- Wall Street indices finished yesterday's trading higher after weaker-than-expected retail sales and industrial production data from the United States boosted hopes for quicker Fed rate cuts

- S&P 500 gained 0.58%, Dow Jones jumps 0.91%, Nasdaq added 0.30% and small-cap Russell 2000 rallied almost 2.50%

- Indices from Asia-Pacific traded higher today - Nikkei gained almost 1.0%, S&P/ASX 200 traded 0.7% higher, Kospi jumped 1.3% and Nifty 50 moved 0.6% higher. Hang Seng rallied over 2%

- European index futures point to a higher opening of the cash session today

- Fed Bostic said that US central bank is likely to consider rate cuts soon but there is no urgency to deliver them

- BoJ Governor Ueda said that the bank will consider policy moves once inflation target is achieved sustainably

- Ueda also said that based on the economic and inflation outlook, accomodative monetary conditions will continue even after ending negative interest rates

- New Zealand's manufacturing PMI improved from 43.4 to 47.3 in January. Employment subindex climbed to 51.3 - the first reading in expansion territory (above 50 pts) since February 2023

- Cryptocurrencies extend gains, with Bitcoin holding above $52,000 mark

- Energy commodities trade little changed - US natural gas prices gain 0.2% while oil trades flat

- Precious metals pull back - gold and silver trade flat, while platinum drops 0.6% and palladium declines 0.8%

- USD and AUD are the best performing major currencies while JPY and NZD lag the most

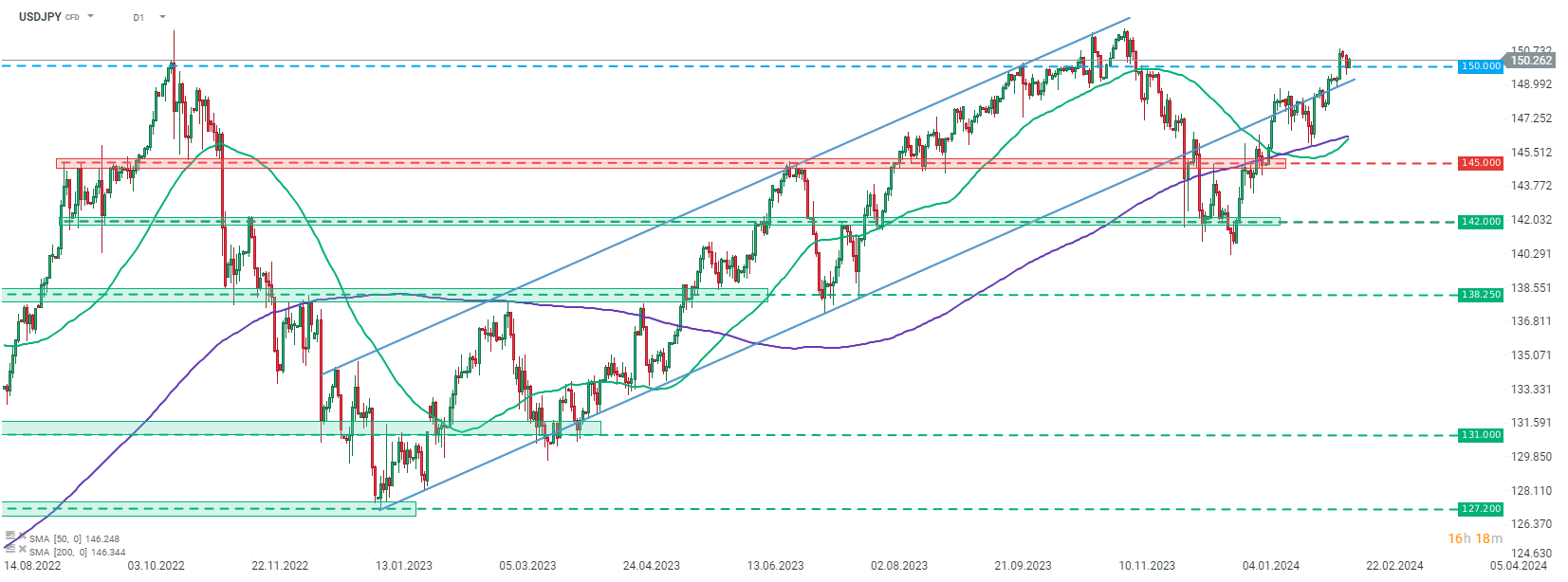

USDJPY resumes climb after a brief two-day correction. Pair continues to trade above 150.00 level associated with BoJ interventions. BoJ, however, limited itself to verbal interventions so far. Source: xStation5

USDJPY resumes climb after a brief two-day correction. Pair continues to trade above 150.00 level associated with BoJ interventions. BoJ, however, limited itself to verbal interventions so far. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️