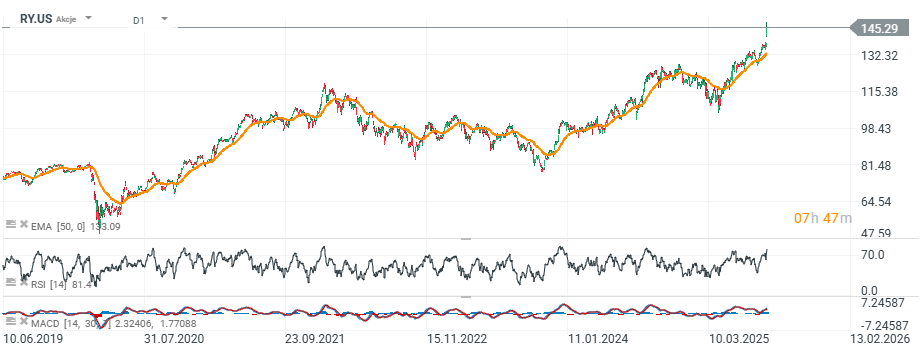

Royal Bank of Canada (RY.US) delivered a strong third quarter, comfortably beating analyst expectations and posting record earnings across all of its major business lines. Shares of the leading Canadian bank surge more than 5% today, reaching all-time-high and outperforming almost all US and Canadian financial sector.

Q3 2025 Earnings

-

Net income: $5.4 billion, up 21% from $4.5 billion in Q3 2024.

-

Reported EPS: $3.75 versus $3.09 a year earlier.

-

Adjusted EPS: $3.84, topping analyst estimates of $3.32 and well above $3.12 in Q2.

-

Revenue: $16.99 billion, compared with $14.63 billion a year ago.

-

Provision for credit losses (PCLs): $881 million, higher than $659 million last year but below analyst expectations of $1 billion; also down sharply from $1.4 billion in Q2.

-

Segment performance:

-

Personal Banking net income: $1.9 billion (+22% y/y)

-

Commercial Banking: $836 million (+2% y/y)

-

Wealth Management: $1.1 billion (+15% y/y)

-

Capital Markets: $1.3 billion (+13% y/y)

-

Insurance: $247 million (+45% y/y)

-

-

Return on Equity (ROE): 17.3% reported; 17.7% adjusted.

-

Efficiency ratio: 54.4% reported; 53.5% adjusted, reflecting strong cost control.

Business segments breakdown

-

Personal Banking

-

Net income up 22% year-over-year; PPPT also up 22%.

-

Revenue rose 13%, driven by 14% growth in net interest income and a 24 bps increase in net interest margin to 2.61%.

-

Average volume growth of 3% with flat expenses year-over-year.

-

Efficiency ratio improved to 37.2%.

-

-

Commercial Banking

-

Net income and adjusted net income both up 2% year-over-year; PPPT rose 8%.

-

Revenue grew 6%, supported by an 8% rise in net interest income.

-

Expenses rose only 1% year-over-year, yielding an efficiency ratio of 32.4%.

-

-

Wealth Management

-

Net income up 15% year-over-year; revenue up 11%.

-

Canadian Wealth Management revenue up 15%; Global Asset Management up 14%; U.S. Wealth Management up 7%.

-

-

Capital Markets

-

Net income up 13% year-over-year; PPPT surged 36%.

-

Revenue grew 25%, with Corporate & Investment Banking up 11% and Global Markets up 37%.

-

A strong rebound compared with the cautious tone on investment banking in Q2.

-

-

U.S. Region

-

Net income rose 21% year-over-year.

-

Efficiency ratio improved to 81.5%, down 6.6 percentage points year-over-year.

-

Capital and Credit Management

-

CET1 capital ratio steady at 13.2%.

-

Repurchased 5.4 million shares worth $955 million in Q3.

-

Credit quality remained stable:

-

PCL on impaired loans relatively flat.

-

PCL ratio at 35 bps (up 8 bps y/y, down 23 bps q/q).

-

Allowance for credit losses rose by $161 million.

-

Gross impaired loans fell by $188 million q/q; new impaired loan formations trended lower.

-

-

Digital adoption: over 10 million active digital users and 190 million sessions in Q3, supporting both efficiency gains and customer experience.

-

Management expects continued net interest income growth in the high single to low double digits and solid loan growth in commercial banking in the second half of 2025.

-

Record Q3 results demonstrate the strength of RBC’s diversified model, resilience in a challenging macroeconomic environment, and ability to deliver strong shareholder returns while maintaining prudent risk management.

RY.US shares (D1)

Source: xStation5

Daily summary: Silver plunges 9% 🚨Indices, crypto and precious metals under pressure

Does the current sell-off signal the end of quantum companies?

Howmet Aerospace surges 10% after earnings reaching $100 bilion market cap 📈

US Open: Cisco Systems slides 10% after earnings 📉 Mixed sentiments on Wall Street