The New Zealand dollar is today a victim of low inflation in Australia. Inflation in Australia fell today for May to 5.6% year-on-year (YoY) with an expected 6.1% YoY and a previous level of 6.8% YoY. The Australian Bureau of Statistics has been publishing monthly data for over a year, but from a market perspective, the quarterly index still seems to be more important. This index for Q1 was 7.0%. Why is the NZD falling harder today than the AUD?

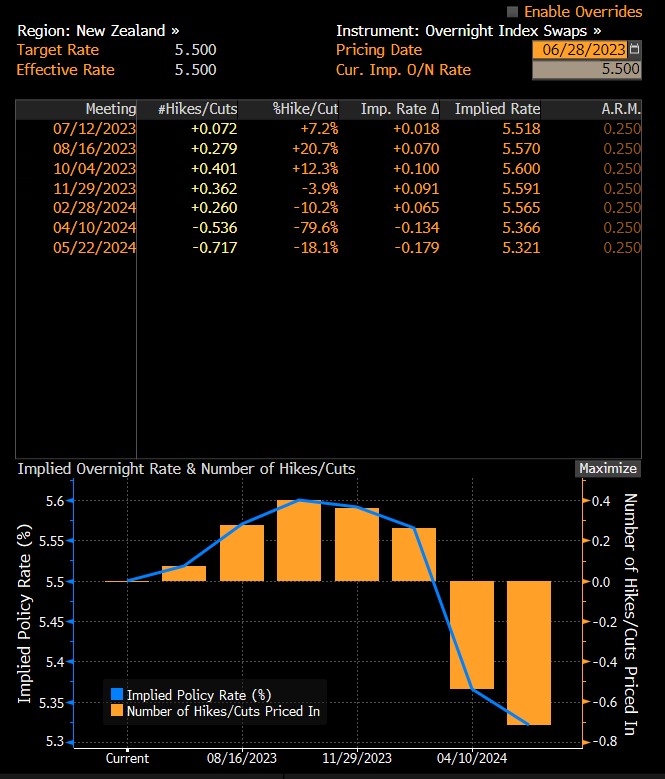

The CPI index for Q1 in New Zealand was 6.7% YoY, which may indicate that inflation for Q2 in this country will fall even more. Of course, it's worth remembering that the RBNZ has already announced that it will not raise rates, but the market indicated that after the recent surprise from the RBA, BoC, BoE or Norges Bank, the RBNZ could also return to rate hikes. However, inflationary trends suggest that the RBNZ will likely keep rates unchanged at 5% during the decision on July 12. Currently, the market sees only a 7% probability of a hike, and by the end of this year, it values a maximum of 10 basis points increase. Meanwhile, despite a clear drop in inflation in Australia or Canada, there the valuations of rate hikes are significantly higher.

NZDUSD is falling today to its lowest level since June 8. It is rare for a daily change in a G10 currency pair to exceed 1%. Meanwhile, AUDNZD recently fell to 1.0800, but the pair is currently recovering losses. Stronger declines in NZDUSD can be seen as a delayed movement compared to the fairly strong shock of AUDUSD at the end of last week. The NZDUSD pair is currently testing around 0.6000 and may be planning to test the 50.0 retracement of the last major upward wave. The pair remains within a rather weakly inclined downward trend channel.

Expectations for RBNZ rate movements. Source: Bloomberg

Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

BREAKING: US RETAIL SALES BELOW EXPECTATIONS

Takaichi’s party wins elections in Japan – a return of debt concerns? 💰✂️

Three markets to watch next week (09.02.2026)