Photronics shares rallied as much as 50% on Wednesday, noting the biggest intraday rise since March 2009, after the semiconductor company forecast revenue for the first quarter that beat the average analyst estimate. Photronics is one of the largest semiconductors photomasks producers in the world; photomasks are important part of infrastructure. The EPS came in almost 35% higher than market consensus.

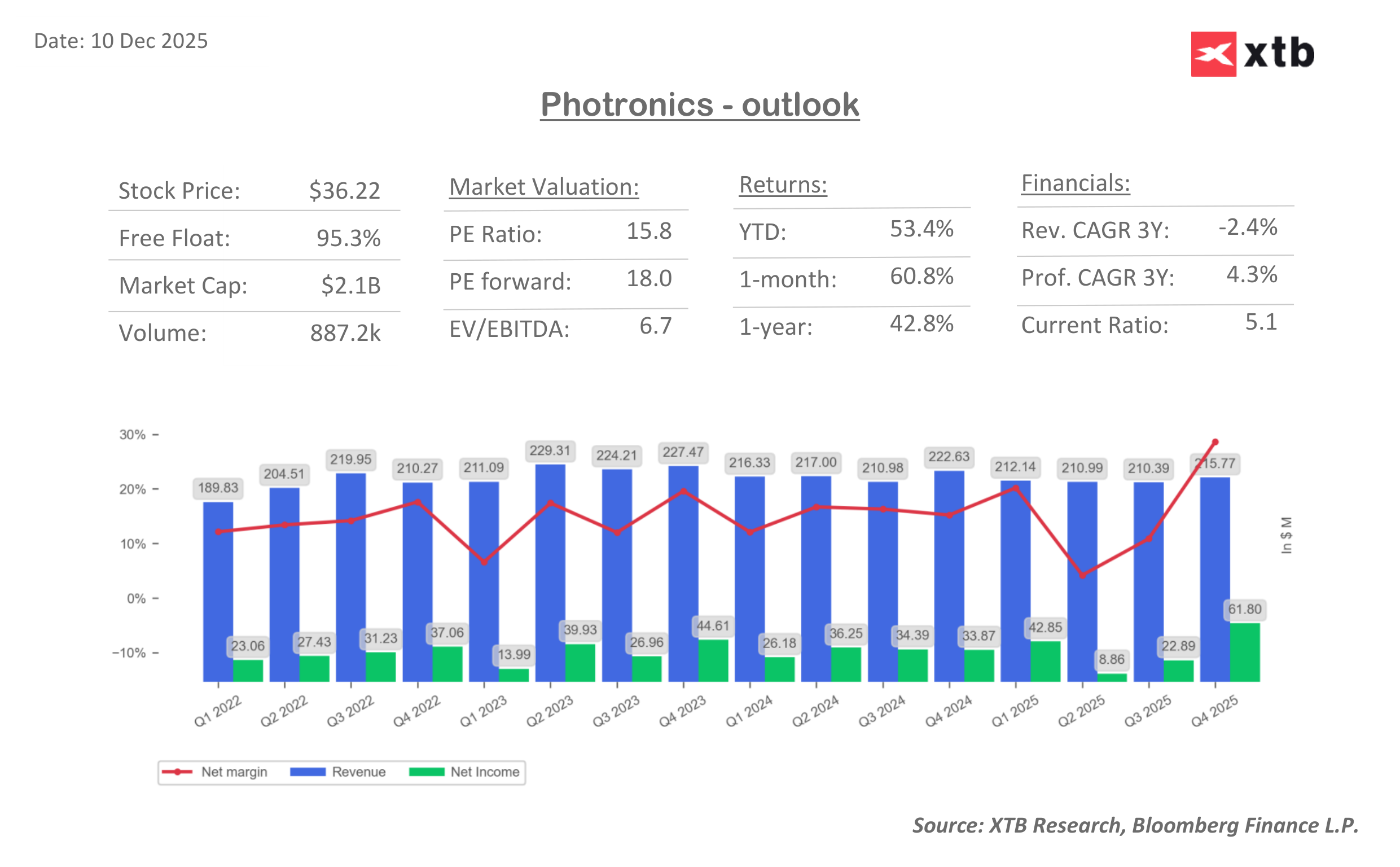

Fiscal Q4 results:

- Adjusted EPS 60c vs. 59c y/y, estimate 45c

- Revenue $215.8 million, -3.1% y/y, estimate $205.3 million

- EPS $1.07 vs. 54c y/y

Fiscal Q1 forecasts:

- Sees revenue $217 million to $225 million, estimate $207.3 million (Bloomberg Consensus)

- Sees adjusted EPS 51c to 59c (estimate 46c)

