OPEC released a monthly report on the oil market condition and outlook. Cartel of oil producers said that global economy entered a period of significant uncertainty and challenges mounted in Q4 2022. Economic growth forecasts for 2022 and 2023 were left unchanged but oil demand forecasts were lowered. Oil demand growth in 2022 is now seen at 2.55 million bpd, down from 2.65 million bpd in previous forecast. Forecast for 2023 was cut from 2.34 to 2.24 million barrels per day. OPEC also said that supply outpaced demand by 0.2 million bpd in Q2 2022 and 1.1 million bpd in Q3 2022, signaling a move to surplus.

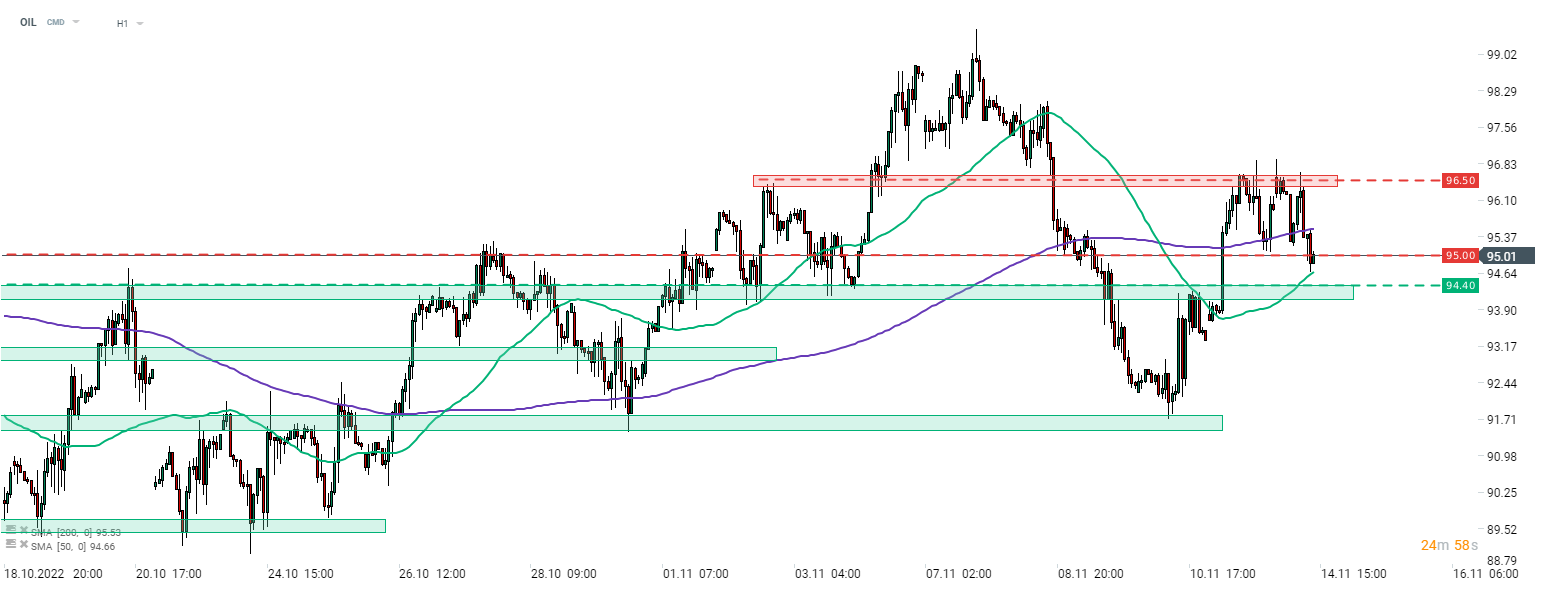

Overall, OPEC monthly report did not signal any major changes and a cut to demand forecast was expected (supply forecasts were left more or less unchanged). There was not any major reaction on the market. Brent(OIL) price gained slightly after the release and climbed to $95 per handle but continues to trade around 1% down on the day.

Source: xStation5

Source: xStation5

Morning wrap (05.03.2026)

Daily Summary – Indices rebound as oil markets await further developments

Iran: Situation overview and outlook

BREAKING: Another strong increase of oil inventories. Oil WTI close to 74