-

US indices finished yesterday's trading mixed. S&P 500 gained 0.13%, Dow Jones added 0.05%, Nasdaq dropped 0.5% and Russell 2000 declined 0.88%

-

Stocks in Asia dropped. Nikkei dropped 1.6%, S&P/ASX 200 declined 0.9% and Kospi moved 2% lower. Indices from China drop over 2% each

-

DAX futures point to a lower opening of the European cash session

-

Reserve Bank of New Zealand left interest rates unchanged at today's meeting. RBNZ said that the economic outlook remains uncertain and asset purchases are still needed. Scale of QE was left unchanged

-

US House will vote on Biden's $1.9 trillion stimulus bill on Friday at 2:00 pm GMT

-

Japan finance minister said that no new stimulus is being considered beyond what was already announced

-

Oil trades lower after API report showed 1 million barrel increase in oil inventories (exp. -5.3 mb)

-

Precious metals trade mixed - palladium and gold gain while silver and platinum decline

-

Bitcoin climbed back to $50,000 area

-

NZD and GBP are top performing major currencies. JPY and CHF are top laggards

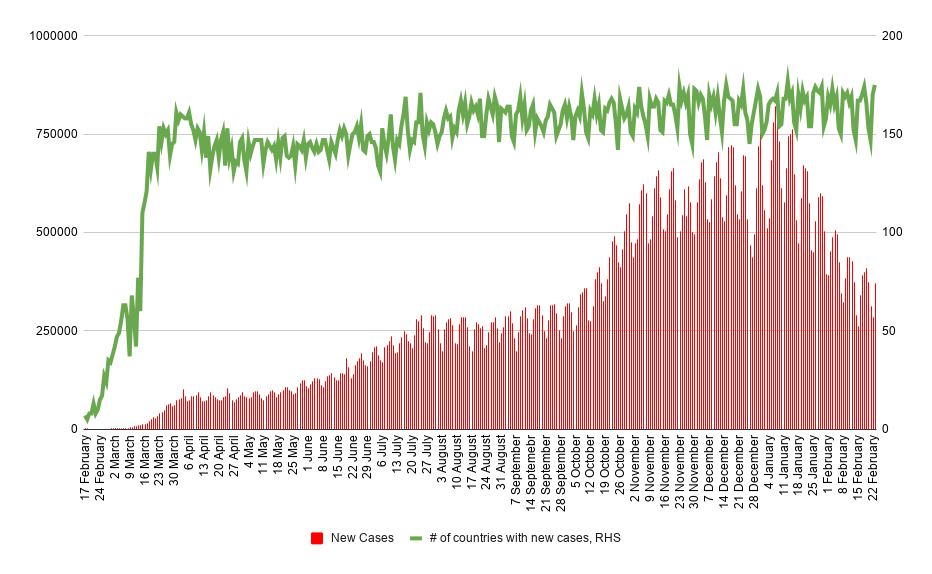

370 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

370 thousand new coronavirus cases were reported yesterday. Source: worldometers, XTB

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report