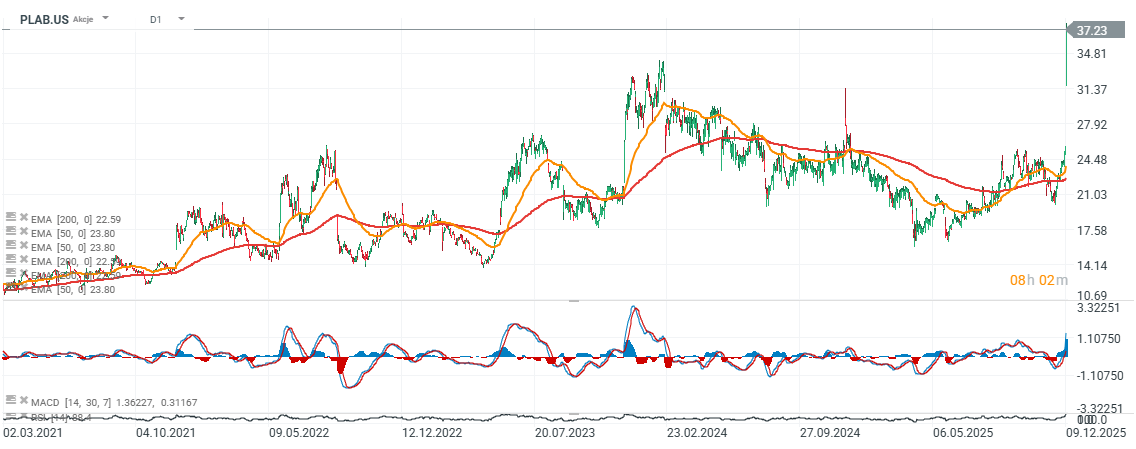

Source: xStation5

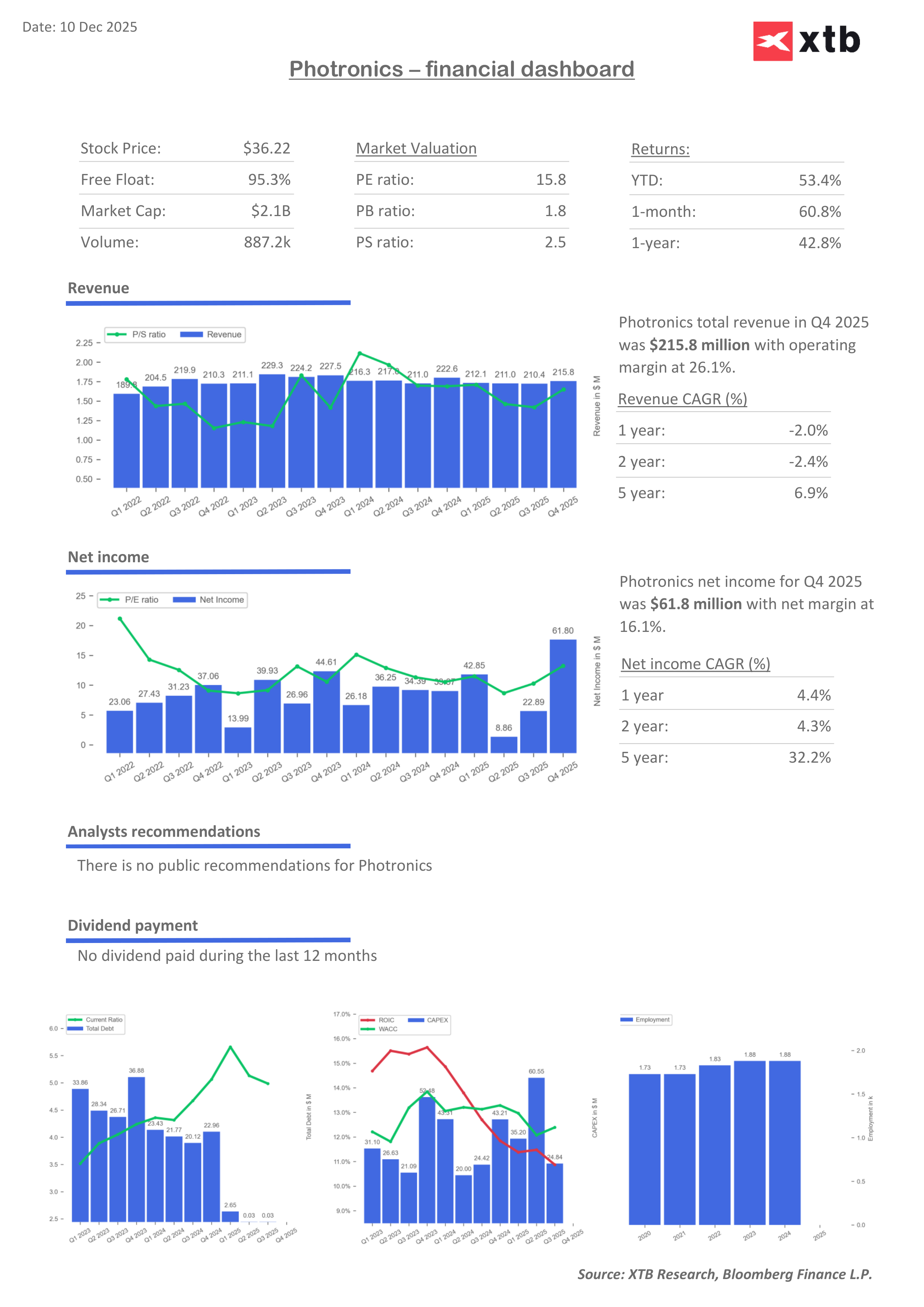

Photronics valuation even after today stock surge remain potentially attractive with PE ratio in mid 20s and 2.5 price to sales ratio. The company net margin is surging, as well as net income which came at almost $62 million, which is almost 35% better result than previous record from Q3 2023.

Source: Bloomberg Finance L.P, XTB Research

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records