National Bank of Sweden (Riksbank) rises interest rates by 25 bp to 4.25%.

The Riksbank has raised its policy rate by 0.25 bp to 4% in an effort to curb persistently high inflationary pressures in the Swedish economy. This move, combined with decreasing energy prices, aims to stabilize inflation around the 2% target. The bank's forecast suggests that there could be further rate hikes in the future.

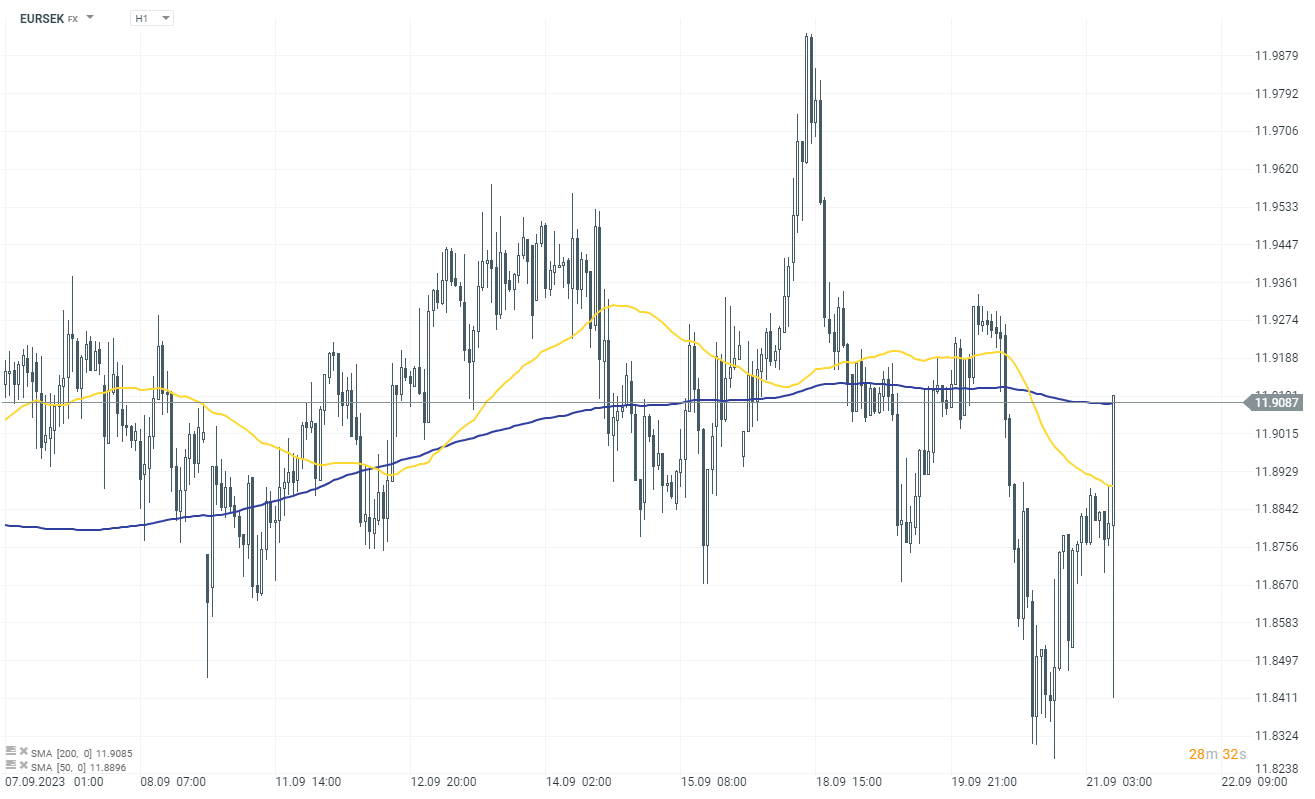

The market reaction is somewhat contrary to the decisions of Riksbank. Since rates are higher now, the SEK should appreciate. The Swedish krona's initial depreciation could be a result of the Riksbank's decision to hedge a portion of its foreign exchange (FX) reserves by selling 8 billion USD and 2 billion EUR in exchange for Swedish kronor. This process will start on September 25, 2023, and is expected to take four to six months to complete. The move is intended to curb potential losses for Riksbank in the event of the krona appreciating, and is not motivated by monetary policy objectives.

Source: xStation 5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes