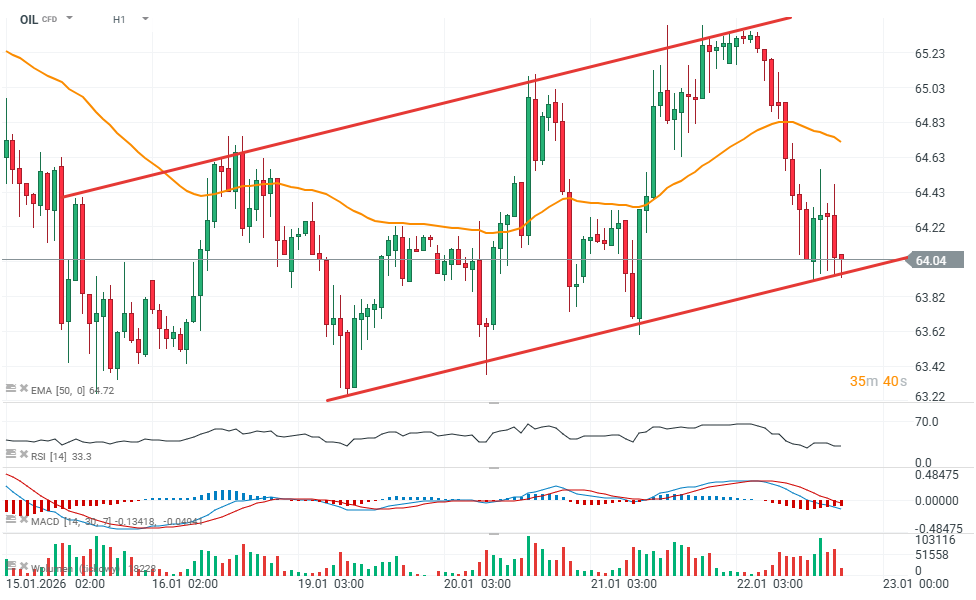

US energy market data released today pointed to a solid build in crude oil inventories and a larger-than-expected draw in natural gas stocks. As a result, oil prices slipped slightly toward the $64 per barrel area. Meanwhile, the “supportive” natural gas report triggered some profit-taking, although the base case remains a continuation of the strong uptrend.

-

Crude Oil Inventories (EIA): +3.602M bbl (forecast: -0.108M, previous: +3.391M)

-

Gasoline Inventories (EIA): +5.977M bbl (forecast: +1.466M, previous: +8.977M)

-

Distillate Inventories (EIA): +3.348M bbl (forecast: 0M, previous: -0.029M)

-

Cushing Crude Inventories (EIA): +1.478M bbl (previous: +0.745M)

-

Natural Gas Storage (EIA): -120 bcf (forecast: -98 bcf, previous: -71 bcf)

Source: xStation5

Source: xStation5

BREAKING: US CPI below expectations! 🚨📉

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

BREAKING: Oil prices plummet amid rumors of further OPEC production increases 🚨