-

Stocks in Asia traded mixed with Nikkei gaining 1.1% and S&P/ASX 200 dropping 0.2%. Trading was subdued however as Chinese, New Zealand and South Korean traders were on holiday

-

US futures trade slightly higher following massive rally on Friday

-

DAX futures point to higher opening of the European cash session

-

US President Biden said that US troops will be moved to the Eastern Europe soon

-

Fed's Bostic says that 50 basis point rate hikes cannot be ruled out if inflation remains elevated

-

Sergio Mattarella was re-elected as President of Italy and accepted to serve second term

-

Official Chinese manufacturing PMI dropped in January from 50.9 to 49.1 (exp. 50.4)

-

Japanese retail sales increased 1.4% YoY in December (exp. 2.7% YoY)

-

Japanese industrial production was 1.0% MoM lower in December (exp. -0.9% MoM)

-

Cryptocurrencies traded sideways over the weekend but some weakness can be spotted on Monday. Bitcoin dropped to $37,000 while Ethereum trades near $2,500

-

Gains can be spotted all across the commodity market. Agricultural good, precious metals and energy commodities all trade higher

-

AUD and NZD are the best performing major currencies while JPY and CHF lag the most

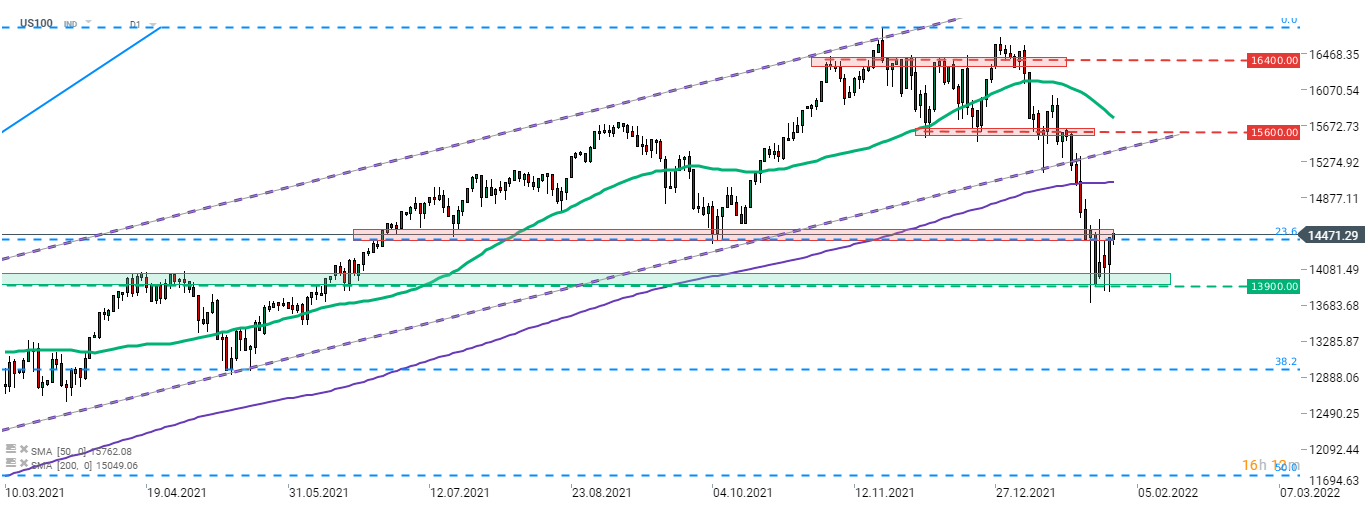

US100 and other Wall Street indices managed to recover from a drop on Friday and finish the session with big gains. Upward move continues this morning. US100 attempts to break above the upper limit of recent trading range - the resistance zone marked with 23.6% retracement of the post-pandemic recovery move. Source: xStation5

US100 and other Wall Street indices managed to recover from a drop on Friday and finish the session with big gains. Upward move continues this morning. US100 attempts to break above the upper limit of recent trading range - the resistance zone marked with 23.6% retracement of the post-pandemic recovery move. Source: xStation5

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

US100 loses 1.5% 📉