08:15 AM BST, Spain - PMI Data for Jun:

- HCOB Spain Services PMI: actual 56.8; forecast 56.5; previous 56.9;

08:45 AM BST, Italy - PMI Data for Jun:

- HCOB Italy Services PMI: actual 53.7; forecast 53.9; previous 54.2;

- HCOB Italy Composite PMI: actual 51.3; previous 52.3;

08:50 AM BST, France - PMI Data for Jun:

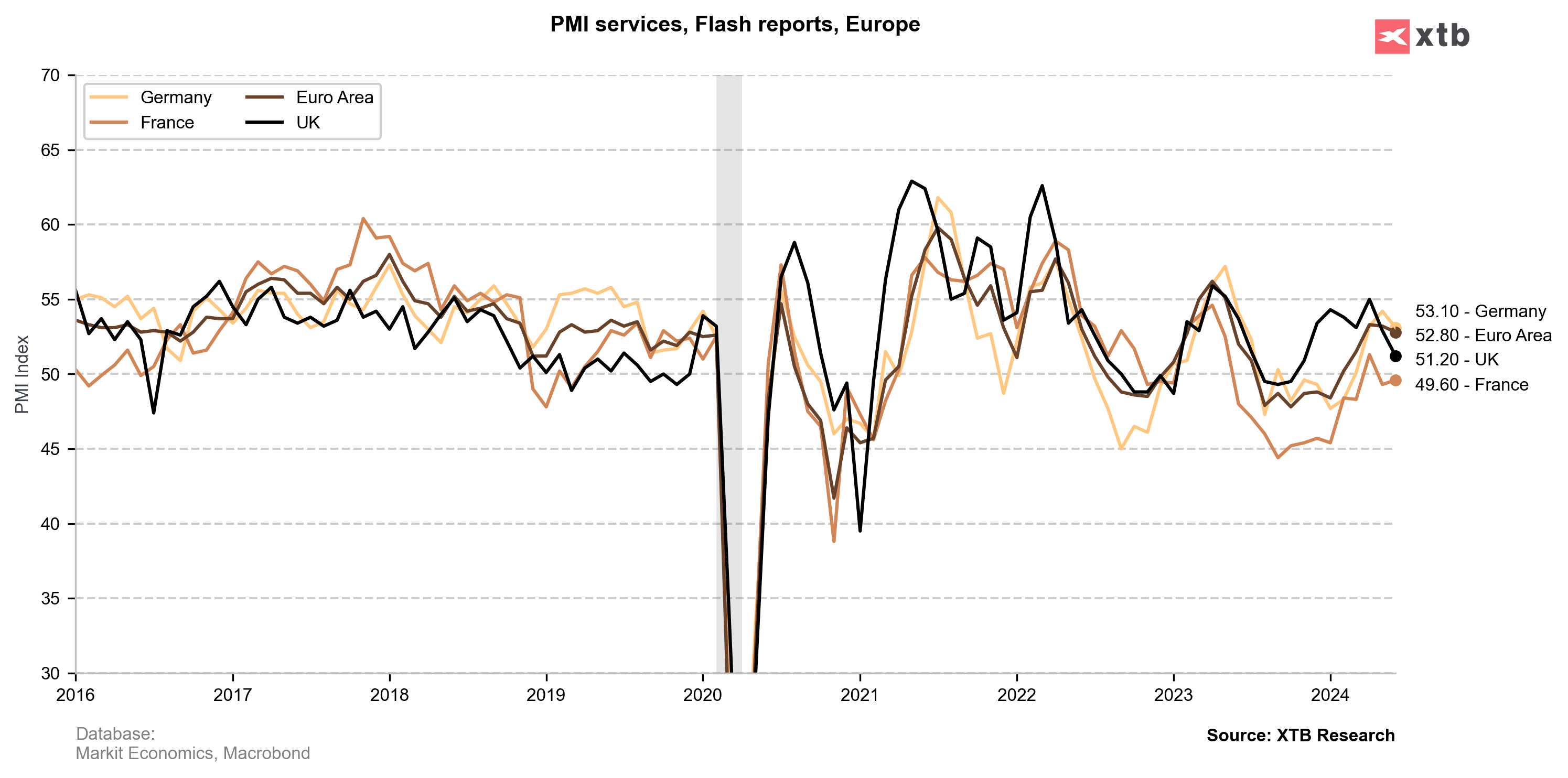

- HCOB France Services PMI: actual 49.6; forecast 48.8; previous 49.3;

- HCOB France Composite PMI: actual 48.8; forecast 48.2; previous 48.9;

08:55 AM BST, Germany - PMI Data for Jun:

- HCOB Germany Services PMI: actual 53.1; forecast 53.5; previous 54.2;

- HCOB Germany Composite PMI: actual 50.4; forecast 50.6; previous 52.4;

09:00 AM BST, Euro Zone - PMI Data for Jun:

- HCOB Eurozone Services PMI: actual 52.8; forecast 52.6; previous 53.2;

- HCOB Eurozone Composite PMI: actual 50.9; forecast 50.8; previous 52.2;

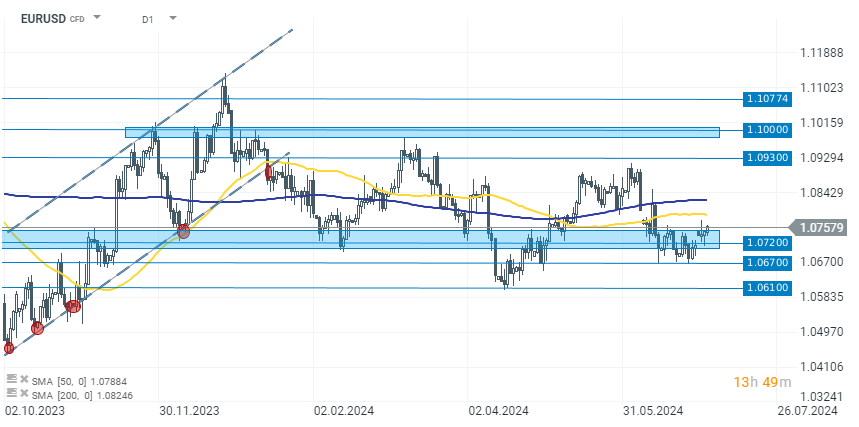

The Eurozone PMI report for the services sector performed relatively better than analysts' expectations. Nevertheless, the month-on-month trend is slightly downward. Noteworthy are the strong data in France and Spain. EURUSD gains 0.13% also supported by USD decrease.

BREAKING: US100 jumps amid stronger than expected US NFP report

Economic calendar: NFP data and US oil inventory report 💡

Morning Wrap: Dollar in a trap, all eyes on NFP 🏛️(February 11, 2026)

Daily summary: Weak US data drags markets down, precious metals under pressure again!