-

US indices finished yesterday's trading mostly lower but scale of drop was nowhere near as big as the day before. S&P 500 dropped 0.07%, Nasdaq moved 0.03% lower while Dow Jones gained 0.27%. Russell 2000 dropped 1.12%

-

Moods during the Asian session were mixed. Nikkei, S&P/ASX 200 and Kospi dropped more than 1% while indices from China traded 1.5-2.0% higher

-

DAX futures point to a lower opening of the European cash session

-

Russian President Putin said he cannot rule out that tensions with Finland and Sweden will emerge after joining NATO

-

According to Reuters report, Saudi Arabia may increase oil prices for Asian delivery in August to near record levels

-

According to Wall Street Journal, talks between Iran and the United States in Qatar ended with no progress and no date for set for further negotiations

-

Official Chinese PMI indices returned to the expansion territory in June. Manufacturing index jumped from 49.6 to 50.2 (exp. 50.5) while services index moved from 47.8 to 54.7 (exp. 50.4)

-

Japanese industrial production dropped 7.2% MoM in May (exp. -0.2% MoM)

-

Australian private sector credit increased 0.8% MoM in May (exp. +0.6% MoM)

-

South Korean industrial production increased 7.3% YoY in May (exp. 3.1% YoY)

-

Cryptocurrencies are pulling back amid reports that SEC declined to approve 2 spot Bitcoin ETFs. Bitcoin drops 1.5% and breaks below $20,000 mark

-

Oil trades higher with WTI trading near $110 and Brent trading near $113

-

Precious metals trade mixed - gold and silver drop while platinum gains

-

GBP and JPY are the best performing major currencies while NZD and CAD lag the most

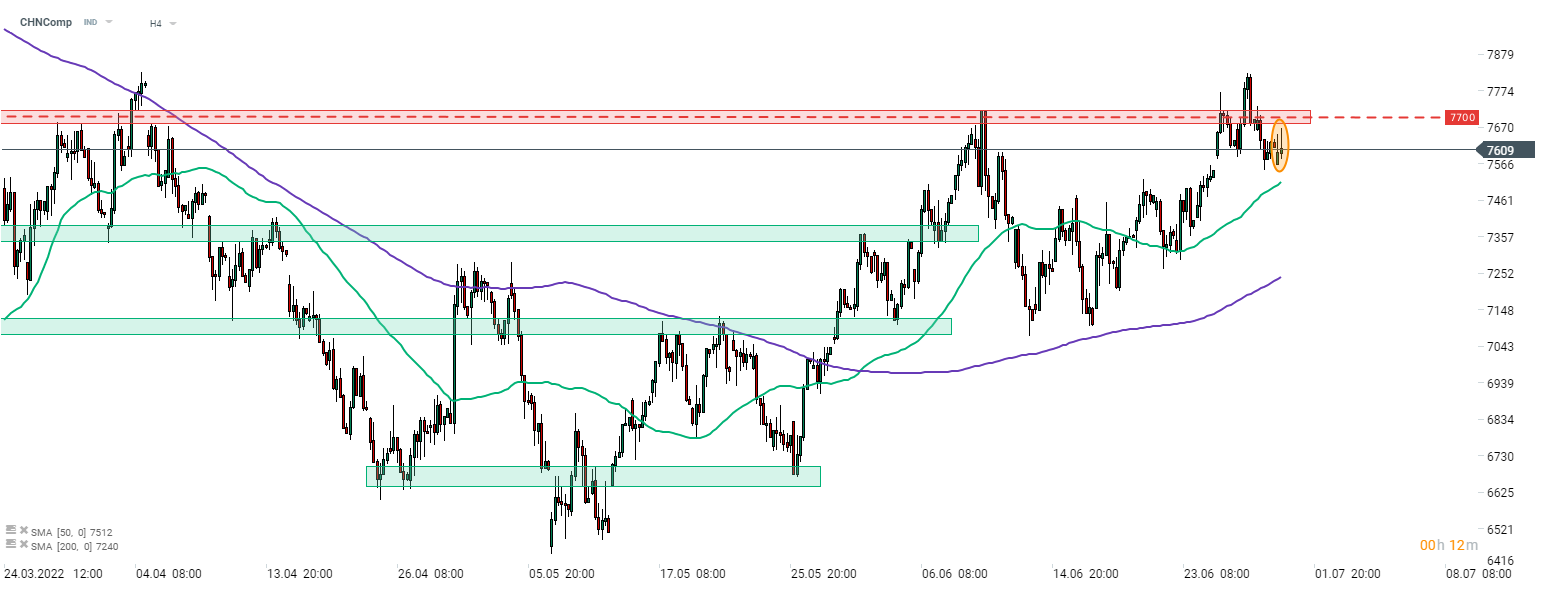

CHNComp jumped along other indices from China following release of solid PMI indices for June. However, the index has erased most of the gains already and threatens to resume pullback. Source: xStation5

CHNComp jumped along other indices from China following release of solid PMI indices for June. However, the index has erased most of the gains already and threatens to resume pullback. Source: xStation5

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report

Daily summary: Weak US data drags markets down, precious metals under pressure again!