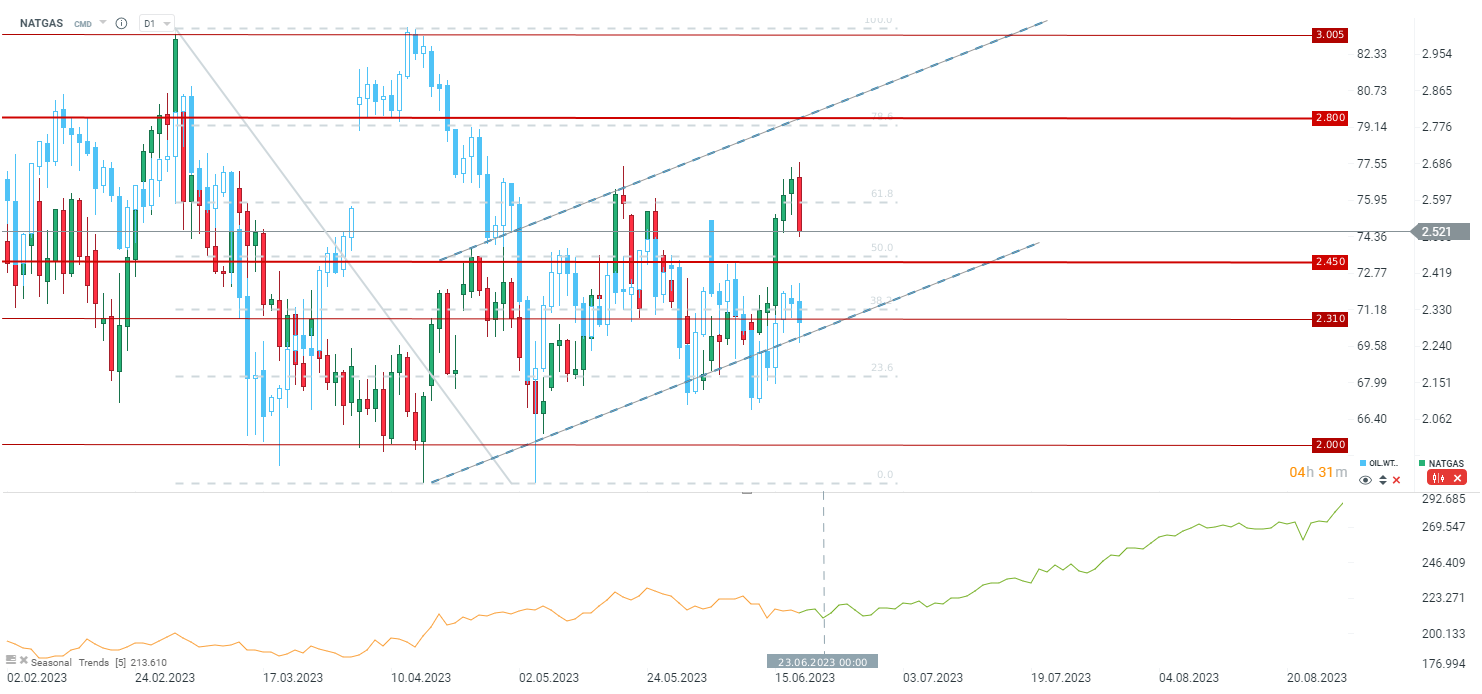

US natural gas prices (NATGAS) are experiencing a significant pullback today and are trading over-5% lower. This comes after a shortened trading on NATGAS yesterday, what was due to US holiday. Declines today have accelerated after launch of the US cash stock market session at 2:30 pm BST.

New set of weather forecasts for the United States is named as a reason behind the drop today. However, those forecasts point to a significant pick-up in temperatures, especially in Texas, where the share of gas-powered plants in electricity generation is large.

As those do not support the current drop from a fundamental point of view, we see today's drop as profit taking following steep gains made by NATGAS last week. Also quite a strong correlation can be spotted between oil and natural gas since the beginning of May and a drop on crude market may also be playing a role in today's natural gas sell-off.

NATGAS is trading over 5% lower. A key support can be found in the 2.45 area with 2.30 area being the next one in-line. Seasonal patterns suggest that local low may be reached by the end of this week. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?