-

NFP report release on Friday, 1:30 pm GMT

-

Market expects 100k increase in non-farm payrolls

-

ADP showed unexpected drop

-

Markets reaction may be muted

NFP report for December (Friday, 1:30 pm GMT) is a top macro release of the week. Market consensus expects a 100k increase in the US employment following a 245k addition in November. However, ADP report released on Wednesday pointed to an unexpected 123k decline. Are there reasons to be worried about the condition of the world's largest economy?

ADP data showed impact of pandemic restrictions

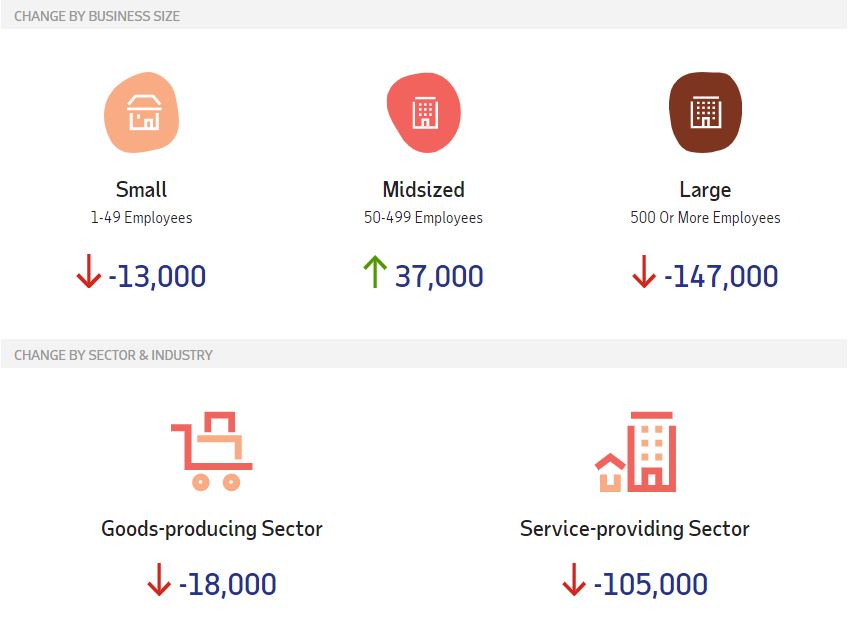

ADP report signalled a 123 thousand decline in the US private employment against an expected increase of 88 thousand. 18 thousand jobs were lost in the manufacturing sector while 105 thousand decline was seen in the services sector. Large companies (over 500 employees) and small companies (less than 50 employees) reduce jobcount by a combined 160 thousand in December. This was partially offset by 37 thousand jobs added by mid-sized companies (50-499 employees). A point to note is that job cuts in the services sector were more or less limited to two categories - "Trade, Transportation & Utilities" and "Leisure & Hospitality". Having said that, an impact of recently reimposed coronavirus restrictions in many parts of the United States on the data is evident. However, these may not be as worrisome as one would think.

Jobs losses in December were limited to small and big companies according to ADP data. Services took the biggest hit. Source: ADP

Jobs losses in December were limited to small and big companies according to ADP data. Services took the biggest hit. Source: ADP

Old news already?

The most important point to make is that the US economic relief package was passed by the end of December therefore ADP and NFP reports won't capture its impact. As business will be provided more support from the government, they may not be forced to cut more jobs. Moreover, a shift on the US political scene may lead to even more stimulus. Democrats have won control over Congress and it will make passing new laws much easier. Traders should keep in mind that it was Republicans who opted for a smaller stimulus deal while Democrats were all in for big and broad spending packages. There is a high chance that Democrats will quickly start working on another badge of government support and this could be the reason why markets largely overlooked dismal ADP reading yesterday.

What is expected from the NFP report and how will markets react?

Median estimate points to a 100k increase in the US employment level in December. Range of estimates compiled by Bloomberg is very wide with -400k being the lowest estimate and +250k being the highest one. Risks are tilted to the downside following a big miss in the ADP data. However, markets may look past disastrous reading because of the reasons mentioned above. Moreover, we have seen a few times in the past months that the market often treats bad news as good news hinting at more fiscal support. Having said that, NFP release is definitely a risk event to watch but investors should not be too surprised if reaction will be muted in case of a weaker-than-expected reading.

