- Wall Street indices finished yesterday's trading lower, following a late-session slump. S&P 500 dropped 1.47%, Dow Jones moved 1.27% lower and Nasdaq dropped 1.50%. Small-cap Russell 2000 was down 1.89%

- Indices from Asia-Pacific traded mixed today - Nikkei dropped 1.6%, S&P/ASX 200 moved 0.4% lower, Kospi dropped 0.6% while Nifty 50 gained 0.1%. Indices from China traded up to 1.1% higher

- DAX futures point to a lower opening of the European cash session

- According to media reports, Chinese President Xi told US President Biden during recent APEC summit that China will reunite with Taiwan one way or another

- According to Wall Street Journal, Biden administration is considering increasing tariffs on Chinese EVs. It was also reported that US officials are discussing tariffs on Chinese goods worth around $300 billion, that were imposed by Donald Trump

- ECB Kazaks said that interest rates will remain at 4.00% for some time before ECB decides to cut

- Morgan Stanley does not expect Federal Reserve to cut rates before June 2024

- Japanese government boosted GDP growth forecast for fiscal years 2023/24 and 2024/25. Real economic growth in FY2023/24 is now seen at 1.6%, up from previous forecast of 1.3%, while growth in FY2024/25 is seen at 1.3%, up from 1.2%

- Japanese government said that external demand is likely to more than offset weak domestic consumption, and that domestic demand is expected to rebound next fiscal year

- Japanese CPI inflation is seen at 3.0% this fiscal year (2023/24), before slowing to 2.5% in the next fiscal year

- China will suspend tariff cuts on some goods imported from Taiwan, starting from January 1, in retaliation for 'discriminatory restrictions' Taiwan imposed on Chinese exports

- Major cryptocurrencies trade slightly higher - Bitcoin gains 0.1%, Ethereum trades 0.5% higher while Dogecoin trades flat

- Energy commodities trade higher - oil gains 0.5% while US natural gas prices climb 0.2%

- Precious metals gain amid USD weakening - gold trades 0.2% higher, silver gains 0.5%, platinum jumps 0.8% and palladium gains 0.3%

- AUD and JPY are the best performing G10 currencies, while USD and GBP lag the most

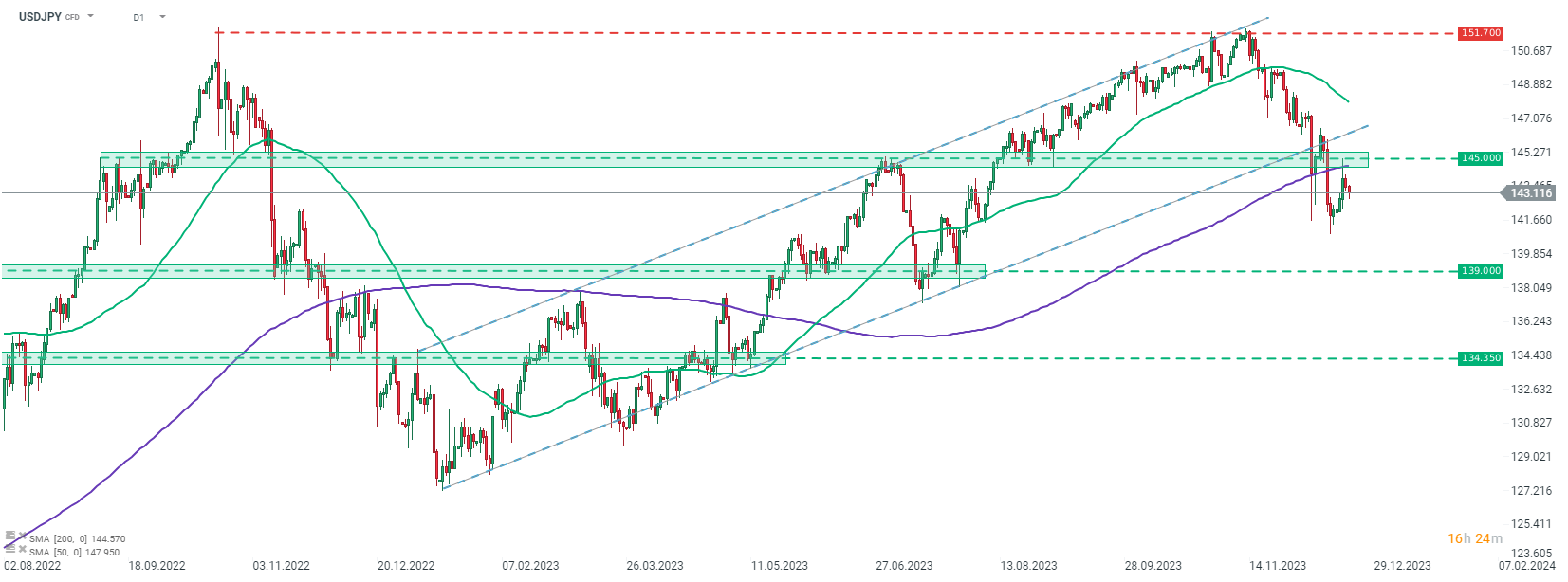

Japanese yen is the best performing G10 currency, after a new set of Japanese government forecasts showed higher growth and above-target inflation. USDJPY resumed slide after a brief correction and an attempt to break back above 200-session moving average (purple line). Source: xStation5

Japanese yen is the best performing G10 currency, after a new set of Japanese government forecasts showed higher growth and above-target inflation. USDJPY resumed slide after a brief correction and an attempt to break back above 200-session moving average (purple line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)