• US indices finished yesterday's session lower. The Dow Jones fell 0.25%, S&P 500 dropped 0.3% and Nasdaq lost 0.16%.

• US stocks are set to cap another strong year, with the S&P 500 and Nasdaq up more than 20%, while the Dow gained about 19% in 2021

• Mixed moods prevail in the Asian markets today. Nikkei and Kospi are both closed, DJ New Zealand lost 0.46%. Indices from China struggled to find common direction

• German, Spanish and Italian markets are closed, while French and UK markets are scheduled for an early close

• President Biden made clear during yesterday's phone call with president Putinthat, the US and its allies and partners will respond decisively if Russia further invades Ukraine

• US cruise line stocks took a hit yesterday after the CDC discouraged Americans from taking cruises, while US-listed Chinese firms rallied sharply on year-end buying.

• China PMIs for December. Manufacturing 50.3 (expected 50.1) & Services 52.7 (expected 53.1)

• South Korea’s consumer prices rose 3.7% in December, above markets expectations of a 3.6% increase and remaining at a decade high

• South Africa says its Omicron wave has passed its peak with no big spike in deaths

• Oil and precious metals move slightly higher

• Bitcoin is trading around $47400 while Ethereum rose slightly to $3730

• AUD and CAD are leaders among major currencies while CHF and EUR lag the most

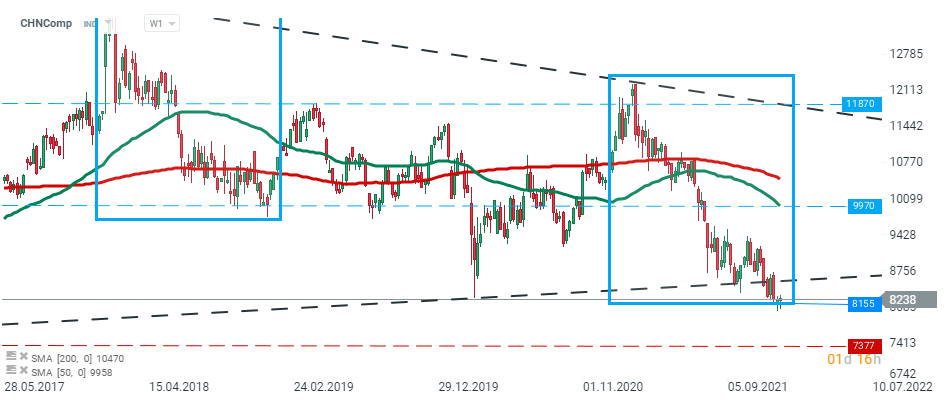

CHNComp fell sharply this year due to government crackdown on major Chinese tech companies, however it seems that buyers managed to halt declines at the lower limit of the 1:1 structure around 8155 pts. Source: xStation5

CHNComp fell sharply this year due to government crackdown on major Chinese tech companies, however it seems that buyers managed to halt declines at the lower limit of the 1:1 structure around 8155 pts. Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

BREAKING: US jobless claims slightly higher than expected

Economic calendar: US Jobless Claims and ECB Speeches to Offer Markets Breathing Room (12.02.2026)

BREAKING: Pound frozen after lower-than-expected GDP data from UK 🇬🇧 📉