-

US indices finished yesterday's trading lower. Dow Jones dropped 0.11%, Nasdaq moved 0.14% lower while S&P 500 finished flat. Russell 2000 dropped 0.74%

-

Stocks from Asia-Pacific traded mixed today. Nikkei, S&P/ASX 200 and Kospi gained while indices from China traded lower

-

DAX futures point to a slightly lower opening of the European cash session

-

According to Ukraine, Russia began a large-scale offensive in eastern Ukraine for which it has been preparing recently

-

Chinese authorities imposed lockdown in parts of Tangshan, a major steel producing hub in China

-

Fed's Bullard said he cannot rule out a possibility of 75 basis point rate hike at a single meeting but he also said that it is not the base case scenario. Bullard does not expect US economy to fall into recession

-

Goldman Sachs sees a 35% of the US recession in the next two years

-

According to RBA minutes, recent developments like higher inflation or wage growth have brought forward timing of the first rate hike

-

Cryptocurrencies trade mixed. Bitcoin drops 0.2% while Ethereum gains 0.1%

-

Oil trades slightly higher while precious metals pull back

-

AUD and CAD are the best performing major currencies while JPY and CHF lag the most

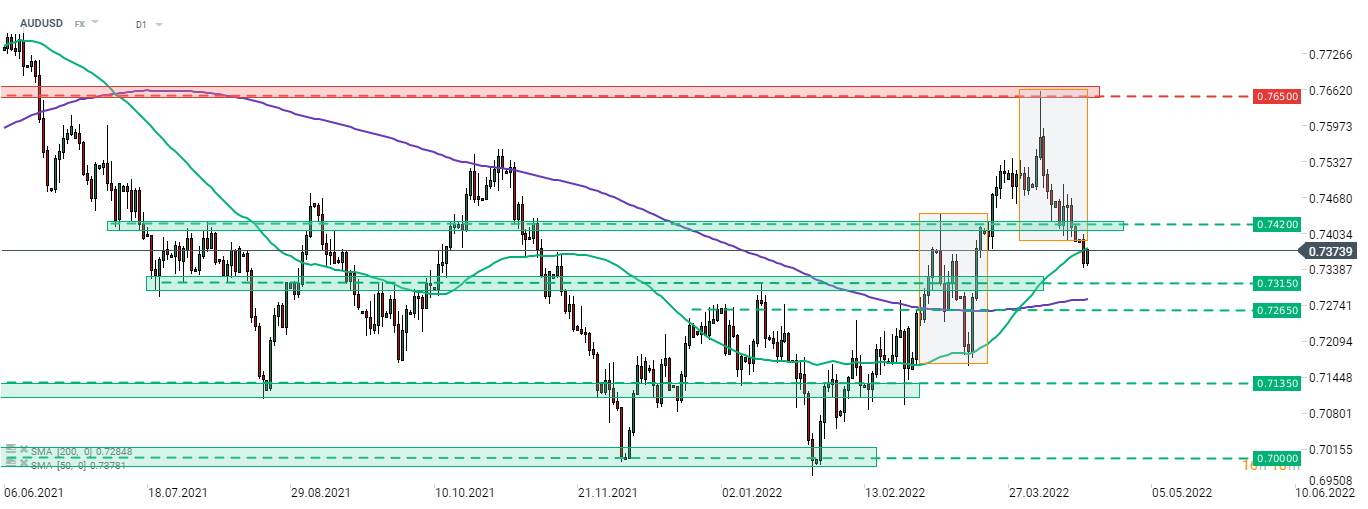

AUD is one of the best performing major currencies today after the RBA hinted that the first rate hike may come quicker. AUDUSD is trying to recover from recent declines today. However, as the pair dropped below the lower limit of market geometry, the technical outlook is somewhat bearish. Source: xStation5

AUD is one of the best performing major currencies today after the RBA hinted that the first rate hike may come quicker. AUDUSD is trying to recover from recent declines today. However, as the pair dropped below the lower limit of market geometry, the technical outlook is somewhat bearish. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)