-

US indices had a solid session yesterday with S&P 500 finishing less than 10 points below its record high. S&P 500 gained 0.37%, Dow Jones moved 0.43% while Nasdaq dropped 0.05%

-

Stocks in Asia traded mixed. Nikkei dropped over 1.5%, Kospi dropped slightly, S&P/ASX 200 traded flat and indices from China gained slightly

-

DAX futures point to a lower opening of the European session

-

160 Republicans wrote a letter to US President Biden urging him to fix supply chain issues before considering any new spending measures

-

Fed Mester said that she does not expect rate hikes anytime soon. She also said that upside risks to inflation remain

-

Japanese Minister of Economy, Trade and Industry said that electricity supply-demand balance is expected to be the tightest in a decade during the upcoming winter season

-

United Kingdom has reached a preliminary free trade agreement with New Zealand

-

New Zealand credit card spending dropped 12.9% YoY in September (exp. -6.3% YoY)

-

South Korean exports increased 36.1% YoY during the first 20 days of October while imports were 48% YoY higher. Semiconductor exports increased 23.9% YoY

-

Tesla reported record revenue for Q3 2021 - $13.76 billion (exp. $13.63 billion). Unlike other carmakers that have already reported results, Tesla managed to increase sales in spite of chip shortages. Net income reached $1.62 billion, or $1.86 per share (exp. $1.59 per share). Company recorded a Bitcoin-related impairment of $51 million. Stock traded lower in the after-hours trading

-

Bitcoin reached fresh record levels yesterday with new all-time high being painted just slightly below $67,000 mark

-

Precious metals trade mixed - platinum and palladium gain while silver and gold drop

-

Brent reached a 3-year high near $86 per barrel but has pulled back since

-

AUD and GBP are the worst performing major currencies while CHF and JPY outperform

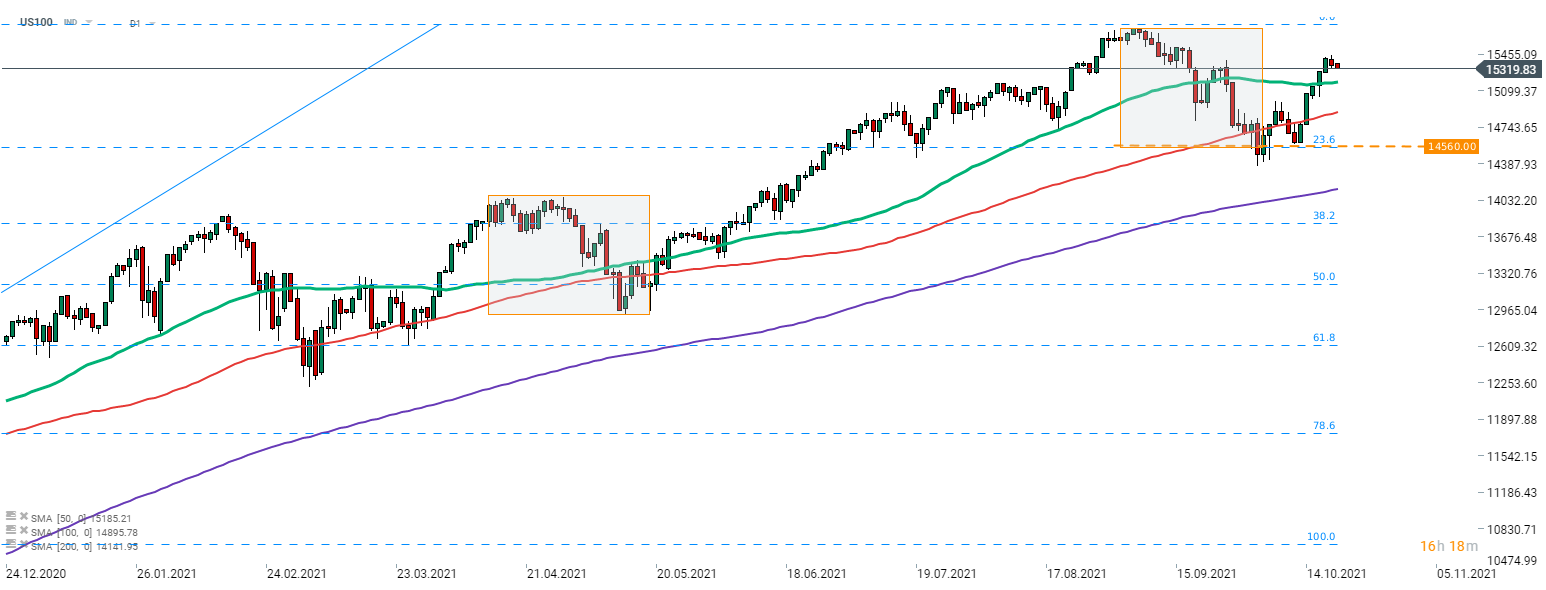

While the US tech sector tended to outperform the broad market, things look different now. S&P 500 (US500) trades around 0.5% below its all-time high while Nasdaq-100 (US100) would need to gain almost 3% to reach new record levels. Source: xStation5

While the US tech sector tended to outperform the broad market, things look different now. S&P 500 (US500) trades around 0.5% below its all-time high while Nasdaq-100 (US100) would need to gain almost 3% to reach new record levels. Source: xStation5

BREAKING: US500 gains amid military officials remarks on Strait of Hormuz

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook