Summary:

-

Q2 contraction confirmed in UK

-

Minimal negative impact seen on the markets

-

GBPUSD holds above prior support zone

A raft of data from the UK has come in on balance a little on the soft side, with the stand out release showing that, as was widely expected the economy contracted in Q2 with a decline of 0.2% seen in quarter-on-quarter terms. As is often the case Brexit developments had a clear impact here, with the delaying of the original departure date from March 31st meaning that 1st quarter activity was artificially boosted due to provisions for the break and therefore 2nd quarter figures have come in unfavourably in comparison, as contingency measures such as stockpiling were unwound.

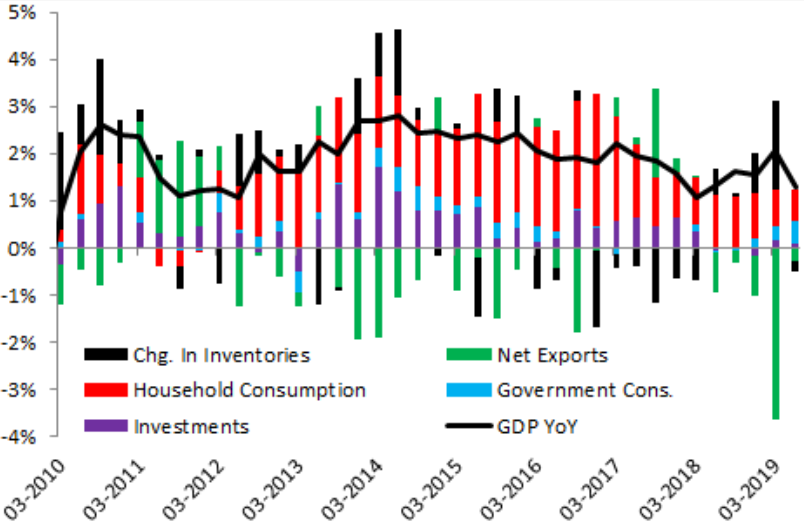

While the latest GDP figures showed a contraction in Q/Q terms and a decline in Y/Y (shown above) this can be explained away to some extent by the large fall in inventories between the first and second quarters which occurred due to the unwinding of stockpiling ahead of the original Brexit deadline on March 31st. Source: XTB Macrobond

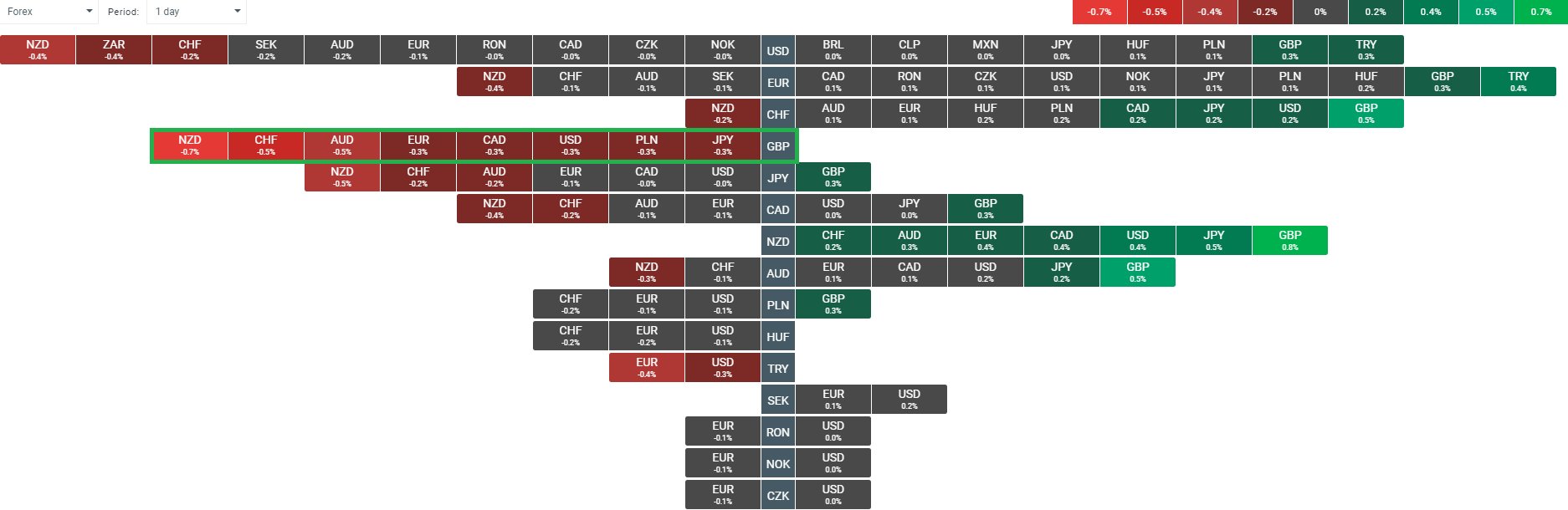

Despite the latest data looking negative on the face of it, it has caused minimal selling in the pound with the currency actually moving higher since the release and trading higher against all its peers on the day at the time of writing. Source: xStation

At the same time there was also the latest current account figures which provided some negative news with the Q2 reading of -25.2B well below the -19.2B exp and the 33.1B prior (itself revised down from -30.0B initially). While these are clearly not positive releases they have had minimal impact in the markets, due in part to the lagging nature of the data and also thanks to more recent indicators pointing at a recovery in Q3.

The pound has actually moved a little higher since the release with the GBP/USD rate bouncing from the prior support zone seen around 1.2230-1.2270. Source: xStation

⏬EURUSD softens ahead of the US CPI

Market Wrap: Dollar accelerates before CPI. Mixed earnings from French giants (13.02.2026)

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)