Risk assets sink today as investors are concerned about a new coronavirus variant in South Africa. New variant is said to be more transmissible and more resilient to antibodies.

-

Blue chips from almost all Western European countries trade over 3% lower at the start of the session. Risk of new lockdowns in Europe has been on the rise in recent weeks and the probability of imposing new restrictions is even greater.

-

Both WTI and Brent trade almost 5% lower already as potential new restrictions on mobility, including flights, threaten to destroy demand. In fact, Singapore has already banned arrivals from South Africa and nearby countries while Japan is mulling a similar move

-

Gold and other precious metals climb as resurgence of pandemic risks delaying policy tightening by the Federal Reserve

-

CHF and JPY lead on the FX markets as investors seek safety amid virus uncertainty

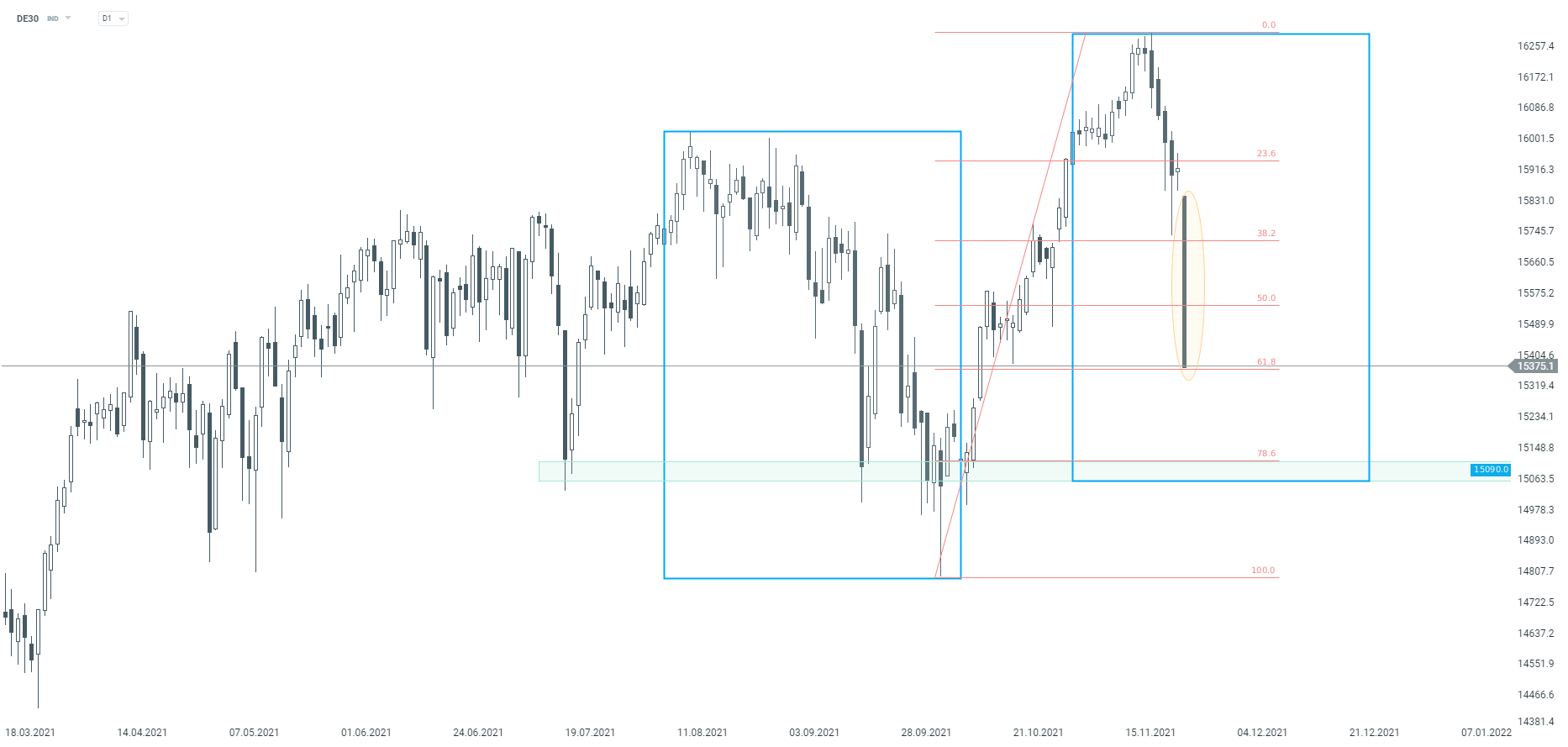

DE30 plunged during the Asian session and the downward move continues at the beginning of the European session. Taking a look at the daily interval, we can see that 61.8% retracement of a recent upward impulse is being tested at press time. Breaking below this hurdle would open the way towards the support zone in the 15,090 pts area.

Source: xStation5

Source: xStation5

Daily Summary - Powerful NFP report could delay Fed rate cuts

US OPEN: Blowout Payrolls Signal Slower Path for Rate Cuts?

BREAKING: US100 jumps amid stronger than expected US NFP report

Market wrap: Oil gains amid US - Iran tensions 📈 European indices muted before US NFP report