-

US indices finished yesterday's trading higher. S&P 500 added 0.51%, Dow Jones gained 0.20% and Nasdaq moved 0.79% higher. Russell 2000 added 0.43%

-

Indices from Japan, South Korea and China gain. Australian S&P/ASX 200 lags

-

DAX futures point to a flat opening of the European session

-

Fed Chairman Powell said that the Fed will not raise rates preemptively and that he believes inflation will wane over time

-

China said that its army is reading to respond to provocations from other countries

-

Rumours that OPEC+ will decide to boost oil output during a meeting next week intensify

-

Bank of Japan minutes showed that members agreed economy is on the road to recovery and that inflation increase lacks strength

-

Australia may decide to impose coronavirus restrictions on Sydney amid jump in new cases in the city

-

Japanese manufacturing PMI index for June dropped from 53.0 to 51.5 (exp. 53.2)

-

API report on oil inventories point to a 7.2 million barrel draw (exp. -3.5 mb)

-

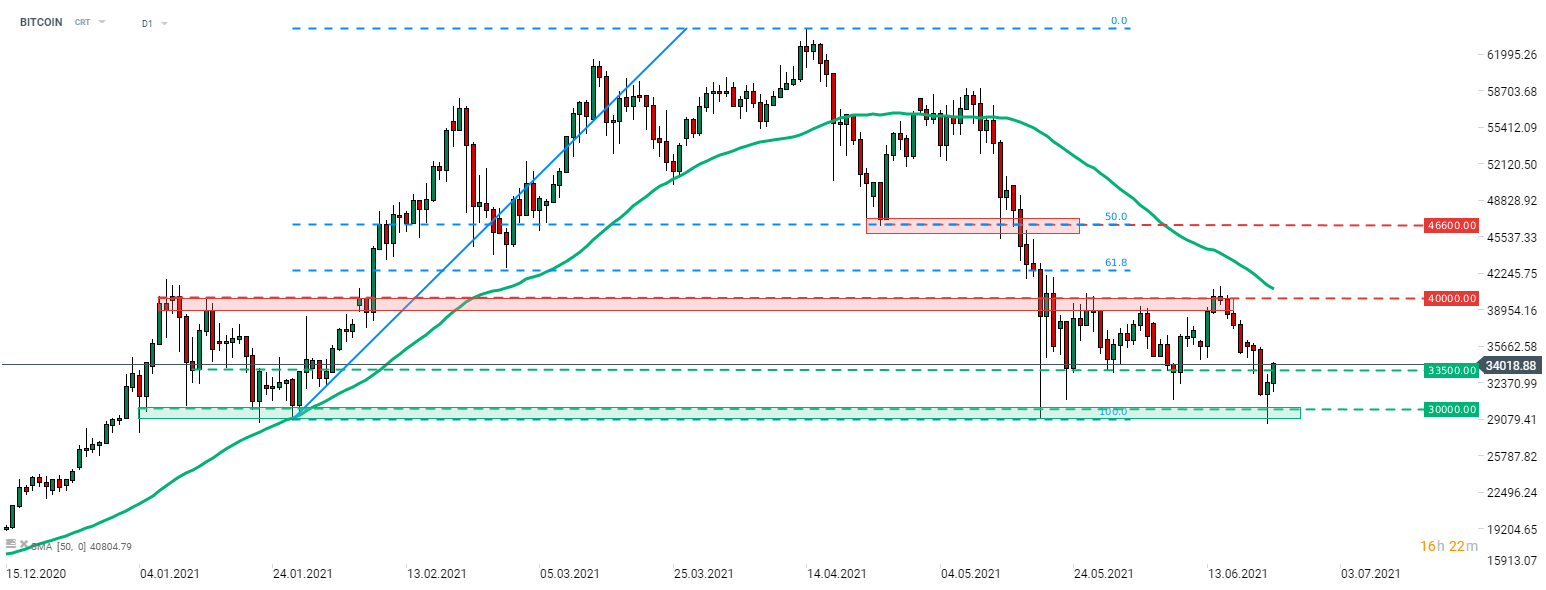

Bitcoin trades slightly below $34,000 mark

-

Precious metals and oil trade higher. Industrial metals trade mixed

-

GBP and USD are the best performing major currencies while NZD and EUR lag the most

Bitcoin continues to recover from a recent massive sell-off. The coin bounced off the $30,000 support area yesterday and climbed above a lower limit of a recent trading range at $33,500. Source: xStation5

Bitcoin continues to recover from a recent massive sell-off. The coin bounced off the $30,000 support area yesterday and climbed above a lower limit of a recent trading range at $33,500. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?

Market wrap: Novo Nordisk jumps more than 7% 🚀

Crypto news: Bitcoin falls below $70k 📉Will crypto slide again?