SILVER rallied on Wednesday evening following FOMC decision. Dovish reaction of the markets was somewhat puzzling given that new FOMC forecasts were rather hawkish. However, lack of outright rejection of the idea of cutting rates as soon as in the first half of 2024 seems to have been enough for investors to consider the meeting 'dovish'. Those post-FOMC price moves are being reversed today, at least on the US dollar and precious metals markets. Equity indices hold onto yesterday's gains.

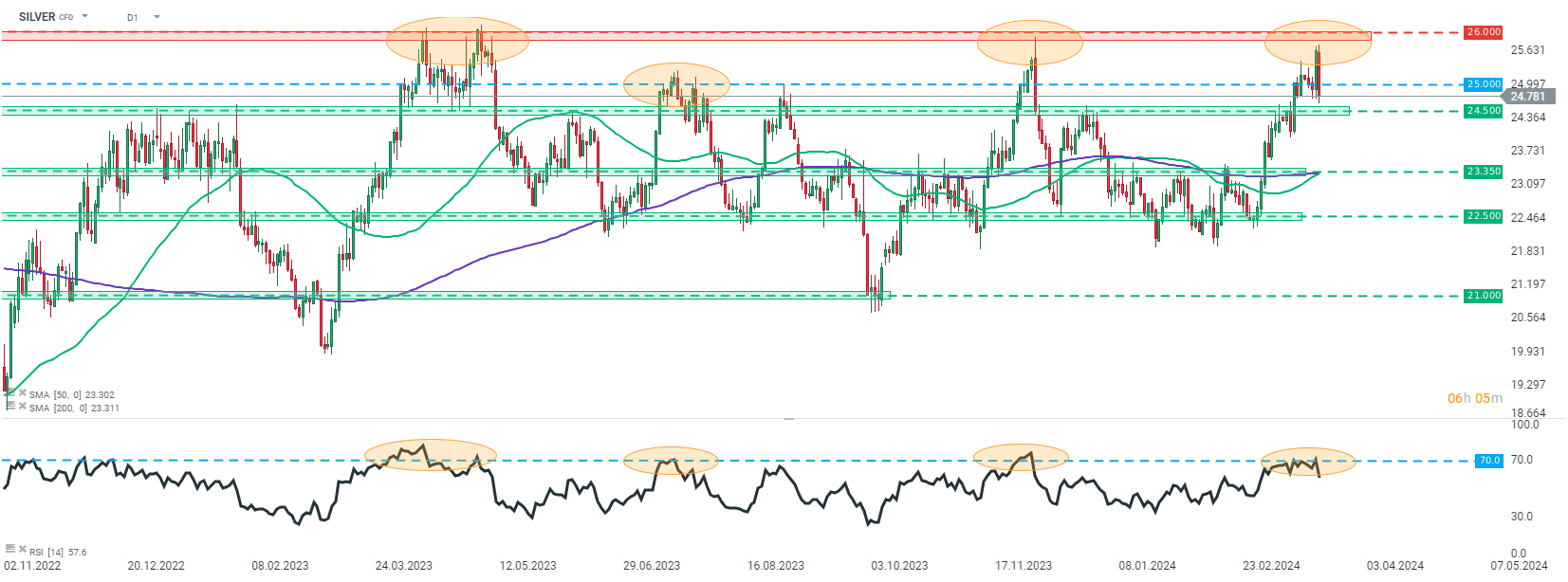

SILVER is a big mover today, erasing all of yesterday's gains. Precious metal is down over 3% today and trades back below $25 per ounce mark. Taking a look at the chart at D1 interval, we can see that while price managed to climb to the highest level since early-December 2023 yesterday, it failed to reach $26 resistance zone, that acted as a ceiling for the price for around 2 years. Price remains locked in a $22.50-26.00 trading range. A point to note is that the 14-day RSI indicator has climbed above 70.0 pts yesterday, a level often associated with recent local highs.

SILVER erases all of yesterday's post-FOMC gains. Source: xStation5

Daily summary: Weak US data drags markets down, precious metals under pressure again!

NATGAS slides 6% on shifting weather forecasts

Three markets to watch next week (09.02.2026)

Geopolitical Briefing (06.02.2026): Is Iran Still a Risk Factor?