-

Indices from Asia-Pacific launched a new week in mixed moods. Nikkei gained 0.5%, S&P/ASX 200 moved 0.3% higher, Kospi finished flat and indices from China traded slightly lower

-

European and US index futures are trading slightly below Friday's cash closing prices

-

Authorities in Shanghai announced that some restrictions will start to be lifted and business will be allowed to reopen. Authorities said that no new cases outside of quarantined areas were found and that restrictions will be lifted gradually

-

Finland said that it will apply for NATO membership. Biggest Swedish political party also said that it is in favor of Sweden joining NATO

-

German governing SPD party won 27% support in North Rhine-Westphalia elections, losing to CDU with 35.7% support. North Rhine-Westphalia is one of the most populous German states and is considered a bellwether for other elections

-

Monthly data from China for April turned out to be a massive disappointment. Retail sales dropped 11.1% YoY (exp. -6.1% YoY), industrial production was 2.9% YoY lower (exp. +0.5% YoY) and urban investments increased 6.8% YoY (exp. 7.1% YoY)

-

Japanese PPI inflation accelerated from 9.7 to 10.0% YoY in April (exp. 9.4% YoY)

-

Cryptocurrencies are pulling back although scale of the drop is nowhere near as big as in the previous week. Bitcoin trades 2.2% lower while Ethereum drops 3%

-

Oil is pulling back today. Both Brent and WTI traded around 1.5% lower with the former pulling back below $110 per barrel

-

Precious metals trade mostly flat. Palladium is an exception as it gains over 1.2%

-

EUR and JPY are the best performing major currencies at the beginning of a new week while AUD and NZD lag the most

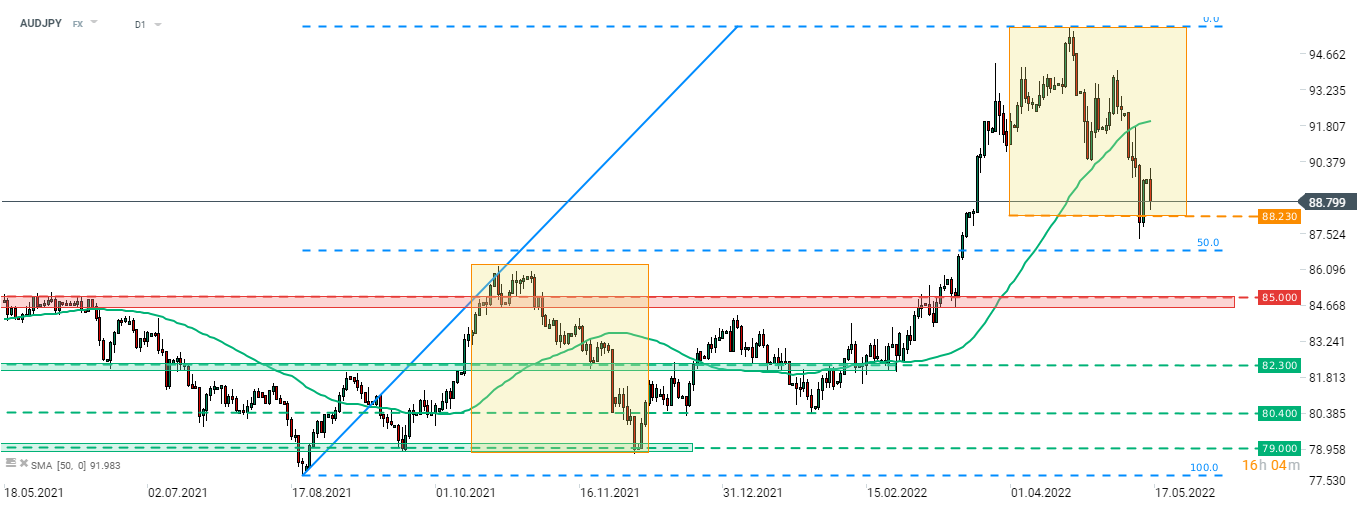

AUDJPY managed to defend the lower limit of a local market geometry last week. However, strong showing of JPY at the beginning of a new week creates a risk of another test. AUDJPY is one of the worst performing G10 crosses today and is approaching a 88.23 support. Source: xStation5

AUDJPY managed to defend the lower limit of a local market geometry last week. However, strong showing of JPY at the beginning of a new week creates a risk of another test. AUDJPY is one of the worst performing G10 crosses today and is approaching a 88.23 support. Source: xStation5

Dollar rally stalls, but for long❓💸

US Raises Tariffs to 15%

Daily summary: Markets capitulate under the influence of the Persian Gulf

🚨 EURUSD deepens decline, falls to key support zone