-

US indices finished yesterday's trading slightly lower. S&P 500 dropped 0.16%, Dow Jones moved 0.12% lower and Nasdaq plunged 0.45%. Small-cap Russell 2000 index dropped 0.06%

-

Indices from Asia-Pacific are trading higher today. Nikkei gained 1.1%, S&P/ASX 200 traded 0.2% higher, Kospi traded flat and Nifty 50 gained 0.1%. Indices from China traded 0.1-0.2% higher while Hong Kong's Hang Seng gains over 2%

-

DAX futures point to a slightly higher opening of the European cash session today

-

US Energy Secretary Granholm said that refilling of strategic petroleum reserve may start this year

-

Shinichi Uchida, deputy governor of Bank of Japan, said that if 10-year Japanese yield climbs to 2%, BoJ will experience an unrealized loss of 50 trillion JPY on its bond portfolio (currently 10-year yield sits at 0.3%)

-

United States said that China shouldn't overreact to Taiwan president's visit to the United States. This comes after China warned that meeting between US officials and Taiwan president would be seen as provocation

-

Lee Bokhyun, head of South Korean financial regulator, said that South Korean authorities will consider lifting the short-selling ban this year. Ban was imposed early in the Covid pandemic

-

Australian CPI inflation decelerated from 7.4 to 6.8% YoY in February (exp. 7.4% YoY). Core inflation dropped from 7.6% in January to 6.9% YoY in February

-

API report pointed to a 6.08 million barrel draw in US oil inventories (exp. +0.2 mb)

-

Cryptocurrencies trade higher - Bitcoin gains 1.3%, Ethereum adds 1.1% and Dogecoin jumps 2.4%

-

Energy commodities trade mixed - oil gains slightly while US natural gas prices drop

-

Precious metals pull back amid USD strengthening - gold drops 0.5%, silver trades 0.7% down and platinum dips 0.6%

-

NZD and USD are the best performing major currencies while JPY and AUD lag the most

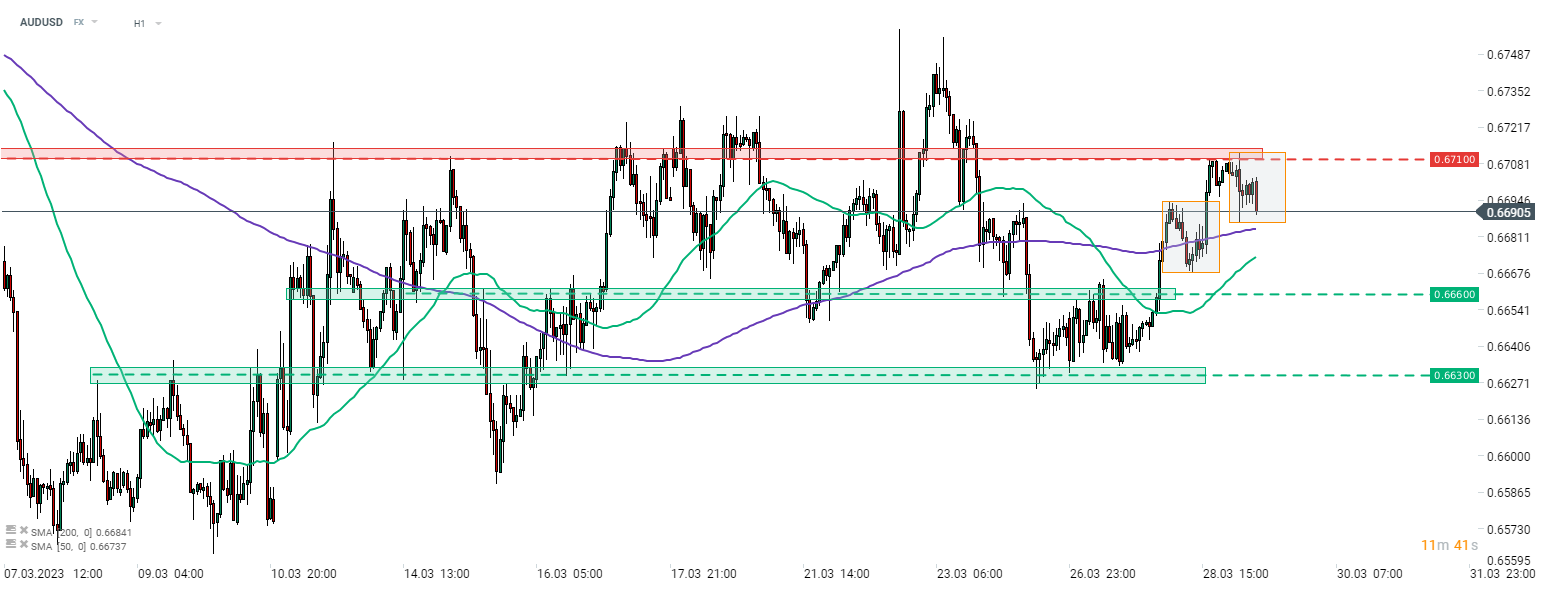

AUD is pulling back after a lower-than-expected CPI reading for February. AUDUSD failed to break above the 0.6710 resistance zone and is now pulling back towards the 200-hour moving average (purple line). Source: xStation5

AUD is pulling back after a lower-than-expected CPI reading for February. AUDUSD failed to break above the 0.6710 resistance zone and is now pulling back towards the 200-hour moving average (purple line). Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)