-

US indices finished yesterday's trading slightly lower. S&P 500 dropped 0.38%, Dow Jones declined 0.49% and Russell 2000 moved 0.46% lower. Nasdaq finished flat

-

Stocks in Asia traded mixed. Kospi dropped 1%, Nikkei moved 0.8% lower and S&P/ASX 200 moved 0.5% lower while indices from China traded higher

-

DAX futures point to a lower opening of the European session

-

In spite of conciliatory tone struck by Russian officials yesterday, satellite data shows continued build-up of Russian troops and military equipment near Ukrainian border

-

United States decided to relocate its embassy further west from Kyiv and order all documents to be destroyed

-

RBA minutes failed to trigger any big moves on the markets. Documents showed that RBA sees the need to remain patient and observe the situation. The Bank does not sees inflation returning to target band yet

-

Canadian Prime Minister Justin Trudeau invoked emergency power to get anti-Covid protests around the country under control

-

Japanese GDP report for Q4 2021 showed 1.3% QoQ growth (exp. 1.4% QoQ). Annualized growth reached 5.4% (exp. 5.8%)

-

Japanese industrial production dropped 1% MoM in December (exp. -1.0% MoM)

-

Cryptocurrencies are trading higher today and recovering part of recent losses. Bitcoin jumped to $43,500 area while Ethereum moved back above $3,000 mark

-

Oil is trading slightly higher. Precious metals trade mixed - gold and platinum gain while silver and palladium drop

-

EUR and JPY are the best performing major currencies while AUD and CAD lag the most

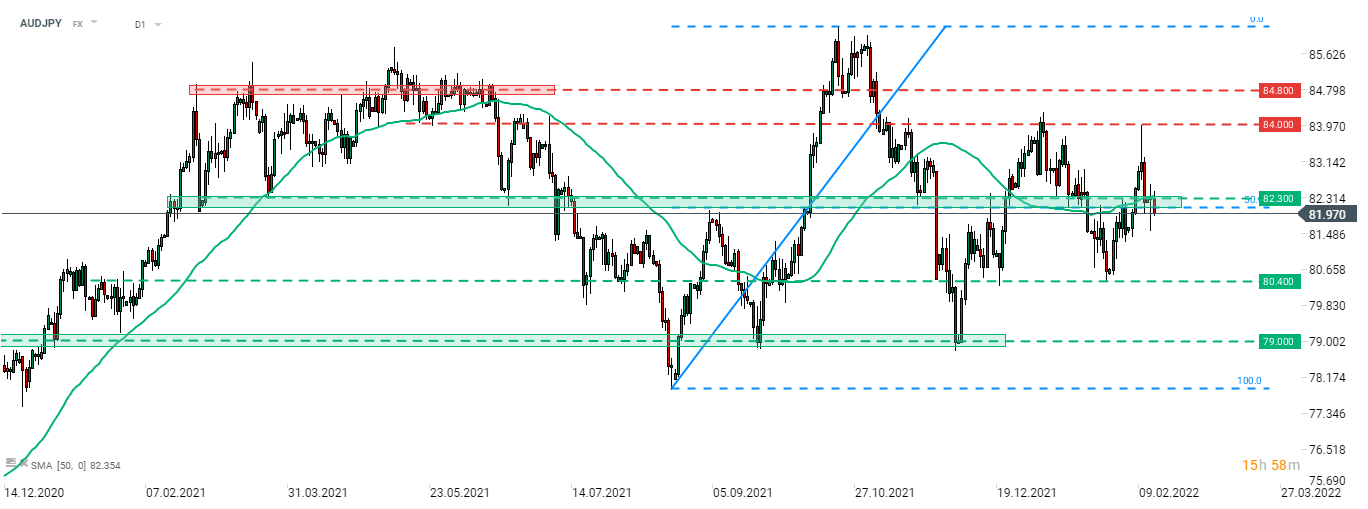

AUDJPY tested 84.00 mark last week but has later seen a massive reversal as war concerns picked up. The pair is currently making a break below the 82.00 handle, that serves as a lower limit of the support zone and is marked with 50% retracement of Q3-Q4 2021 upward move. Source: xStation5

AUDJPY tested 84.00 mark last week but has later seen a massive reversal as war concerns picked up. The pair is currently making a break below the 82.00 handle, that serves as a lower limit of the support zone and is marked with 50% retracement of Q3-Q4 2021 upward move. Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone