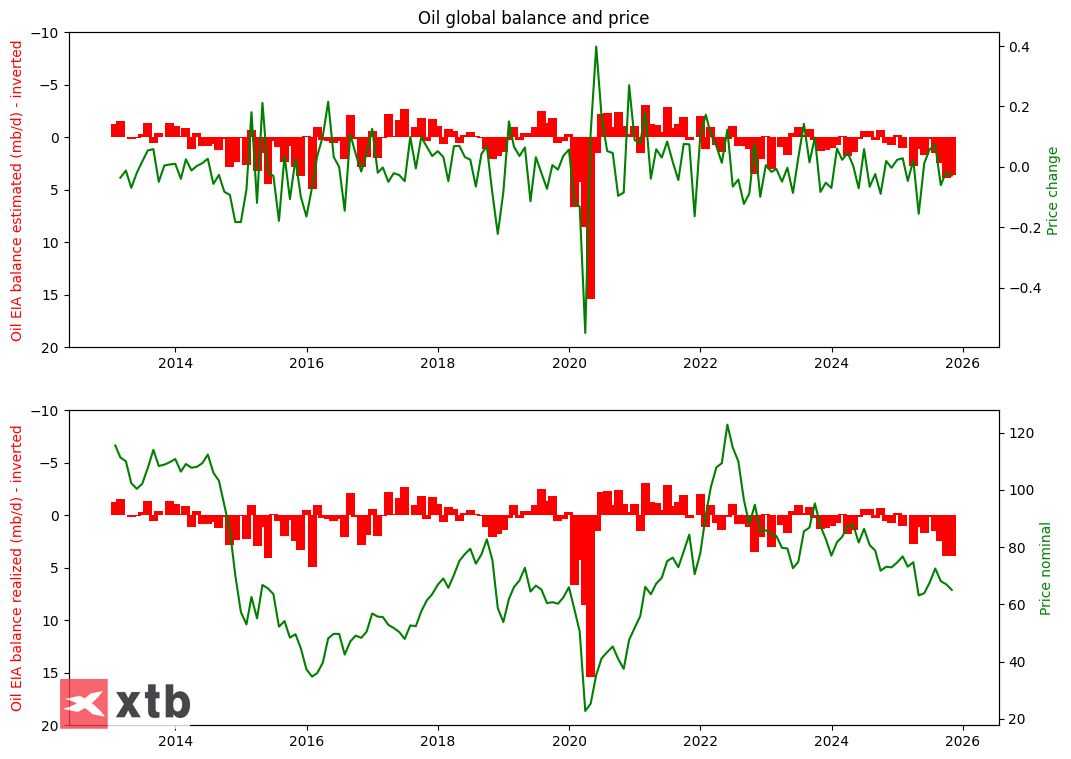

Oil continues its downward trend, driven by relentless pressure on prices due to significant and long-term surpluses of the commodity in the market. Some investors were waiting for the monthly OPEC report as a source of information to support demand, but these proved insufficient.

As a result, WTI and Brent oil contracts are losing about 1.4%.

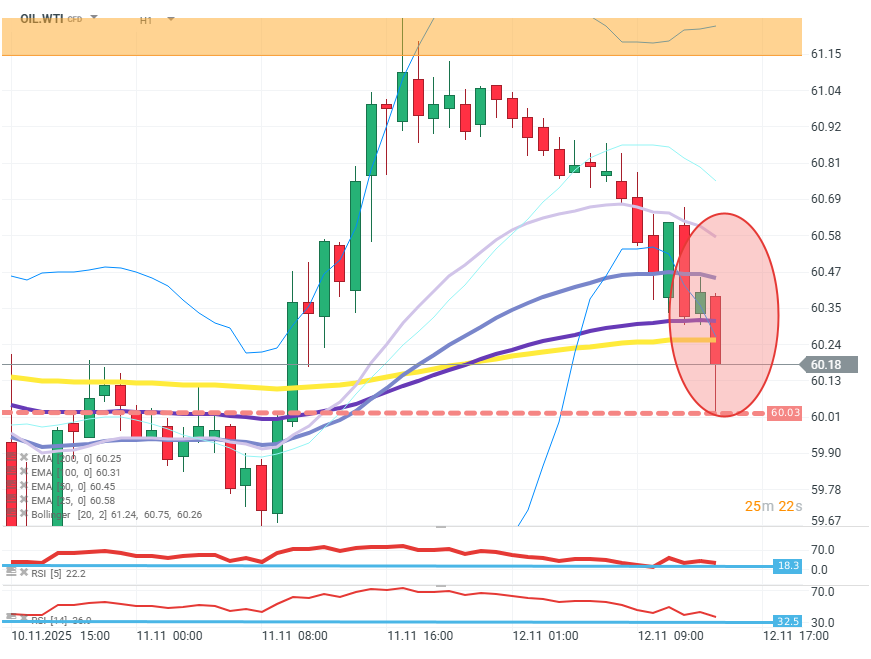

OIL.WTI (H1)

Source: xStation5

Daily summary: Markets capitulate under the influence of the Persian Gulf

US Open: Wall Street in Blood

DE40 dips 3% and falls to 2026 lows 🚨📉

Chart of the day 🚨OIL surges 5% putting pressure on Wall Street