-

US stock markets were recovering from a recent sell-off yesterday. S&P 500 gained 1.78%, Dow Jones moved 1.60% higher while Nasdaq rallied 2.40%. Russell 2000 spiked 2.95%

-

Majority of indices from Asia gained as well but scale of gains was much smaller than in the United States. Nikkei and S&P/ASX 200 gained 0.1%, Kospi moved 0.3% higher while indices from China traded mixed

-

DAX futures point a flat opening of the European cash session today

-

US Army said that it is confident it has developed a vaccine that will be effective against all coronavirus variants. US military worked on the vaccine for 2 years and the vaccine has different features than currently available products

-

Oxford and AstraZeneca are working on an Omicron-targeted vaccine

-

UK Prime Minister Johnson said there is not enough evidence to support imposing Christmas lockdown

-

Russia did not book any Yamal pipeline gas transit capacity for today

-

API report signalled a 3.67 million barrel drop in US oil inventories (exp. -2.5 mb)

-

Cryptocurrencies trade little changed on the day. Bitcoin tested $49,500 area during the Asian session but has pulled back to $49,000 since

-

USD and CAD are the best performing major currencies while NZD and AUD lag the most

-

USDTRY holds onto recent gains and trades near 12.30 mark - 33% below daily high from Monday

-

Precious metals are trading lower while industrial metals gain. Oil trade mixed - Brent drops slightly while WTI ticks higher

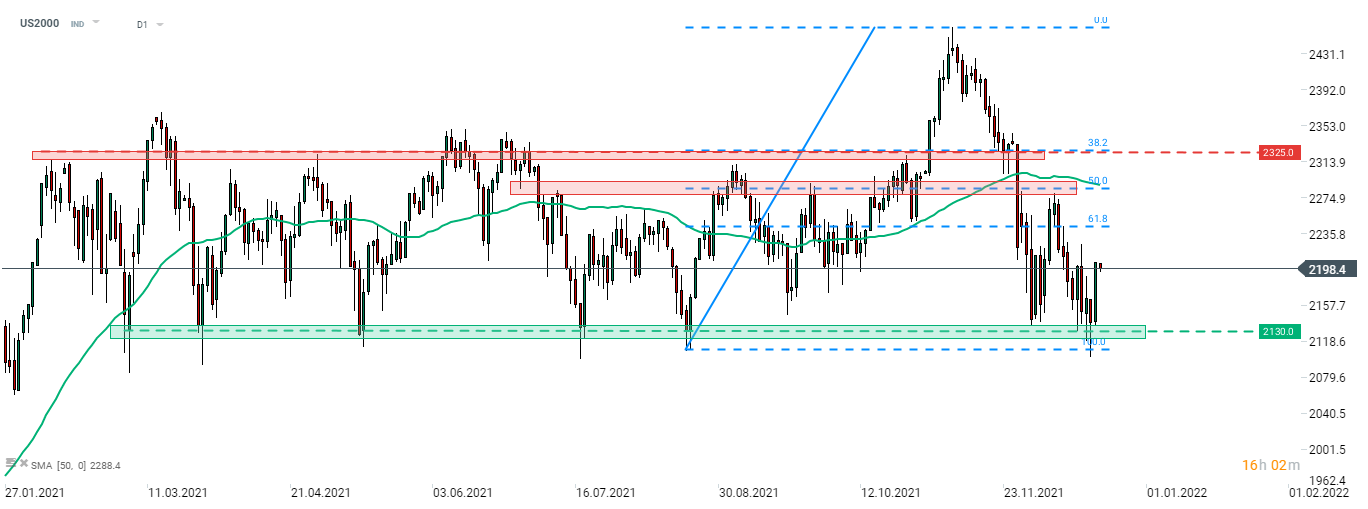

Russell 2000 (US2000) rallied almost 3% yesterday as indices from Wall Street launched recovery after a recent sell-off. US small-cap index bounced off the lower limit of this year's trading range at 2,130 pts. A double bottom was painted in the area with the neckline of the formation being marked by a 2,185 pts handle. Source: xStation5

Russell 2000 (US2000) rallied almost 3% yesterday as indices from Wall Street launched recovery after a recent sell-off. US small-cap index bounced off the lower limit of this year's trading range at 2,130 pts. A double bottom was painted in the area with the neckline of the formation being marked by a 2,185 pts handle. Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report