Summary:

- Australian Treasury signals the RBA could start buying bank bonds to take downward pressure off their profitability

- The RBA could also offer cheap funding to banks

- These measures are intended to help banks as they struggle to pass on subsequent rates cuts to customers

Australian Treasury warned that rate cuts delivered by the Reserve Bank of Australia are squeezing bank profit margins and that it why the central bank may soon have to resort to some measures intended to help banks deal with such downward pressure. What could be the most interesting point here is the fact that according to Josh Frydenberg, the head of Treasury, the central bank could initially start buying bank bonds and residential-mortgage backed securities (RMBS) to lower borrowing costs for households and businesses. This notion differs substantially from the RBA’s message that government bonds should be bought first. Also, other central banks like the Fed or the ECB focused largely on this part of bond markets. Frydenberg says that such a possibility could be needed in the case of reaching by the RBA a zero lower bound and if the government does not loosen the purse strings. In its report the Treasury also warned of risks arising from extremely low rates such as “excessive growth in asset prices, including house prices” and difficulty unwinding the measures, according to AFR.

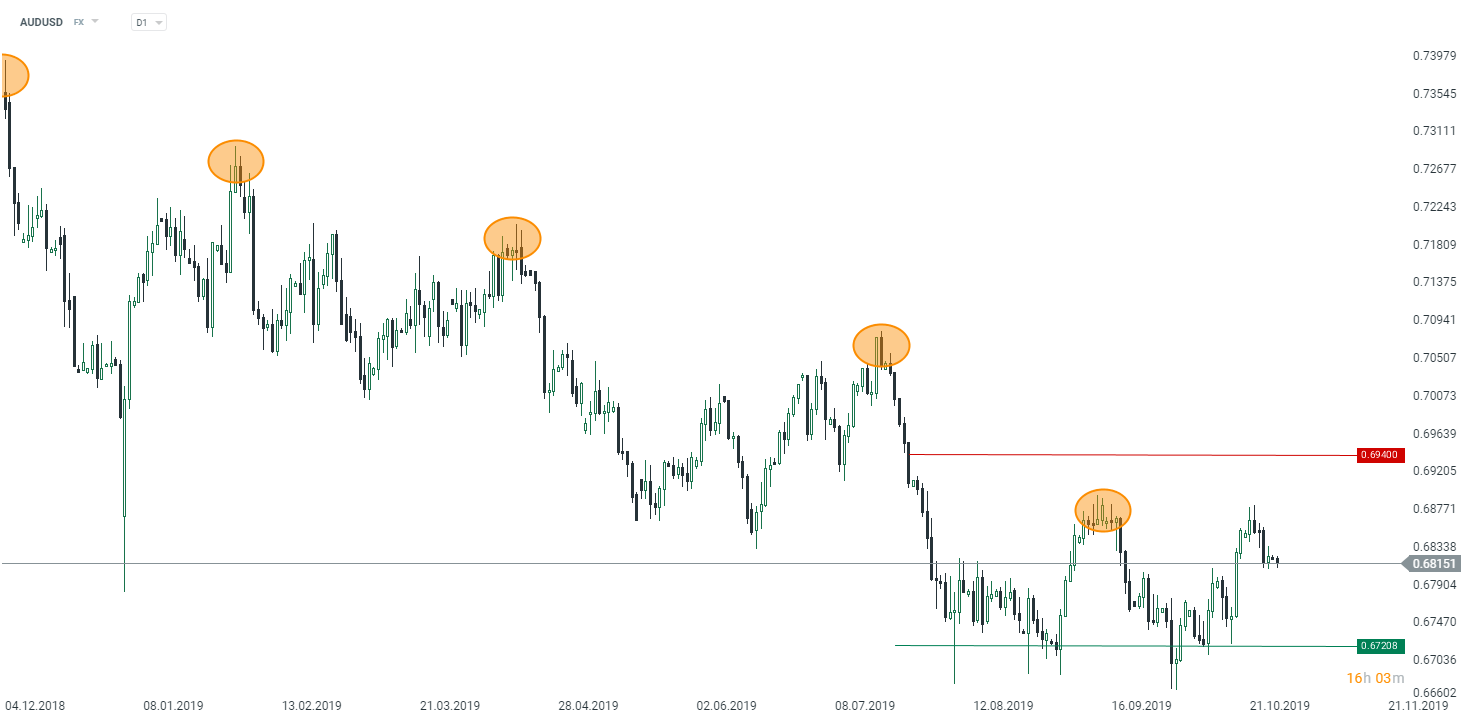

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

The Aussie dollar remains again under selling pressure as the new week kicks off. Source: xStation5

Chart of the Day: USD/JPY highly volatile ahead of US CPI

Morning Wrap: Global sell-off in the technology sector (13.02.2026)

BREAKING: US jobless claims slightly higher than expected

Market Wrap: UK Stagnation, Tariffs Weigh on Giants, and Crypto Stabilizes