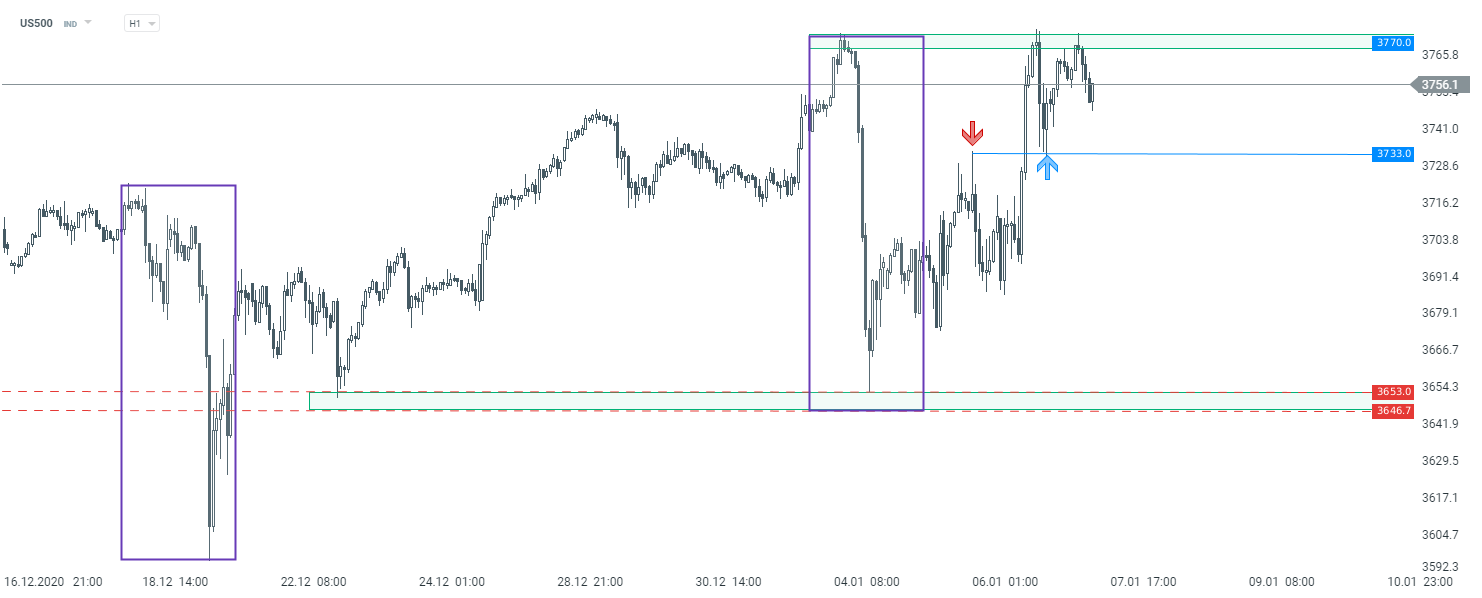

US500 continues to trade near record highs in spite of yesterday's dismal ADP reading. The latest drop was halted at the zone marked by the lower limit of the Overbalance structure and the index rushed to retest a record peak in the 3,770 pts area. A triple top was painted in the area and the index pulled back a bit. Swing area at 3,733 pts remains key support to watch should the decline deepen. Source: xStation5

US500 continues to trade near record highs in spite of yesterday's dismal ADP reading. The latest drop was halted at the zone marked by the lower limit of the Overbalance structure and the index rushed to retest a record peak in the 3,770 pts area. A triple top was painted in the area and the index pulled back a bit. Swing area at 3,733 pts remains key support to watch should the decline deepen. Source: xStation5

Economic calendar: markets await Trump’s official Fed chair nomination 🔎

Morning wrap (30.01.2026)

Economic calendar: November trade balance and US factory orders 📈

Morning wrap (29.01.2026)