- Asia-Pacific markets are trading at mixed levels during today's session in the absence of any surprise from the Bank of Japan's decision.

- The BOJ is keeping interest rates unchanged, and the Japanese yen itself is trading down moderately against other currencies following the bank's dovish comments, which have reduced somewhat expectations that the BoJ has changed its policy stance in the short term.

- The BoJ's decision reflects the bankers' lack of conviction that wage growth will lead to sustained inflationary pressures.

- European index futures point to a slightly higher opening of the session on the Old Continent.

- Australian unions have agreed to support an industrial arbitrator's recommendations to end their dispute with Chevron.

- Investors' attention today will focus on the Ueda conference following the BoJ decision, PMI data from major economies and speeches by ECB and Fed central bankers.

Barclays and BNP Paribas lowered their BoE forward rate forecasts to 5.25% from 5.5%. - Moody's downgraded the ratings of some Chinese property development companies

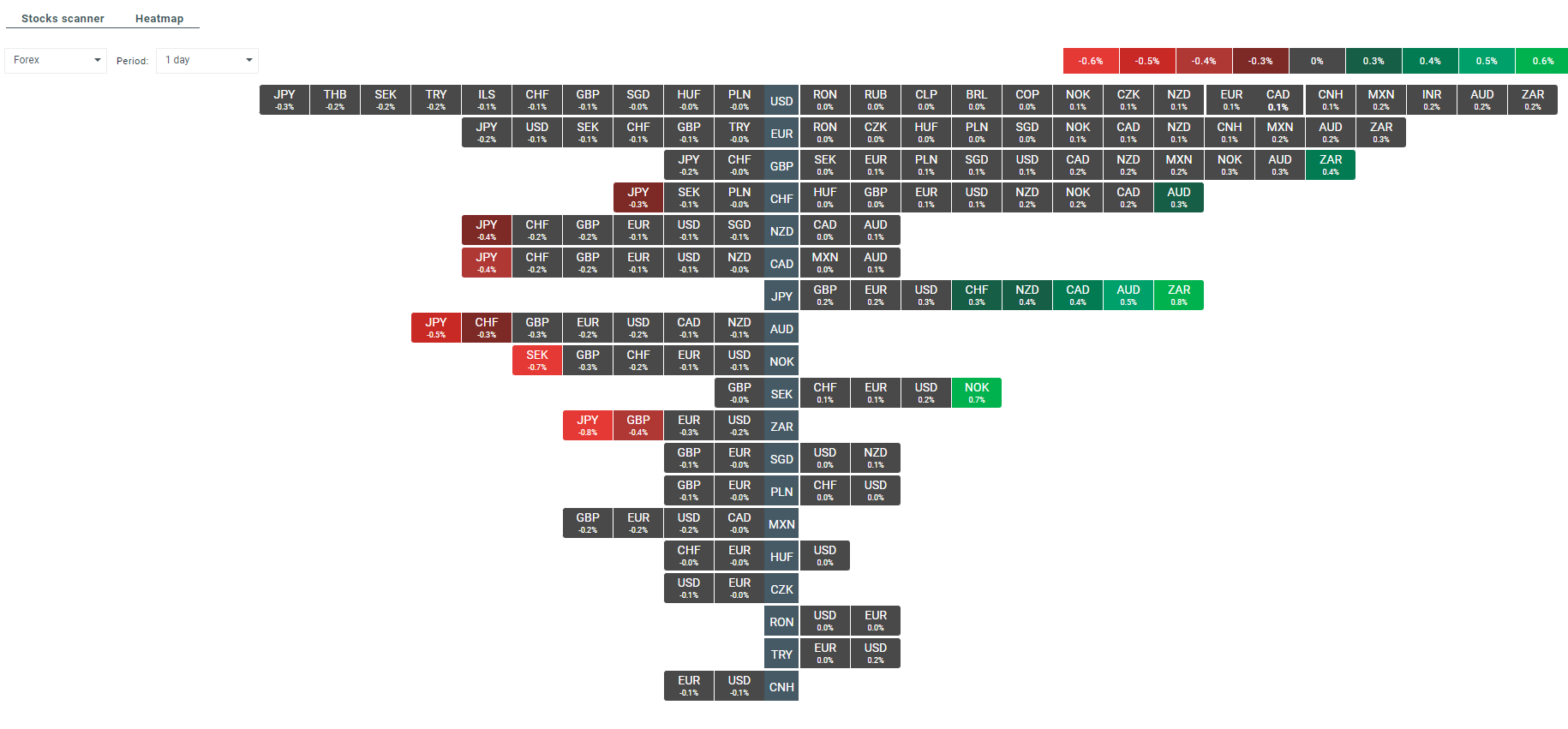

- The U.S. dollar is gaining slightly at the start of today's session. However, the leaders of the increases in the FX market are currently Antipodean currencies. The Japanese yen and the British pound are experiencing the greatest downward pressure.

Heatmap of the FX market, which illustrates the volatility on individual currency pairs at the moment. Source: xStation 5

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

BREAKING: US RETAIL SALES BELOW EXPECTATIONS