-

Yesterday's session on Wall Street ended with slight gains in the major indices. The S&P 500 gained 0.38%, Nasdaq 0.56%, and the Russell 2000 was up 0.40%.

-

The session in Asia-Pacific was more mixed. Indices from China decreased slightly, Hang Seng was down 0.50%, Nifty lost 0.11%, the Australian index S&P/ASX 200 was down 0.10%, and the Korean Kospi was 0.40% lower.

-

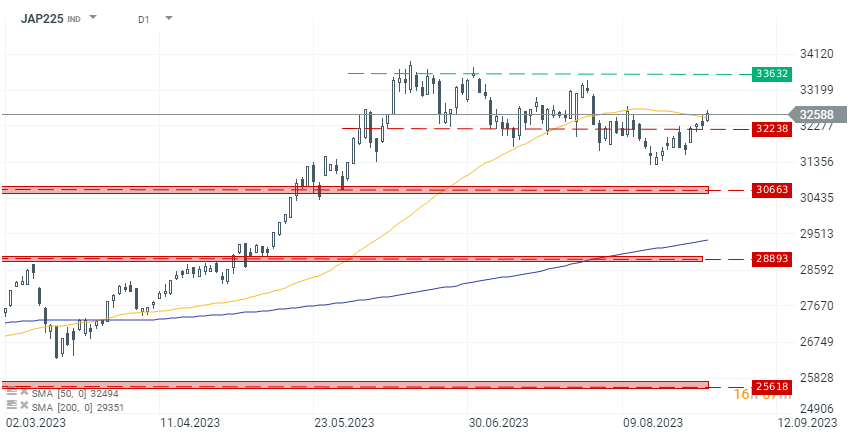

The only market gaining during the Asian session was the Japanese Nikkei 225, which rose by 0.20% after better retail sales.

-

Retail sales in Japan increased by 6.8% year-over-year in July, compared to forecasted 5.4% year-over-year and 5.6% year-over-year a month earlier in June. A drop in sales was forecasted, but the data turned out much better.

-

On the contrary, the data on industrial production was worse than expected. Industrial production in July was -2.5% year-over-year and -2.0% month-over-month, compared to expected -1.3% month-over-month and -2.4% month-over-month a month earlier in June.

-

A member of the board at the Bank of Japan (BoJ), Toyoaki Nakamura, stated that Japan's economic recovery requires the central bank to consider ending its negative interest rate policy.

-

Toyoaki Nakamura noted that inflation in Japan is not yet demand-driven, so the demand gap remains negative. Nakamura emphasized that he was not opposed to the flexibility in Yield Curve Control (YCC); his only objection was about the timing when it was being considered.

-

The PMI data from China showed that the actual NBS Manufacturing PMI was 49.7 in August compared to a forecast of 49.2 and previously 49.3. The PMI for services was 51, compared to expected 51.2.

-

The President of the People's Bank of China (PBoC) stated that the central bank would increase stimulus resources for businesses and credit support for private enterprises.

-

Precious metals are relatively flat. Gold and Palladium are gaining 0.15% and 0.30%, respectively, while silver and platinum are down 0.15% and 0.30%, respectively.

-

Not much was happening in the cryptocurrency market. Major projects are flat. Bitcoin is losing 0.20% and is trading around 27,250 dollars, and Ethereum is down 0.15% and is trading at around 1,700 dollars.

Japanese index Nikkei 225 was the only one to gain among the countries in the Asia-Pacific session, following better macroeconomic data and comments from member of the BoJ (Bank of Japan)

Economic calendar: ADP Labor market report and ISM services 🔎

Morning wrap (04.03.2026)

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood