- US indices finished yesterday's session higher. S&P 500 jumped 0.23%, Dow Jones moved 0.06% higher while Nasdaq surged 0.21%. Russell 2000 added 0.68%

-

Indices from Asia-Pacific traded mostly lower today. S & P / ASX 200 fell 0.10%, Nikkei lost 0.15% while Kospi dropped 0.50%. Indices from China struggle to find common direction.

-

DAX futures point to a slightly lower opening of the European cash session

-

FED Bullard said he is considering support for a third straight 75-bp hike in September and said he is not ready to say the economy has seen the worst of the inflation surge.

-

Bed Bath & Beyond (BBBY.US) tumbled 45% in after-hours trading as activist investor Ryan Cohen revealed that he had exited his entire position in the company.

-

Japan’s headline inflation rose 2.6% YoY in July from 2.4% in June, accelerating at the fastest pace since April 2014.

-

UK consumer confidence index fell to a new all-time low at -44.0

-

New Zealand trade data for July shows the annual deficit has hit a new record high

-

RBNZ Governor Orr wants the cash rate (OCR) to be clearly above its neutral level

-

UBS expects that Brent crude oil price will reach $125.00 per barrel by the end of this year

-

Germany's Finance Ministry says economic outlook of the biggest EU economy is bleak

-

Cryptocurrencies retreated during Asian session. Bitcoin fell over 3.0% and Ethereum plunged more than 2.8%

-

Oil is trading slightly lower. WTI trades near $ 89.60 per barrel, while Brent is approaching $ 96.20 mark

-

Downbeat moods prevail on the precious metals market. Gold tumbled 0.30%, while silver fell nearly 1.0% amid stronger dollar

-

USD and AUD are the best performing major currencies while JPY and NZD lag the most

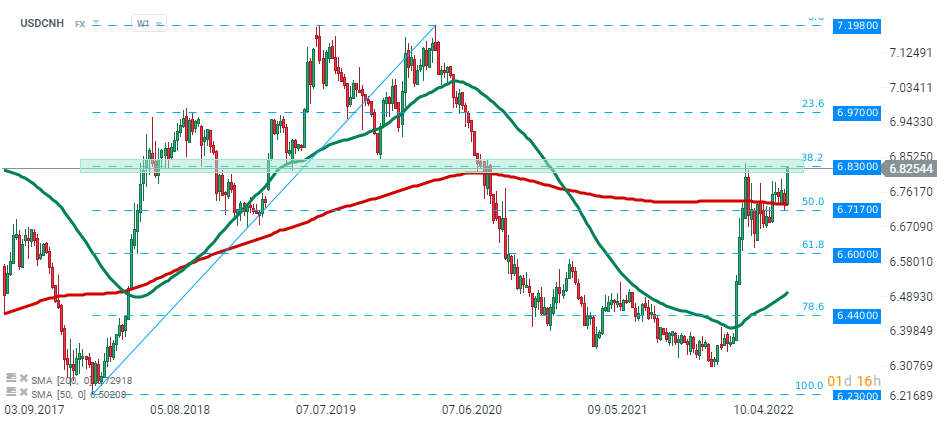

USDCNH - PBOC moved to weaken the yuan this week and the pair is currently testing major resistance at 6.83, which is marked with previous price reactions and 38.2% Fibonacci retracement of the upward wave launched in April 2018. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)