-

US indices finished yesterday's trading lower following a poor performance of European equities. S&P 500 dropped 2.14%, Dow Jones moved 1.91% lower while Nasdaq declined 2.55%. Russell 2000 dropped 2.13%

-

Asian equities find no relief and deepen yesterday's declines today. Nikkei and Kospi trade 1.2% lower, S&P/ASX 200 drops 1% while indices from China are trading 0.1-0.9% lower

-

DAX futures point to a slightly lower opening of the European cash session today

-

EURUSD dropped below parity levels yesterday and reached the lowest level in 20 years. The main currency pair is trading around 0.9920 at press time

-

Chinese state-controlled media hinted that People's Bank of China may decide to cut reserve requirement rate this year to help lower LPR further

-

Citi expects UK inflation to jump above 18% in 2023 on the back of higher energy prices

-

Japanese manufacturing PMI for August dropped from 52.1 to 51.0 - the lowest reading in 19 months. Services PMI dropped from 50.3 to 49.2

-

Australian manufacturing PMI for August dropped from 55.7 to 54.5. Services PMI dropped from 50.9 to 49.6

-

Cryptocurrencies are trading mixed - Bitcoin drops 0.4% while Ethereum gains 0.3%. EOS drops almost 5%

-

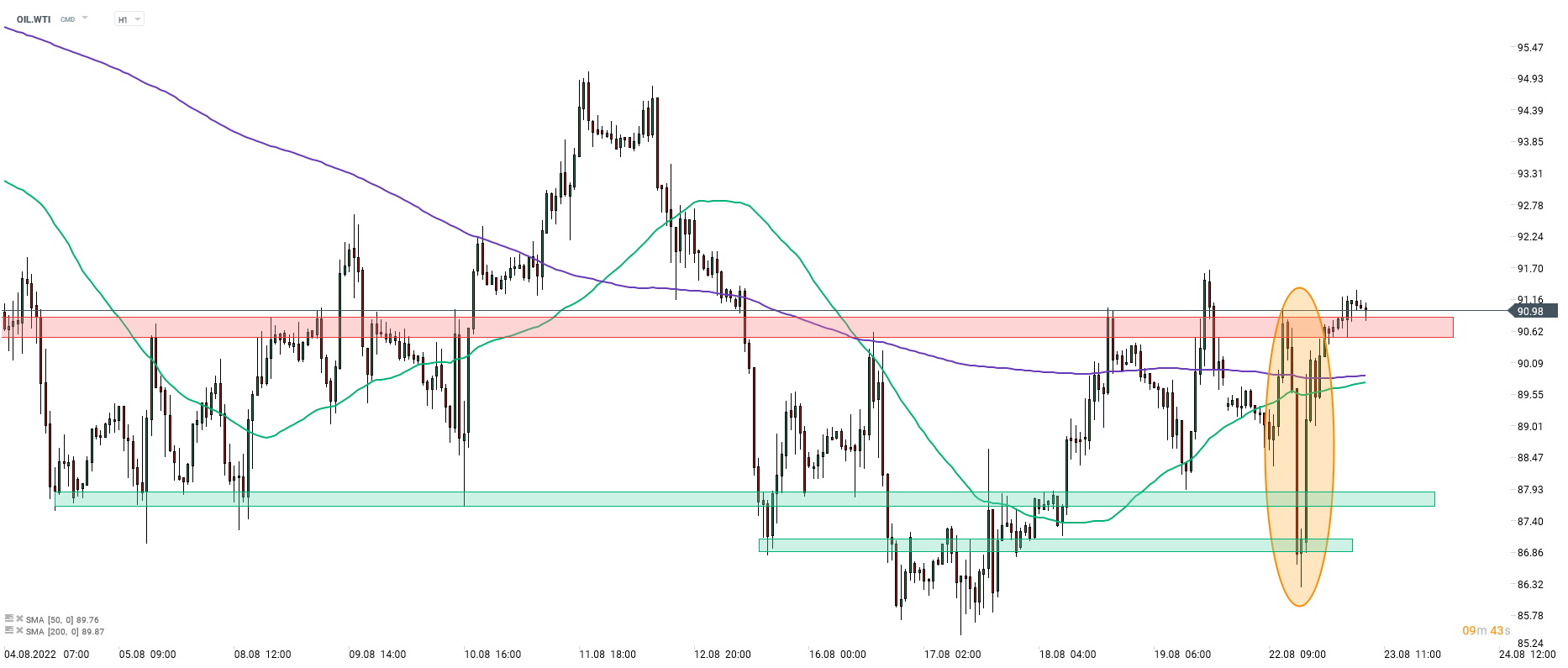

Energy commodities are trading higher today. Oil extends gains follow a reversal on this market yesterday in the afternoon

-

Precious metals trade mixed - platinum and silver drop while gold and palladium gain

-

JPY and NZD are the best performing major currencies while EUR and CHF lag the most

Oil has been very volatile yesterday amid mixed news (orange circle). On one hand, Russia said that the deal with Iran is getting closer while on the other hand, Saudi Arabia warned that OPEC+ may have to reduce output. Nevertheless, it is not expected that any immediate action will follow either of those comments. Source: xStation5

Oil has been very volatile yesterday amid mixed news (orange circle). On one hand, Russia said that the deal with Iran is getting closer while on the other hand, Saudi Arabia warned that OPEC+ may have to reduce output. Nevertheless, it is not expected that any immediate action will follow either of those comments. Source: xStation5

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

📈 Gold jumps 1.5% ahead of NFP, hitting its highest level since Jan. 30

Silver rallies 3% 📈 A return of bullish momentum in precious metals?

Daily summary: Weak US data drags markets down, precious metals under pressure again!