- Chinese stocks rallied after Beijing took stronger action to support the world’s second-largest economy, spurring hopes that the market’s rout may ease.

- Japanese and Korean stocks linked to China's consumer and manufacturing demand initially surged, pushing an Asian equity benchmark towards its best finish in a week, though gains later diminished.

- China’s President Xi expressed willingness to manage differences with the US and jointly address global challenges.

- Japanese Leading Indicator Change was revised to an actual 1.0%.

- Japanese Chain Store Sales Year-over-Year (YoY) reported at 3%.

- Australia's Treasurer Chalmers noted that while inflation is moderating, it remains persistent in Australia.

- Australian CPI figures:

- Month-over-Month (MoM) at 0.30%.

- Year-over-Year (YoY) at 5.4%, slightly above the forecast of 5.3%.

- Reserve Bank of Australia (RBA) Weighted Mean CPI YoY at 5.2%.

- Quarterly CPI at 1.2%, above the forecast of 1.1%.

- US American Petroleum Institute (API) stock changes:

- Gasoline: -4.169M barrels.

- Distillate: -2.313M barrels.

- Cushing: +0.513M barrels.

- Crude Oil: -2.668M barrels, against a forecast of +1.55M barrels.

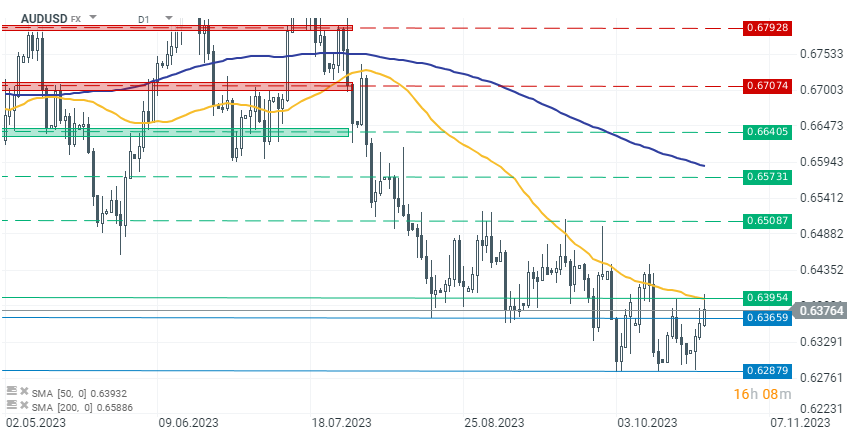

Australia's CPI data comes in slightly above expectations. The Australian dollar is strengthening following the release of the new report. Investors now estimate a higher probability for an interest rate hike at the RBA's November 7 meeting.

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS