EIA report released yesterday showed US natural gas inventories increasing 111 billion cubic feet in the previous week. It was higher build-up than expected and also marked the fifth straight week when inventories increased by more than 100 bcf. Moreover, such a streak has not occured in the previous five years!

US natural gas prices may drop by as much as 20% this week. While NATGAS price is distorted by contract rollover, price of the previous month's contract is nearing $5 per MMBTu. Such price action is not in-line with seasonal patterns. Market chatter on improved weather, that will see the start of the heating season delayed, as well as looming economic slowdown are playing a major role in the sell-off.

US natural gas inventories have been building up quicker recently than suggested by seasonal patterns. In theory, we are now at the seasonal peak of inventory rebuilding. Source: Bloomberg

US natural gas inventories have been building up quicker recently than suggested by seasonal patterns. In theory, we are now at the seasonal peak of inventory rebuilding. Source: Bloomberg

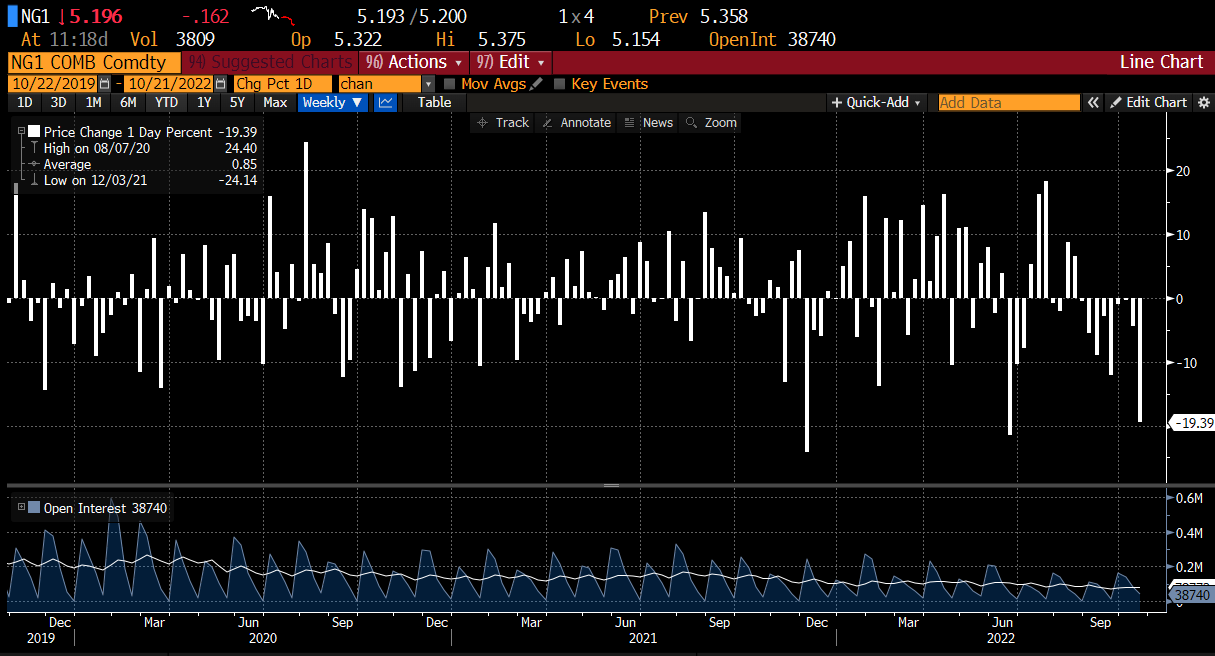

Generic natural gas contract is down almost 20% this week. It should be noted that in previous two such cases, strong declines were followed by another two weeks of 5-10% price drops. This could bring US natural gas prices below $5 per MMBTu mark. Source: Bloomberg

Generic natural gas contract is down almost 20% this week. It should be noted that in previous two such cases, strong declines were followed by another two weeks of 5-10% price drops. This could bring US natural gas prices below $5 per MMBTu mark. Source: Bloomberg

NATGAS launched today's trading higher due to contract rollover but one cannot rule out an attempt to fill in the bullish price gap and a move towards an upward trendline. As one can see, market got disconnected from seasonal patterns. Source: xStation5

NATGAS launched today's trading higher due to contract rollover but one cannot rule out an attempt to fill in the bullish price gap and a move towards an upward trendline. As one can see, market got disconnected from seasonal patterns. Source: xStation5

What else is there to know?

-

European natural gas inventories are 93% full

-

European natural gas prices drops over 4% today and moves below €120/MWh

-

US Freeport LNG terminal is expected to resume operations and exports in mid-November. This could in theory boost US prices but should also improve supply in Europe

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?