Peloton (PTON.US) stock plunged over 25.0% before the opening bell after the exercise equipment and media company reported a wider-than-expected quarterly loss and slowing sales volume followed by weak sales guidance for Q4 due to softening demand;

- Company recorded a Q3 loss of $2.27 per share, down from a loss of 3 cents per share over the same period last year and well above analysts’ estimates of 83 cents per share loss.

- Revenues plunged 23.5% from last year to $964.3 million, below Wall Street estimates of $973 million;

- Similar to other pandemic winners, the company is grappling with weakening demand. Peloton market value fell to $4.69 billion from nearly $50 billion during the pandemic;

- For the current quarter, the equipment maker expects revenues in the region of $675 million to $700 million and approximately 3 million Connected Fitness subscribers.

- Peloton will increase price of its connected fitness programs for the first time since 2014, while reducing costs of bikes and treadmills as company want more people to be able to afford their training equipment;

- The company plans to cut 2,800 workers, more than a fifth of its workforce, and has confirmed the decommissioning of the $ 400 million facility it planned to build in Ohio;

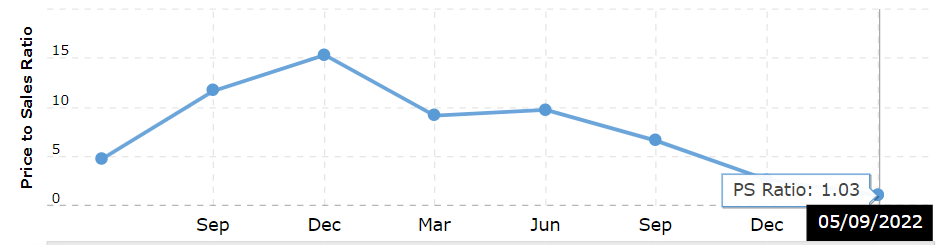

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

The price-to-sales ratio (P/S) fell sharply from pandemic highs. Source: Macrotrends

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Peloton (PTON.US) stock fell sharply in premarket to new all-time low around $11.50. Source xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street