-

US indices finished yesterday's trading mixed. Dow Jones dropped 0.62%, S&P 500 declined 0.44%, Nasdaq gained 0.50% and Russell 2000 finished 0.22% higher

-

Indices in Asia traded lower today. Nikkei and Kospi dropped 0.2%, S&P/ASX 200 declined 0.4% and majority of Chinese indices finished lower as well

-

DAX futures point to a flat opening of the European session

-

RBA minutes showed that the Bank is ready to further ease its policy should the economy require it. Bank noted that if it was not for easier policy, AUD would trade higher against major peers

-

Electoral College confirmed an election win for Biden

-

Australia is seeking clarification from China on coal imports ban

-

Pelosi said that unresolved issued in US economic relief bill can be resolved quickly

-

Chinese industrial production increased 7% YoY in November (exp. 7% YoY), retail sales rose 5% YoY (exp. 5.1% YoY) and urban investments were 2.6% year-over-year higher (exp. 2.6% YoY)

-

US State Department was also a victim of a hacker attack on Monday, along with the Treasury and Commerce Department. Russian group is believed to be responsible

-

Oil pulls back while precious metals advance

-

Bitcoin trades near $19,000

-

GBP and EUR gain the most while AUD is a top laggard among major currencies

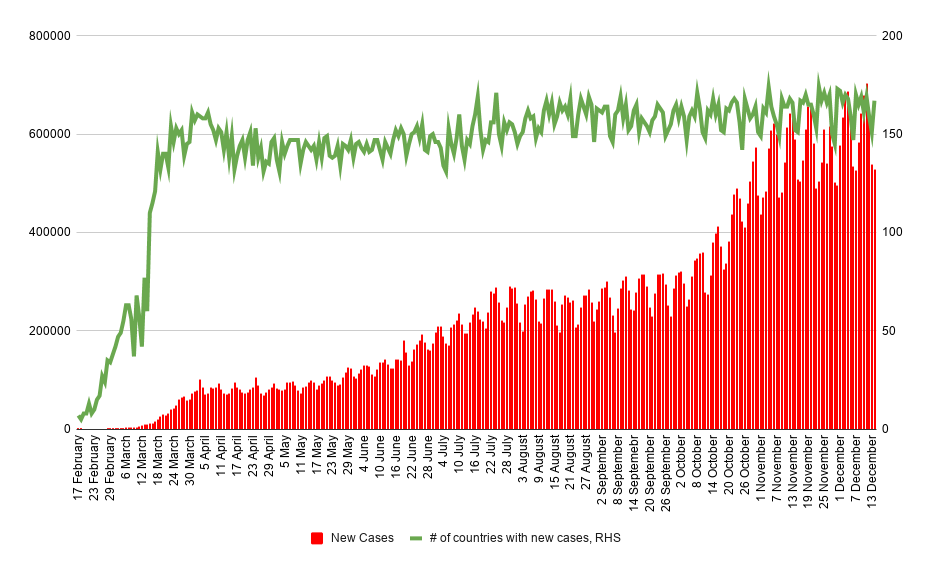

Almost 530 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Almost 530 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Morning wrap (03.03.2026)