-

US indices finished yesterday's trading lower as moods remained sour following Powell's speech on Friday. S&P 500 dropped 0.67%, Dow Jones declined 0.57% and Nasdaq moved 1.02% lower. Russell 2000 dropped 0.89%

-

Indices from the Asia-Pacific traded mixed during a session on Thursday - Nikkei, Kospi and S&P/ASX 200 gained 0.7-1.1% while indices from China traded 0.7-0.9% lower

-

DAX futures point to a slightly higher opening of the European cash session

-

White House Press Secretary said that she expects slowdown in jobs growth and overall employment data to "cool off"

-

Chinese Premier Li Keqiang said that economic support right now is exceeding support policies from pandemic-hit 2020

-

According to a Bloomberg report, European Union is likely to meet its gas storage filling goals around 2 months ahead of a target. EU stockpiles are 80% full at the moment while it was not expected to happen before November 1, 2022

-

Japanese unemployment rate stayed unchanged at 2.6% in July (exp. 2.6%)

-

Australian building approvals plunged 17.2% MoM in July (exp. -2.1% MoM)

-

Cryptocurrencies are trading higher in an attempt to recover from recent declines. Bitcoin gains 1% and climbs back above $20,000 while Ethereum jumps 2.8%

-

Oil is trading a touch lower with Brent and WTI dropping around 0.2% each at press time

-

Precious metals are pulling back, although scale of declines is small. Gold drops 0.1% while silver and platinum trade 0.2% lower

-

JPY and CHF are the best performing major currencies while AUD and NZD lag the most

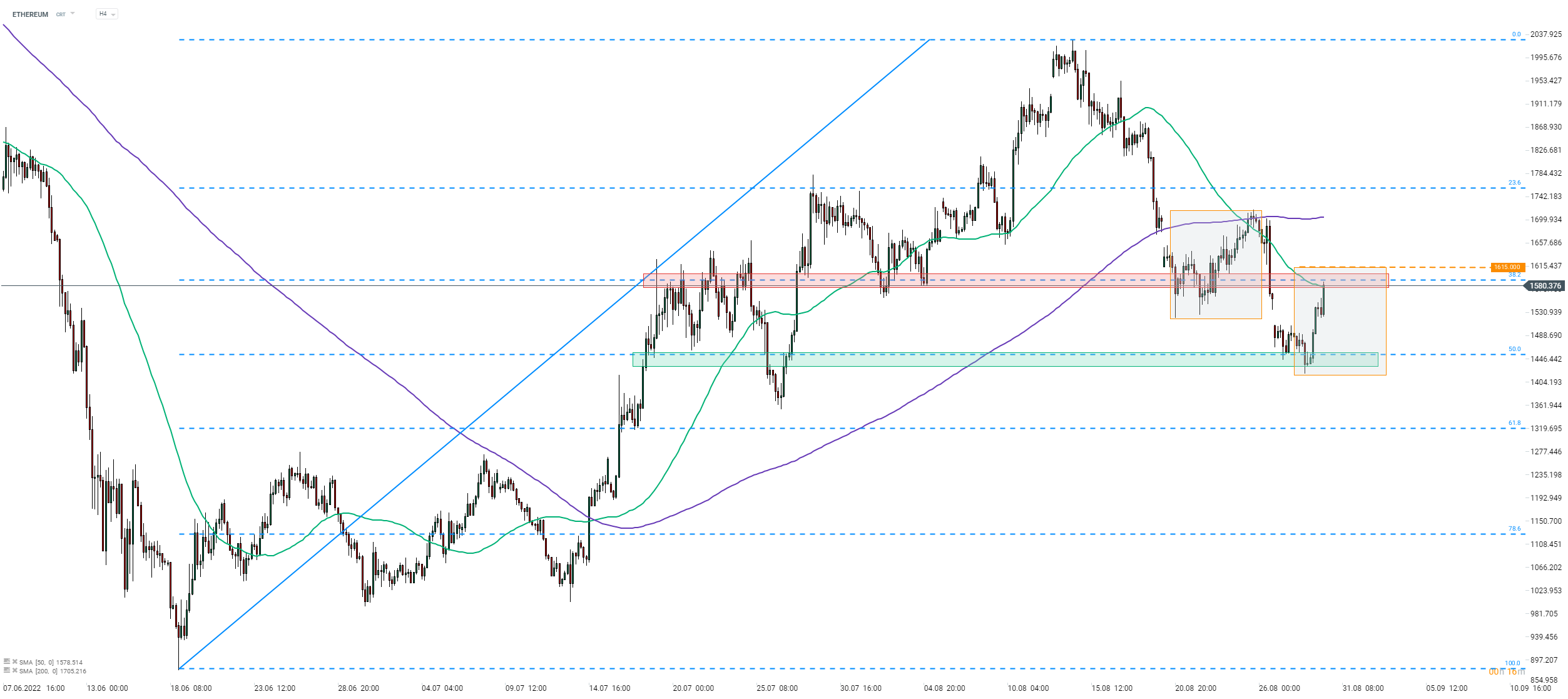

Cryptocurrencies are trying to recover from recent declines. Ethereum is approaching a key near-term resistance zone in the $1,600 area, marked with previous price reactions and the 50-period moving average (green line). Note that the upper limit of local market geometry can be found just slightly above the aforementioned zone. Source: xStation5

Cryptocurrencies are trying to recover from recent declines. Ethereum is approaching a key near-term resistance zone in the $1,600 area, marked with previous price reactions and the 50-period moving average (green line). Note that the upper limit of local market geometry can be found just slightly above the aforementioned zone. Source: xStation5

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!

🚨 Bitcoin drops to $69,000 📉 A 1:1 correction scenario?