-

US indices declined yesterday. S&P 500 dropped 0.66%, Nasdaq declined 0.8% and Dow Jones closed 0.58% lower. Russell 2000 dropped 0.65%

-

Downbeat moods can be spotted during the Asian session. Nikkei trades 0.6% lower, Kospi declines 1% and Nifty drops 0.3%. S&P/ASX 200 gains 0.5%. Indices from China decline

-

DAX futures point to a lower opening of the European session

-

US Treasury Secretary Mnuchin confirmed that getting stimulus bill done ahead of elections will be difficult

-

Angela Merkel said that Germany will take measures if virus spread does not ease in 10 days

-

Australian dollar plunged following remarks from the RBA Chief. Governor Lower said that it is possible to cut interest rates to as low as 0.1%

-

Fed's Quarles said that costs of negative rates would outweigh benefits. Fed's Kaplan said that keep low rates may encourage people to take excessive risk

-

Nomura, Deutsche Bank and others say that chance of a no-deal Brexit has dropped to around 20-25% after UK announced it will not walk away from talks

-

China accuse United States of undermining peace and stability in the Taiwan Strait

-

Australian employment declined 29.5k in September (exp. -35k) while unemployment rate increased from 6.8 to 6.9%

-

Chinese CPI inflation slowed from 2.4 to 1.7% YoY in September. PPI dropped from -2% to -2.1% YoY

-

AUD and NZD are top laggards among majors while CHF and GBP gain the most. Most EM currencies trade lower against USD

-

Precious metals pull back slightly. Oil trades flat. Industrial metals decline.

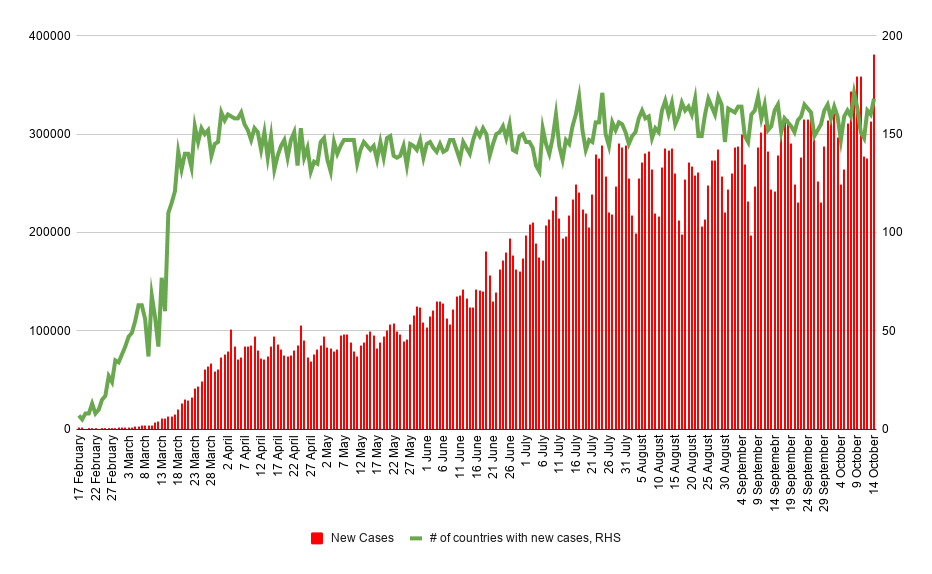

A record 381 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

A record 381 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily summary: Weak US data drags markets down, precious metals under pressure again!

US Open: Wall Street rises despite weak retail sales

US2000 near record levels 🗽 What does NFIB data show?

Chart of the day 🗽 US100 rebound continues as US earnings season delivers