- We are starting a new week of trading on international markets.

- The start of Monday trading is very volatile and interesting. The trend of "de-dollarization," already visible last week, has come to a halt today.

- The EURUSD pair is down 0.32% intraday and is trading in the 1.1852 zone. At the same time, USDJPY is holding steady below 154.500, a key control zone marked by the 100-day EMA.

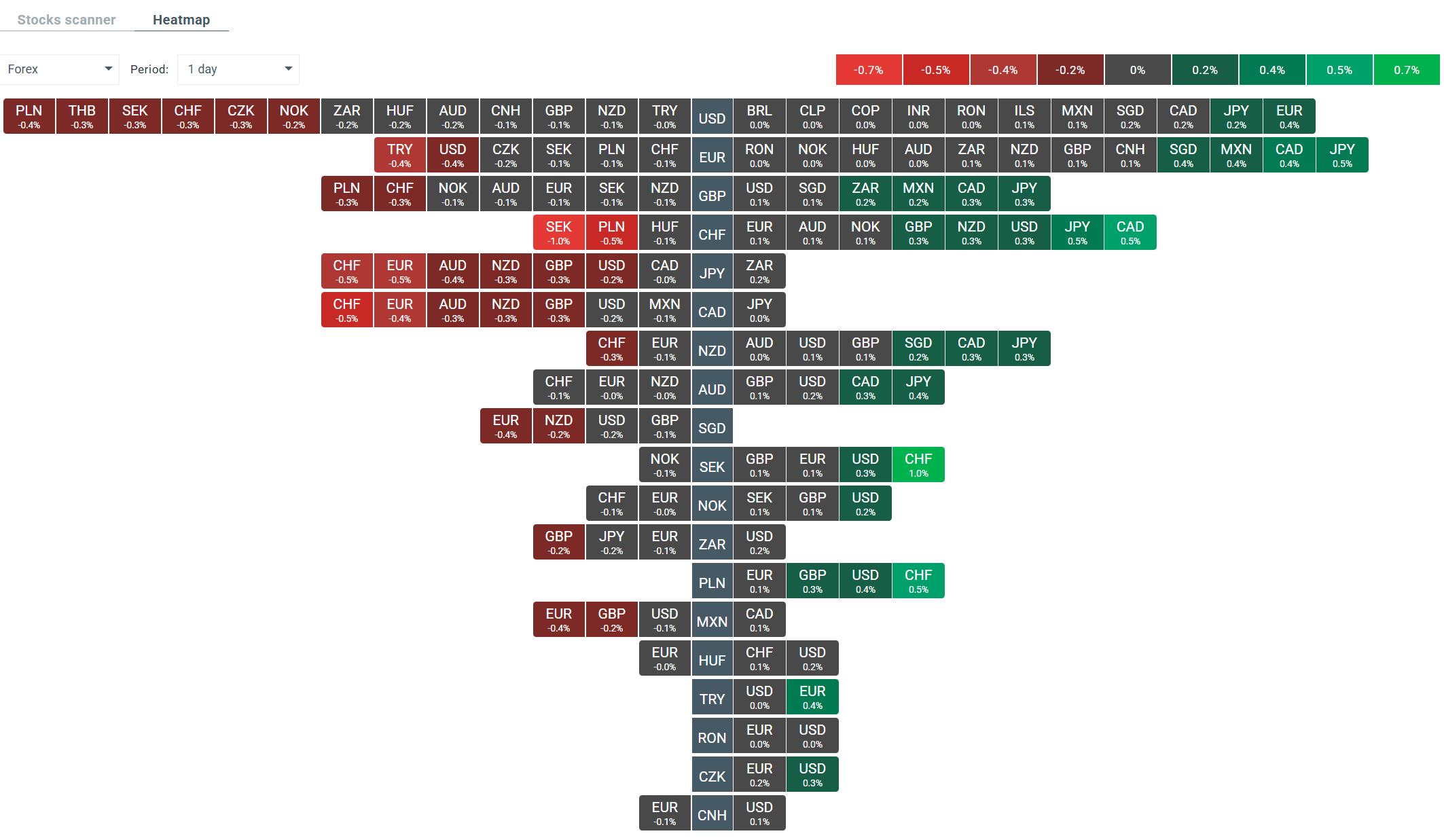

- In the overall Forex market, the yen and the Canadian dollar are currently performing best. Losses dominate the Swiss franc and the Australian dollar.

- The yen's strength stems from statements by Japanese Prime Minister Takaichi, who warned that the government is ready to take action against speculative movements in the face of currency weakness and a sharp rise in bond yields.

- The precious metals market is dominated by increases. The significant upward trends/dynamics of recent weeks are clearly continuing today. GOLD is trading above $5,000 per ounce for the first time, adding nearly 1.9% intraday. At the same time, SILVER prices are up as much as 4.85%, rising above $107.5.

- The extreme increases in metal prices are a combination of the trend toward de-dollarization, geopolitical turmoil, and speculation on the derivatives market itself.

- Trends for NATGAS and OIL.WTI also remain unchanged. Natural gas contracts are already up 5.44% due to continuing low temperatures and snowfall in the US.

- Mixed sentiments prevail on the stock market. Currently, contracts on US indices are losing between 0.10% and 0.3%. On the cash market, most Chinese indices lost value today, with the Nikkei 225 losing 1.83%. Markets in Australia were closed due to a public holiday.

- Sentiment is weak amid concerns about Japanese intervention and the latest threats from US President Trump regarding tariffs on Canada; Trump has threatened Canada with 100% tariffs if it enters into a trade agreement with China.

- Today's macro calendar is relatively empty. Investors will focus on Ifo data from Germany, retail sales from Poland, and the publication of durable goods orders from the US.

- Sentiment on the crypto market is improving after the cryptocurrency plummeted to $86,000 on Sunday.

Current volatility on the currency market. Source: xStation

Current volatility on the currency market. Source: xStation

Economic calendar: Central banks vs global risks to inflation (05.03.2026)

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

📀Coinbase and MicroStrategy surge as Trump challenges Wall Street banks