Summary:

- RBNZ keeps rates unchanged and underlines there is still scope to ease policy further if necessary

- Market participants still see another rate cut later this year, though chances for such a scenario have slightly lowered

- NZ dollar keeps rising this week after experiencing heavy declines earlier

The Reserve Bank of New Zealand kept interest rates unchanged at today’s meeting, the result had been widely expected by surveyed economists. In the statement it wrote that although new information since the August meeting “did not warrant a significant change to the monetary policy outlook”, “there remains scope for more fiscal and monetary stimulus, if necessary, to support the economy and maintain our inflation and employment objectives”. On top of that, the statement also underlined that the reduction in the OCR this year has reduced retail lending rates for households and businesses as well as eased the New Zealand dollar exchange rate. In terms of external factors affecting the NZ economic outlook, the RBNZ suggested that global trade and other political tensions remain elevated and continue to subdue the global growth outlook, dampening demand for New Zealand’s goods and services. Following the meeting we have seen a slight retreat in the market-based probability of rate cuts pushing the NZ dollar slightly higher. Either way, the base-case is still another 25 bps rate cut by the year-end (November), however, we see limited space for the kiwi to decline from the current levels against the US dollar.

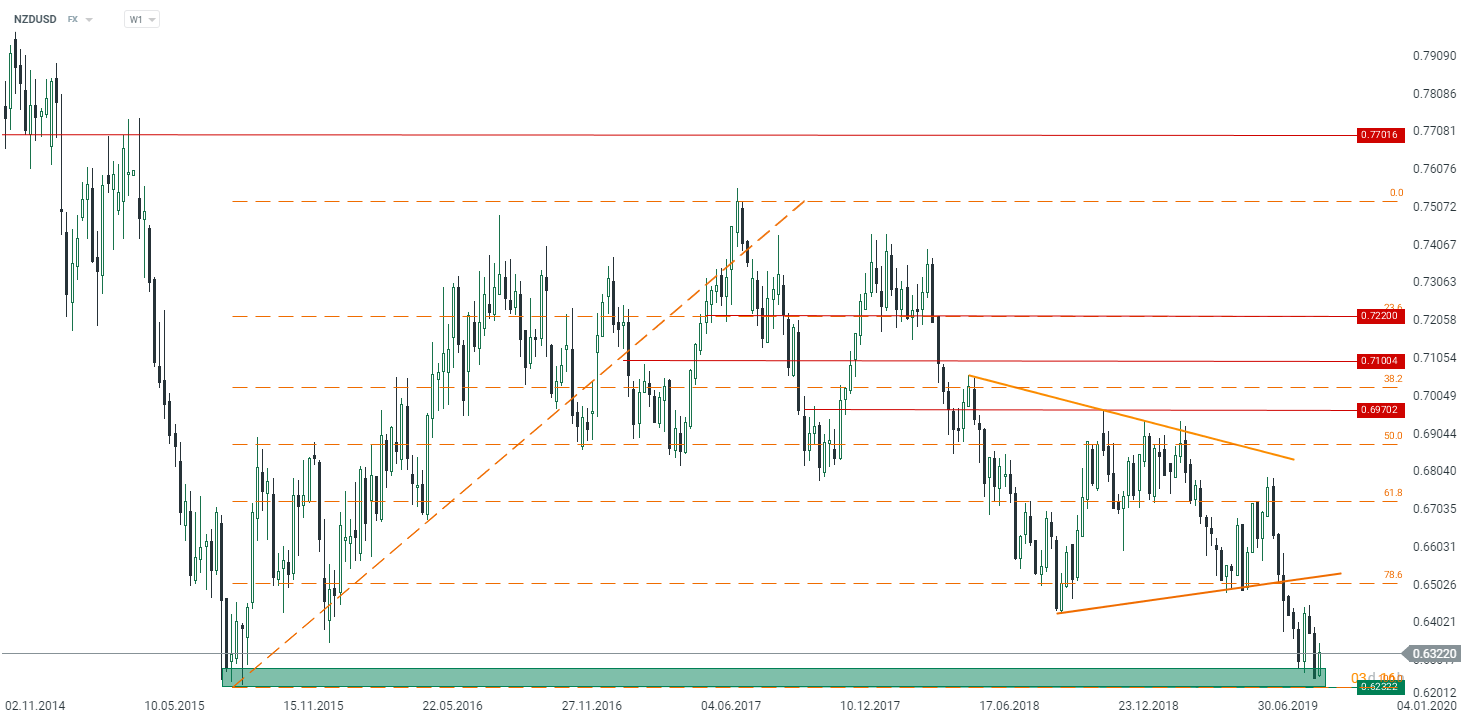

The NZDUSD is attempting to recover this week and from a technical point of view we see limited space for further declines from the current levels. Source: xStation5

The NZDUSD is attempting to recover this week and from a technical point of view we see limited space for further declines from the current levels. Source: xStation5

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes

Morning wrap (12.02.2026)

Daily Summary - Powerful NFP report could delay Fed rate cuts