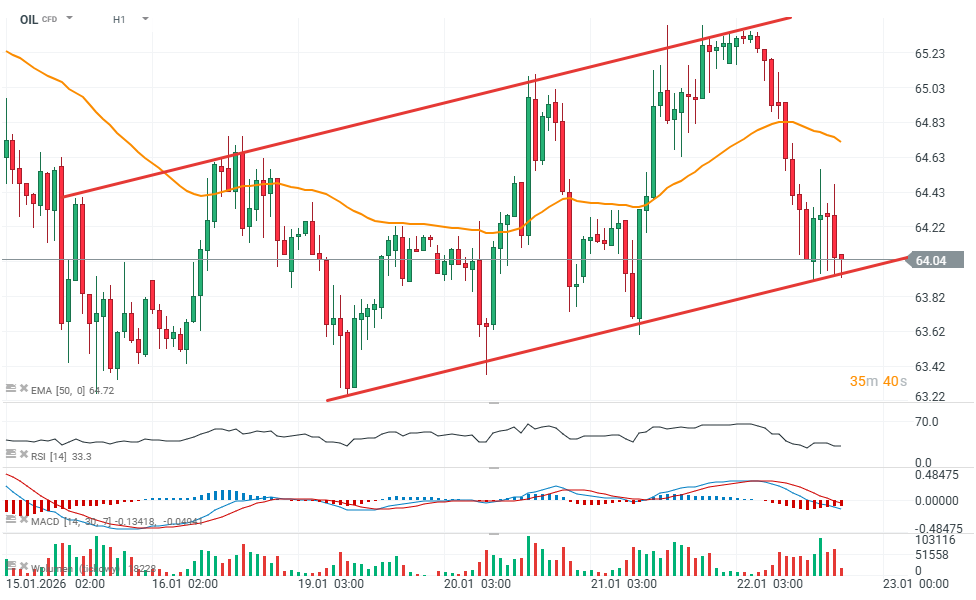

US energy market data released today pointed to a solid build in crude oil inventories and a larger-than-expected draw in natural gas stocks. As a result, oil prices slipped slightly toward the $64 per barrel area. Meanwhile, the “supportive” natural gas report triggered some profit-taking, although the base case remains a continuation of the strong uptrend.

-

Crude Oil Inventories (EIA): +3.602M bbl (forecast: -0.108M, previous: +3.391M)

-

Gasoline Inventories (EIA): +5.977M bbl (forecast: +1.466M, previous: +8.977M)

-

Distillate Inventories (EIA): +3.348M bbl (forecast: 0M, previous: -0.029M)

-

Cushing Crude Inventories (EIA): +1.478M bbl (previous: +0.745M)

-

Natural Gas Storage (EIA): -120 bcf (forecast: -98 bcf, previous: -71 bcf)

Source: xStation5

Source: xStation5

Daily Summary: Markets curb daily gains; Iran to use mines in the Strait of Hormuz🚨❓

📈US100 bounces back above the 100-day EMA

Market Wrap: Energy Stocks Retreat as Hopes for End to Iran War Grow 🌍 (10.03.2026)

Chart of the day: JP225 jumps on unexpected upward GDP revision 🇯🇵 📈 Japan is back in the game❓