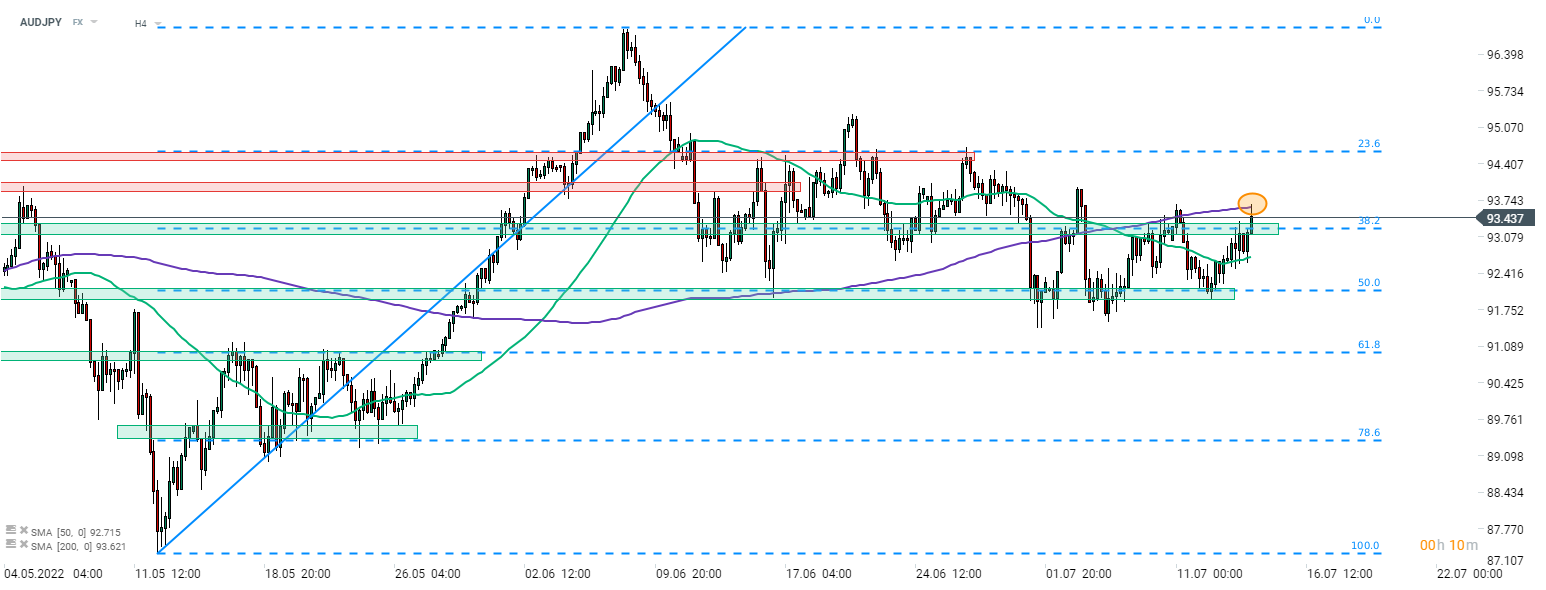

AUDJPY leaped higher today. Gain is fuelled mostly by solid showing of AUD, thanks to strong jobs report for June. However, JPY weakness also plays a role. The pair tested 200-period moving average (purple line, H4 interval) earlier today but failed to break above. Source: xStation5

AUDJPY leaped higher today. Gain is fuelled mostly by solid showing of AUD, thanks to strong jobs report for June. However, JPY weakness also plays a role. The pair tested 200-period moving average (purple line, H4 interval) earlier today but failed to break above. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes