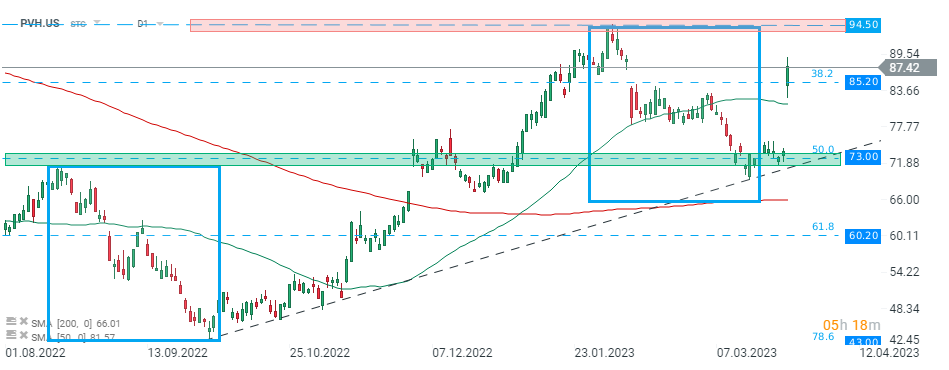

PVH (PVH.US) stock jumped more than 18% on Tuesday after the parent company of Calvin Klein and Tommy Hilfiger posted better than expected quarterly results, while revenue guidance also beat market expectations.

-

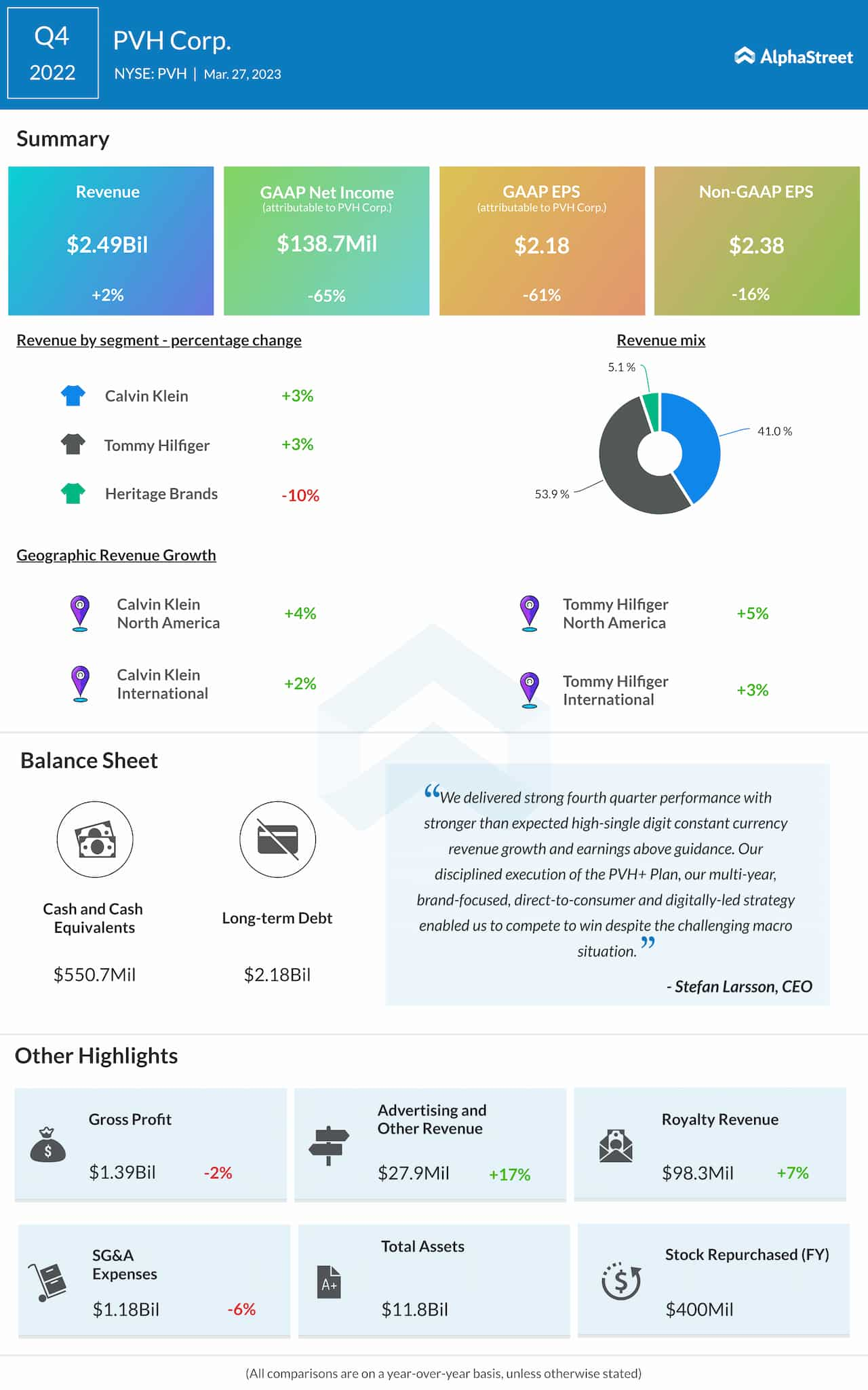

Company recorded adjusted earnings of $2.38 per share (down 16% YoY) on $2.49 billion of revenue (2.0% increase YoY). Analysts surveyed by Refinitiv were expecting $1.67 in earnings per share on $2.37 billion of revenue.

-

Revenue from the Tommy Hilfiger and Calvin Klein brands increased by 3% each.

PVH recorded a drop in adjusted profit in Q4, despite higher revenues. Source: AlphaStreet

-

“We delivered strong fourth quarter performance with stronger than expected high-single digit constant currency revenue growth and earnings above guidance. Our disciplined execution of the PVH+ Plan, our multi-year, brand-focused, direct-to-consumer and digitally-led strategy enabled us to compete to win despite the challenging macro situation,” said PVH’s CEO Stefan Larsson.

-

Company expects revenue to increase 3% to 4% as compared to 2022 (increase 2% to 3% on a constant currency basis), while operating margin is projected to be approximately 10%.

-

PVH expects full-year earnings to be $10 per share compared to $3.03 on a GAAP basis and $8.97 on a non-GAAP basis in 2022.

-

Interest expense is expected to rise to approximately $100 million compared to $83 million in 2022 primarily due to higher interest rates.

PVH (PVH.US) stock launched today’s session with an impressive bullish price gap and later on buyers managed to break above local resistance at $85.20, which coincides with 38.2% Fibonacci retracement of the upward wave started in March 2020. If current sentiment prevails, upward move may accelerate towards February 2023 high at $94.50. Source: xStation5

Boeing gains amid news about potential huge 737 MAX order from China 📈

Wall Street tries to stop the deeper decline 🗽Marvell Technology jumps 10%

RyanAir shares under pressure amid Middle East conflict 📉

Stock of the Week: Broadcom Driven by AI Sets Records